Embed presentation

Downloaded 1,882 times

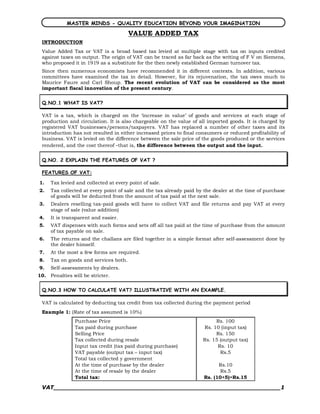

1. The document provides information about Value Added Tax (VAT), including its introduction, features, variants, requirements for a VAT system, and methods of computation. 2. VAT is a tax charged on the increase in value of goods and services at each stage of production and circulation. It is designed to be neutral and reduce the cascading effect of sales taxes. 3. There are three main variants of VAT - gross product, income, and consumption. The consumption variant does not affect investment decisions and is administratively simpler. 4. Key requirements for a VAT system include tax invoices, registration, composition schemes, taxpayer identification numbers, and self-assessment by dealers. Computation methods include addition,