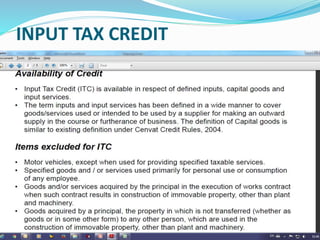

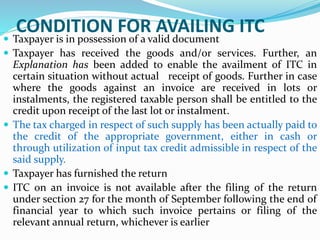

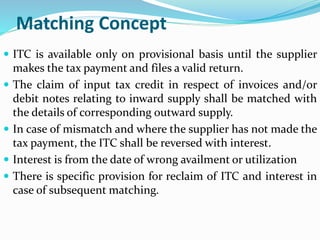

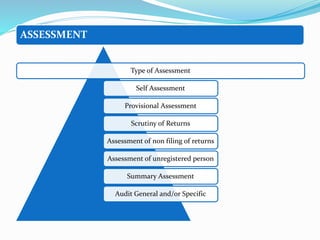

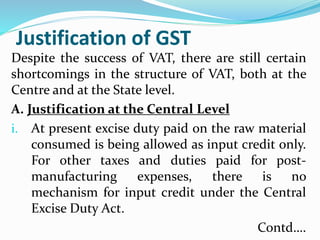

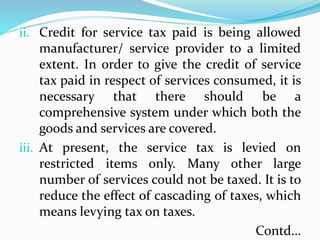

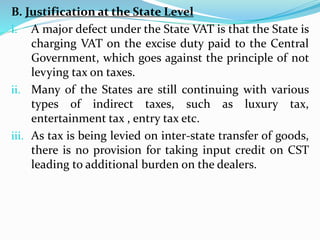

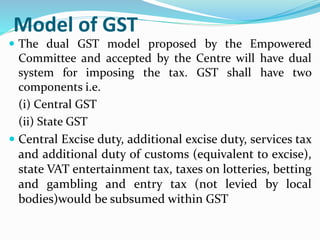

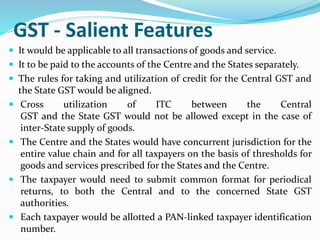

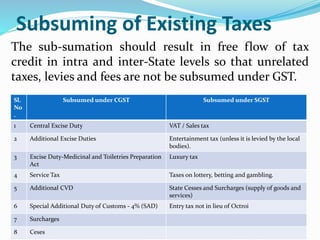

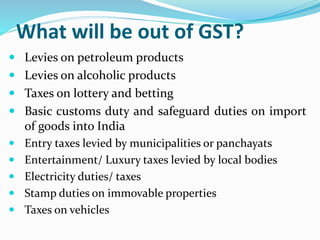

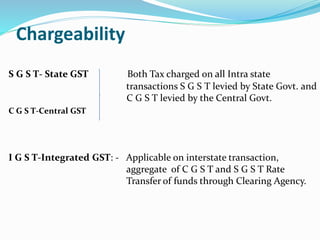

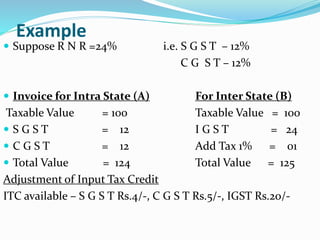

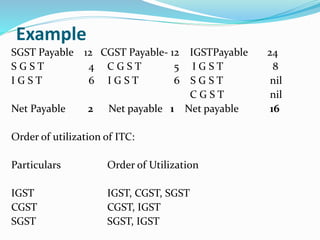

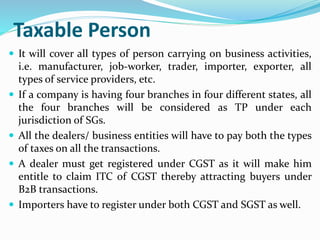

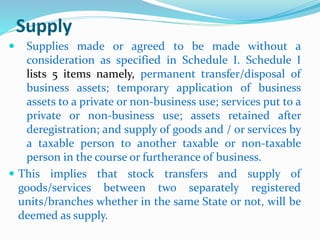

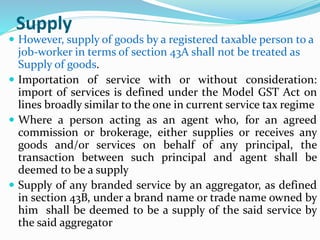

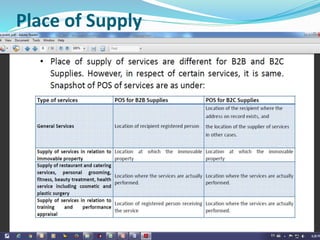

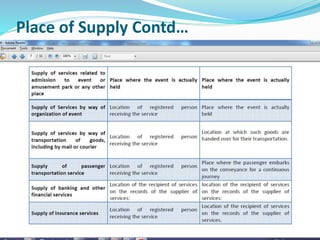

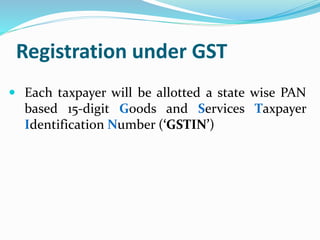

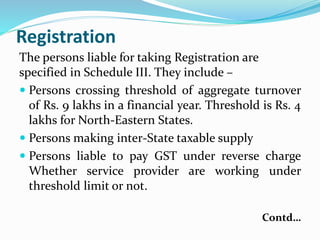

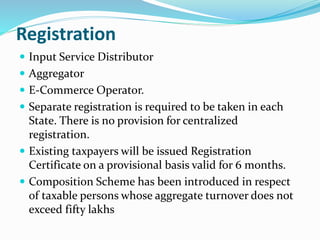

This document provides an overview of the Goods and Services Tax (GST) in India. It defines GST as a comprehensive tax on the manufacture, sale, and consumption of goods and services applied at the national level. The document discusses the need for GST to replace existing multiple tax structures and integrate various taxes to allow for full input tax credits. It outlines the justification for GST at both the central and state levels. The document also covers the key features and benefits of GST, including the types of taxes subsumed under GST, registration requirements, taxable supplies, input tax credits, and returns.

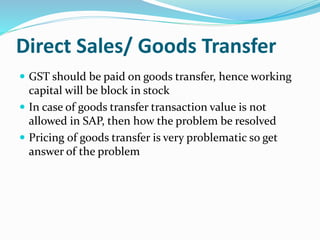

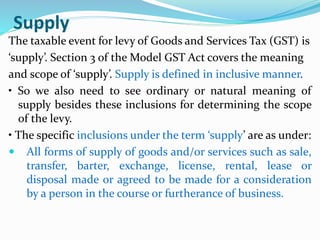

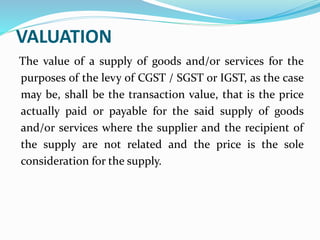

![VALUATION

Where transaction value is not available resort has to

be taken to the GST Valuation (Determination of the

Value of supply of Goods and Services) Rules, 2016

[‘GST Valuation Rules’] for determination of the

value of supply. As per Rule 7 of the said Rules, where

the proper officer has reason to doubt the truth or

accuracy of the value declared, he may ask thesupplier

to furnish further information, including documents

or other evidence. But if he still has reasonable doubt

about the truth or accuracy of the value declared, it

shall be deemed that the transaction value cannot be

determined](https://image.slidesharecdn.com/5c032b50-42eb-4a4d-8185-184fe7fb26de-160922054013/85/GST-PPT-32-320.jpg)