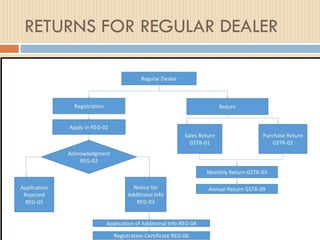

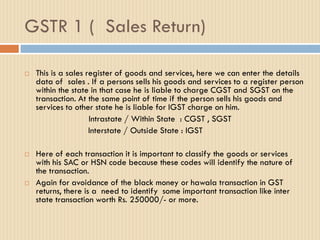

The document provides a comprehensive overview of the Goods and Services Tax (GST) return filing process for taxpayers in India, detailing the types of returns, their due dates, and the required information for each return. It explains the responsibilities of registered individuals and businesses regarding sales, purchases, and tax payments, highlighting specific forms such as GSTR-1, GSTR-2, GSTR-3, and others. Additionally, it outlines the consequences of non-compliance and the importance of accurate reporting to avoid penalties.

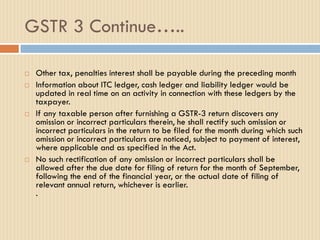

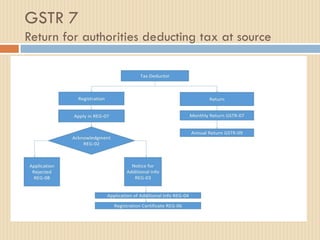

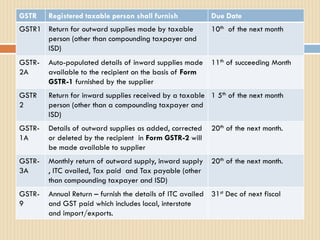

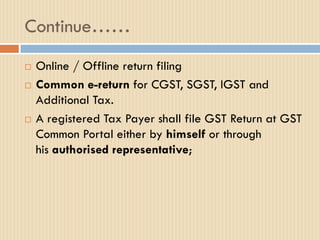

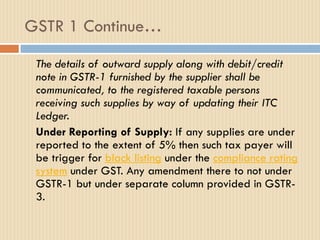

![Type of

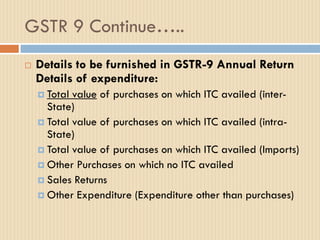

return

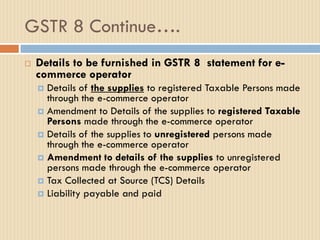

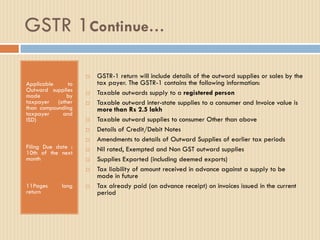

Return for Due Date To be filed by

GSTR 1 Outward supplies made by taxpayer

(other than compounding taxpayer

and Input Service Distributor[ISD])

10th of the next

month All regular tax payers and

casual/ non- resident tax

payers

GSTR 2 Inward supplies received by a taxpayer

(other than a compounding taxpayer

and ISD)

15th of the next

month

GSTR 3 Monthly return (other than

compounding taxpayer and ISD)

20th of the next

month

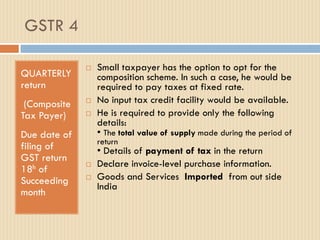

GSTR 4 Quarterly return for compounding

taxpayer

18th of the month next

to quarter

Compounding taxpayers

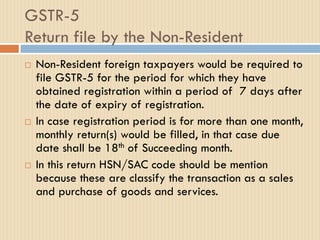

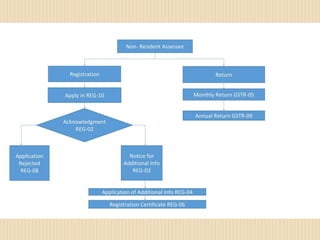

GSTR 5 Periodic return by Non-resident

foreign taxpayer

7 days from last day of

registration

Non-resident tax payers

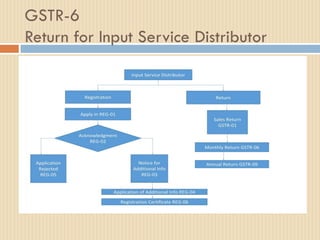

GSTR 6 Return for ISD 13th of the next

month

Input Service

Distributors

GSTR 7 Return for Tax Deducted at Source 10th of the next

month

Person deducting GST

at source

GSTR 8 Return for Tax Collected at Source 10th of the next

month

E- Commerce Service Operator

GSTR 9 Annual Return 31st December of

next FY

All regular tax payers

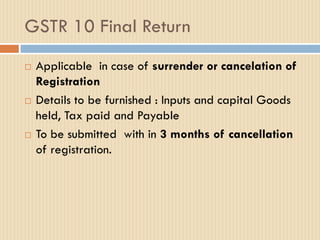

GSTR 10 Final Return With in 3 months Dealers whose license

cancelled or surrendered

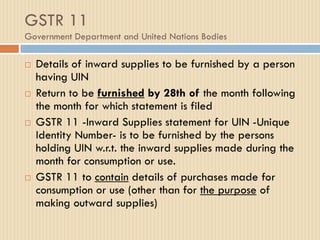

GSTR 11 Govt Bodies, UN 28th of Succeeding

Month

to be furnished by a person

having UIN](https://image.slidesharecdn.com/4-170321060001/85/GST-Return-Overview-by-CA-Shital-Thadeshwar-5-320.jpg)

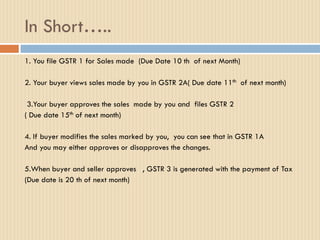

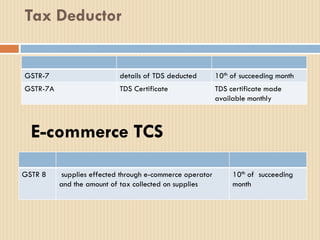

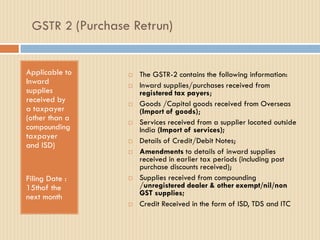

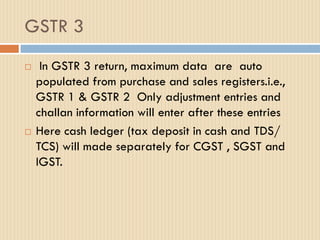

![GSTR 3 Continue….

Monthly return

(other than

compounding

taxpayer and

Input Service

Distributers

[ISD])

Due date of

filing of GST

return 20th of

Succeeding

month

The GSTR-3 contains the following major

information:

Monthly outward (Intra-state/intra-state/export)

supply;

Monthly inwards (Intra-state/intra-state/inward

under reverse charge/import) supply;

Total tax liability for the month including liability

under reverse charge

Net ITC available

The registered taxable person shall not be allowed

to furnish return for a tax period if return for any

previous tax period has not been furnished by him.](https://image.slidesharecdn.com/4-170321060001/85/GST-Return-Overview-by-CA-Shital-Thadeshwar-16-320.jpg)