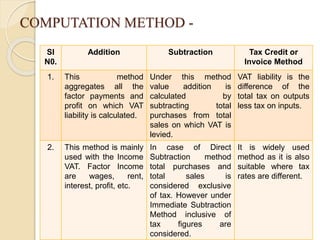

Value Added Tax (VAT) is a multi-point tax collected on the value added at each stage of production and distribution. In India, VAT was introduced in 2005 and is governed by state laws like the West Bengal VAT Act of 2003. Under VAT, a dealer pays tax on sales (output tax) and claims a credit for tax paid on purchases (input tax) in the same tax period, usually a month. This eliminates the cascading effect of taxes being applied to previous taxes. While VAT streamlines taxation, India's federal structure restricts a pure VAT system, with the center and states collecting different taxes.