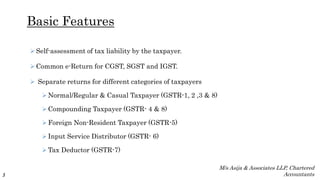

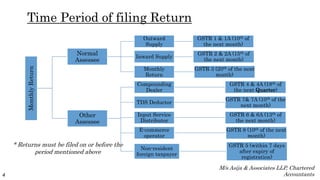

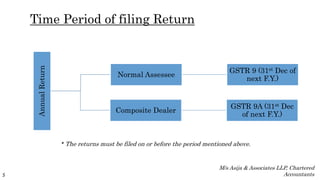

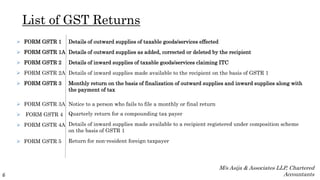

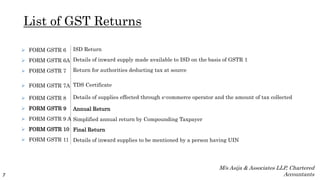

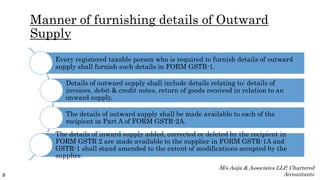

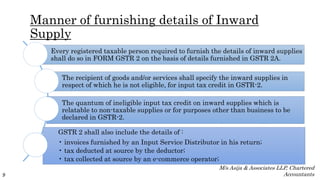

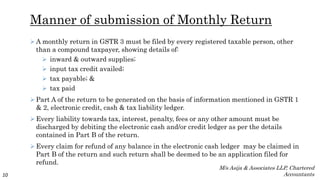

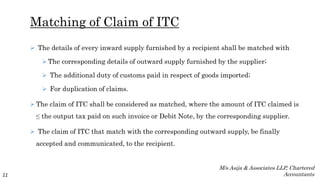

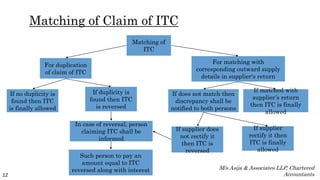

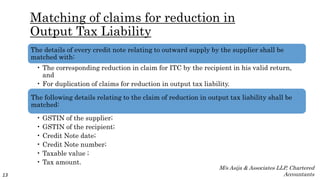

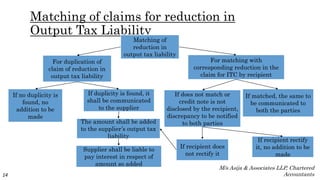

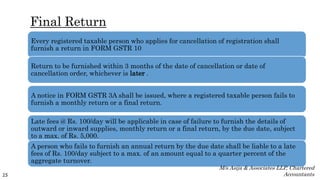

GST returns must be filed by taxpayers on a regular basis to report tax liabilities and claims. There are multiple GST return forms depending on the taxpayer category. Taxpayers must self-assess tax obligations and file monthly, quarterly, or annual returns reporting details of outward and inward supplies, input tax credit, tax payable, and tax paid. Input tax credit claims are matched against supplier returns and any discrepancies can result in credits being denied or reversed. Late fees may apply for failure to submit required returns by the due date.