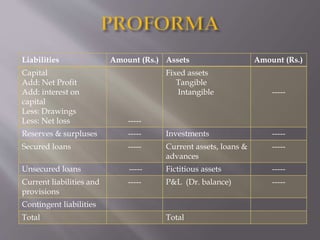

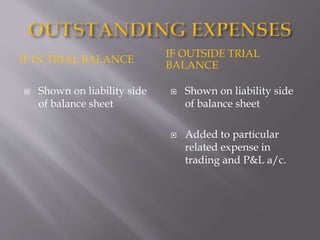

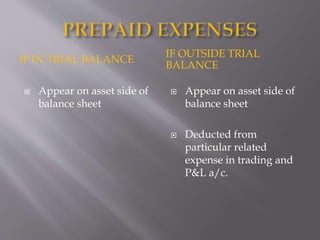

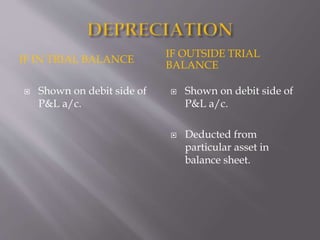

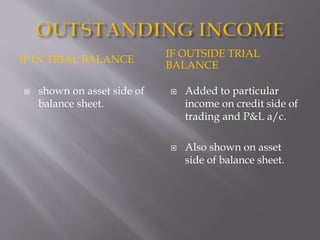

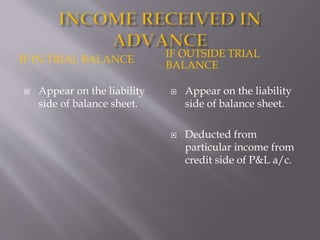

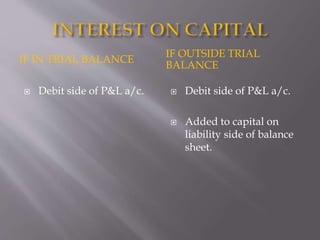

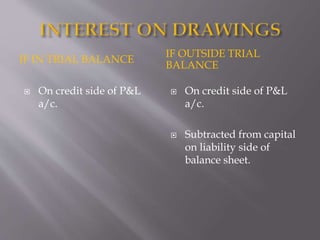

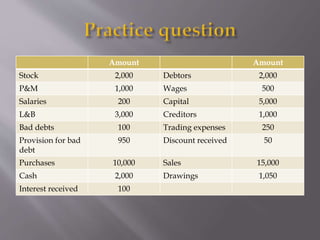

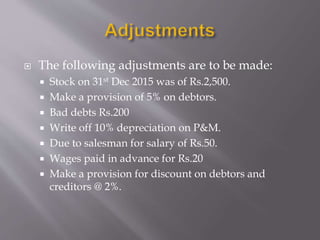

This document discusses the need for adjustments in accounting and how to record various types of adjustments in the financial statements. It provides examples of common adjustments like adjusting accounts for accrued expenses and incomes, prepaid expenses, outstanding expenses, depreciation, provisions, and errors. It explains that adjustments are needed to rectify errors, record omitted transactions, and account for accrued/prepaid items to determine accurate profit/loss and the financial position of a business.