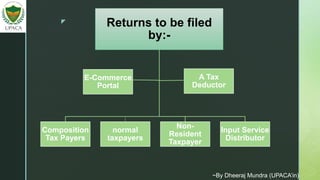

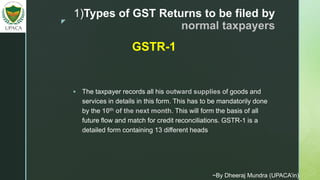

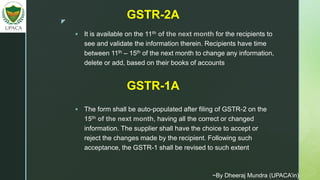

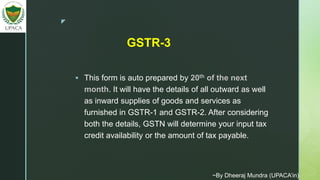

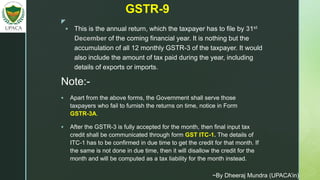

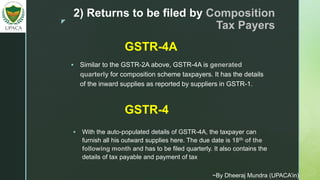

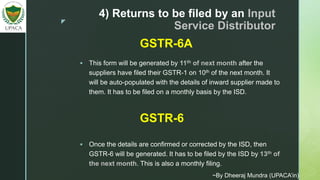

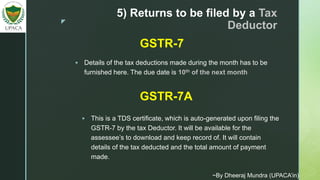

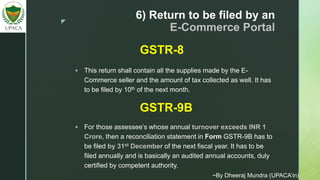

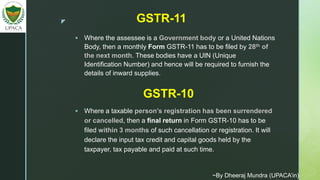

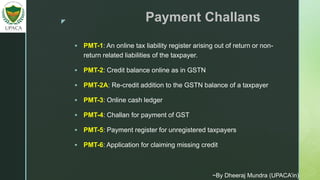

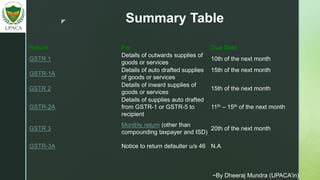

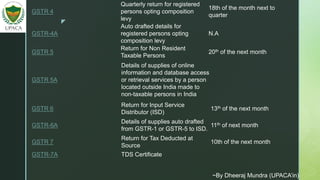

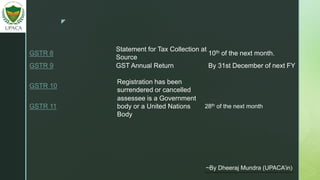

The document outlines the various types of GST returns required to be filed by different types of taxpayers, including normal, composition, non-resident, input service distributors, tax deductors, and e-commerce operators. It specifies deadlines for each form, such as GSTR-1 for normal taxpayers due by the 10th of the following month, and annual returns like GSTR-9 for the previous fiscal year due by December 31st. Additionally, it discusses the implications of timely submissions and the potential penalties for late filings.