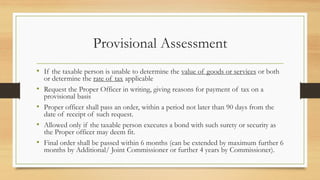

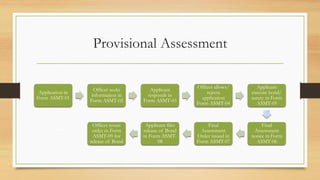

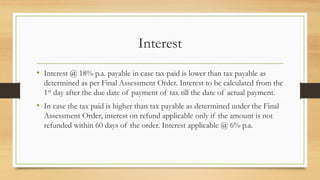

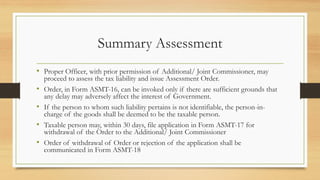

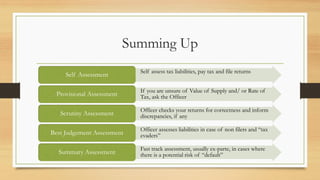

This document discusses the different types of assessments under the Goods and Services Tax (GST) in India. It defines assessment and describes the key types as self-assessment, provisional assessment, re-assessment, best judgment assessment, and summary assessment. For each type, it provides details on the procedures involved, including applicable forms, timelines for orders, and treatment of interest in case of underpayment or overpayment of taxes. The document summarizes the different assessment scenarios and procedures to help taxpayers and officers understand their obligations and processes under GST.