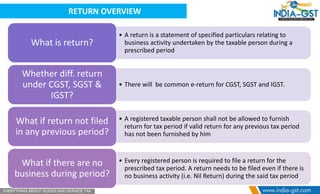

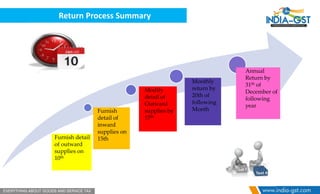

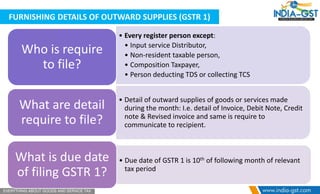

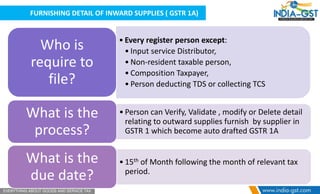

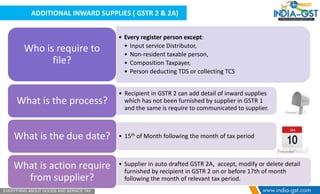

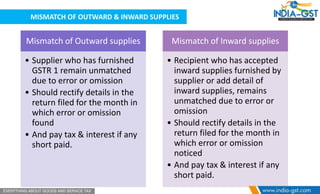

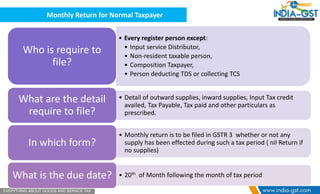

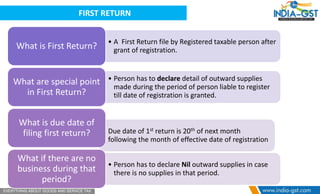

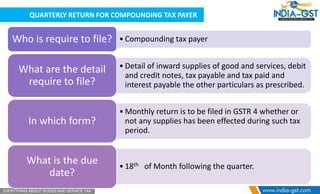

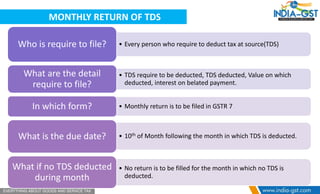

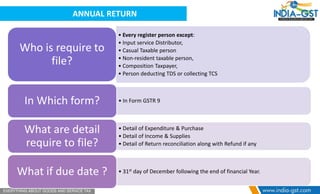

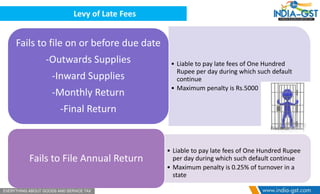

The document outlines the return filing process under GST for registered taxable persons, detailing the requirements and due dates for various types of returns, including monthly and annual filings. It highlights the need to file returns even when there are no business activities (nil returns) and specifies the penalties for late submissions. Additionally, it provides information on the corrections and modifications allowed for mismatches in outward and inward supplies.