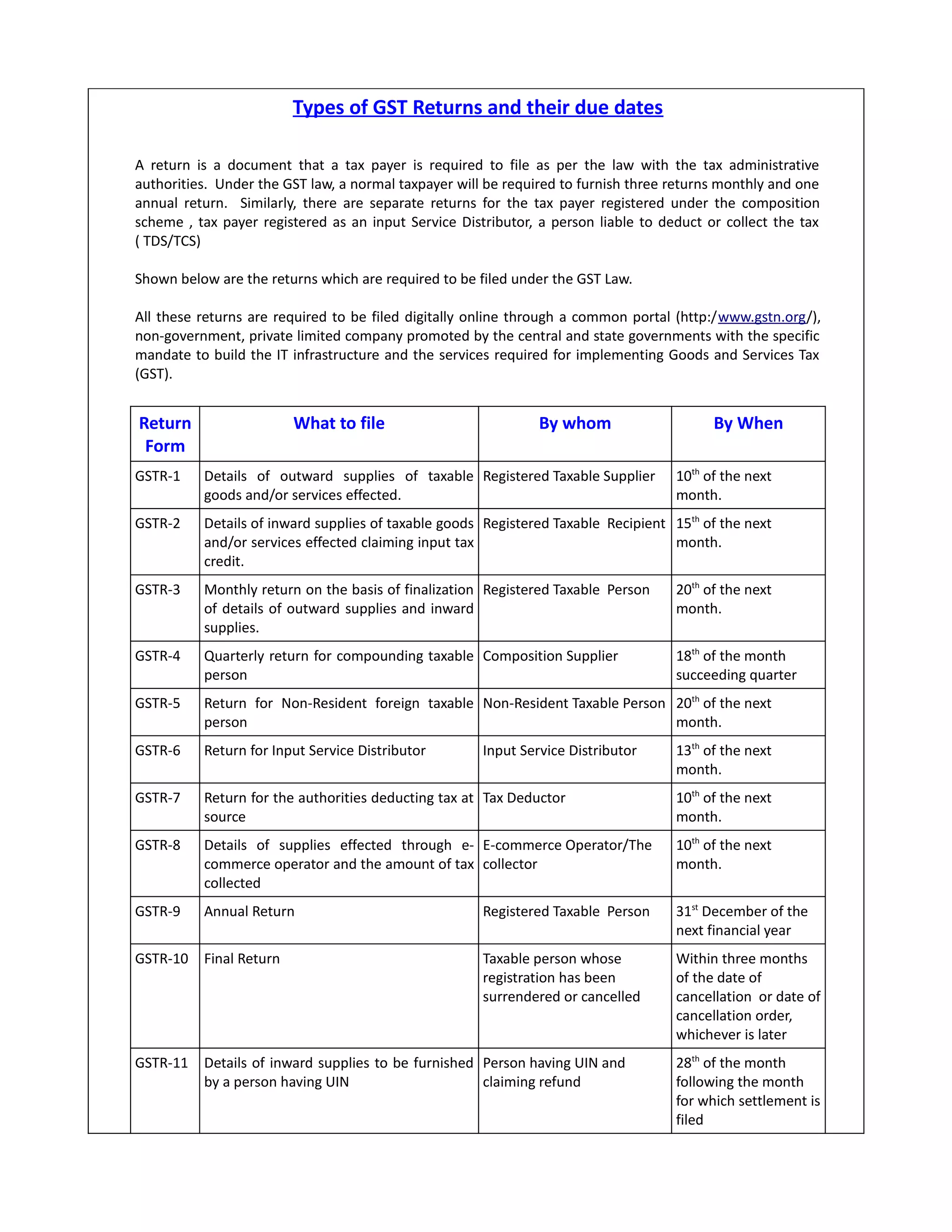

There are several types of GST returns that must be filed by different entities at regular intervals. Registered taxpayers must file three monthly returns (GSTR-1, GSTR-2, GSTR-3) by the 10th, 15th, and 20th day of each month to report details of outward and inward supplies and pay any tax due. Composition taxpayers file quarterly returns (GSTR-4) by the 18th day after each quarter, while non-resident foreign taxpayers file monthly returns (GSTR-5) by the 20th day of each month. Other special returns include input service distributor returns (GSTR-6), tax deducted at source returns (GSTR-7), and e