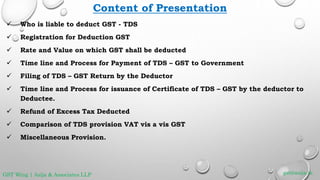

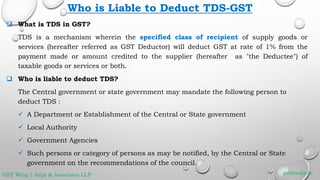

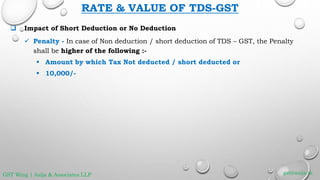

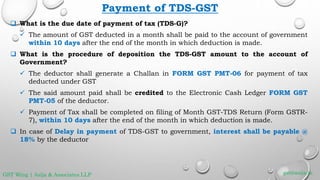

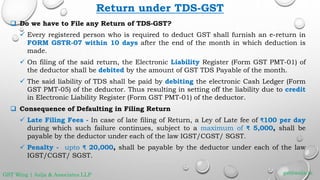

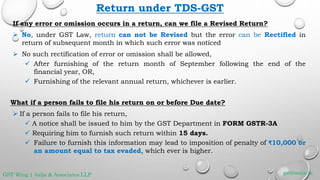

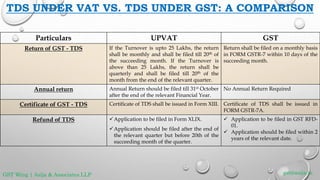

This document provides an overview of the tax deducted at source (TDS) provisions under the Goods and Services Tax (GST) law in India. It discusses who is liable to deduct TDS, the registration requirements, rates and thresholds for TDS, payment and return filing procedures, certificates to be issued, refunds, and comparisons with the previous TDS system under state VAT laws. The key aspects covered are registration under GST for TDS, the 1-2% rates for deduction, monthly payment and return filing timelines, and certificates to be provided to deductees.