This document discusses various aspects of CGST/SGST levy and collection under Section 9 of the CGST Act, including:

1. Rates not exceeding 20% apply to intra-state supplies except alcoholic liquor for human consumption.

2. Petrol and its by-products shall be levied with effect from the date notified by the government based on council recommendations.

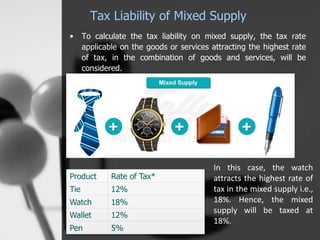

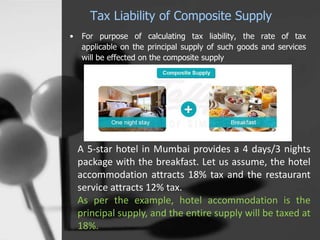

3. For mixed and composite supplies, the highest tax rate among the goods or services in the combination is applied to calculate tax liability for mixed supplies, while the rate applicable to the principal supply is applied for composite supplies.