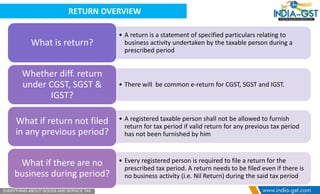

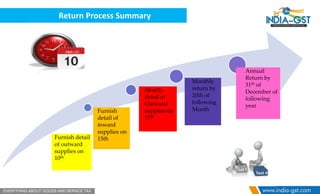

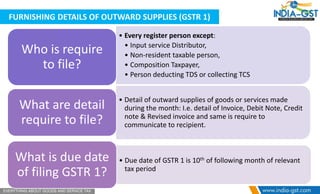

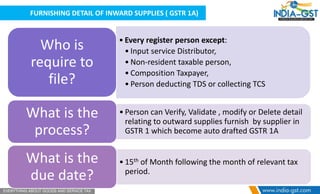

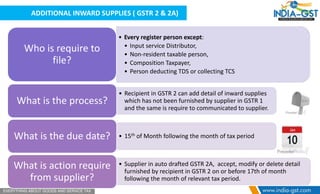

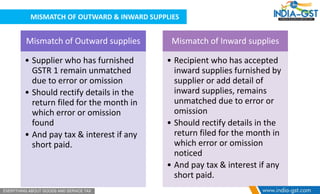

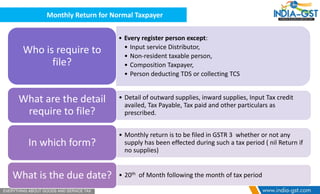

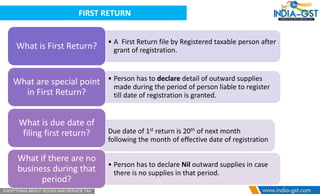

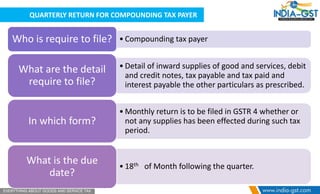

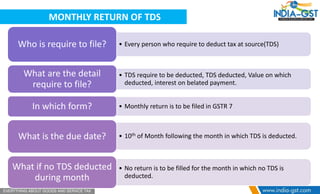

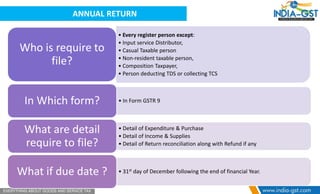

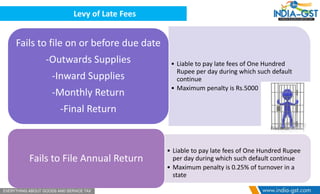

The document provides an overview of the return process under GST, detailing the requirements and deadlines for filing various types of returns, including monthly and annual ones. Key points include the obligation to file returns even with no business activity, the due dates for different forms, and the penalties for late filing. It also outlines the specifics for GSTR 1, GSTR 2, TDS returns, and the annual return process.