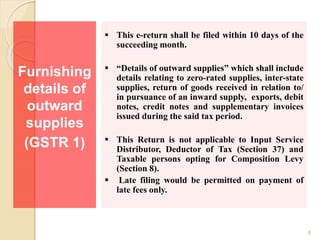

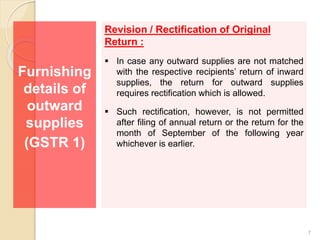

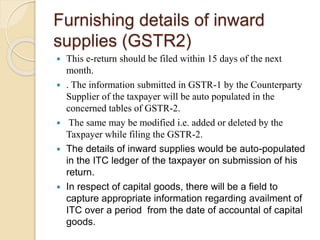

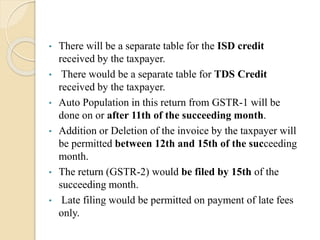

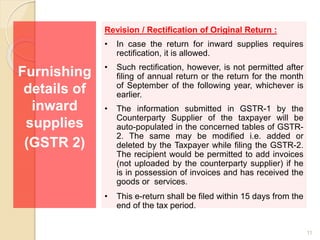

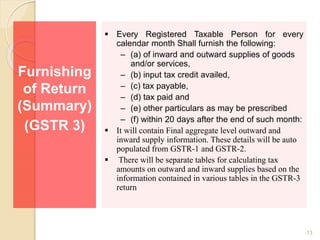

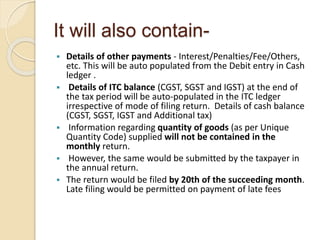

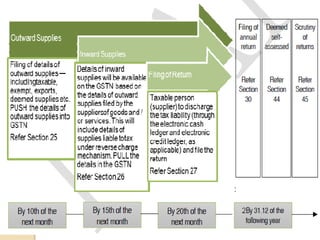

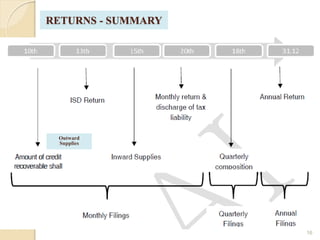

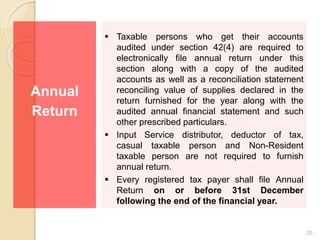

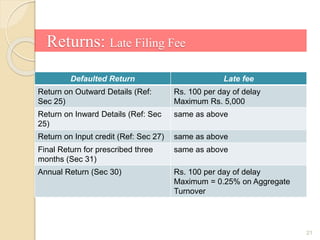

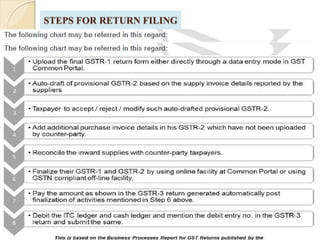

1) A registered person is required to file periodic returns with details of outward supplies, inward supplies, input tax credit, and tax payable. Different returns include GSTR-1, GSTR-2, GSTR-3, and an annual return.

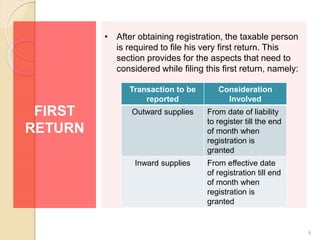

2) The first return filed after registration must include transaction details from the date of liability to register until the end of the month registration was granted.

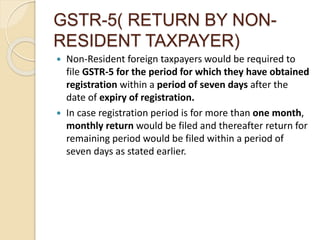

3) Non-resident foreign taxpayers must file GSTR-5 within seven days of the expiry of their registration period in India.