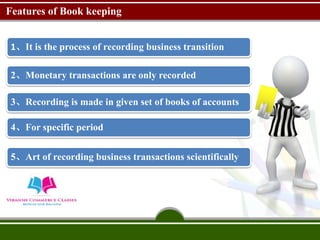

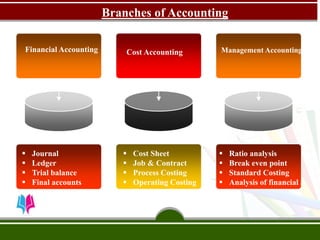

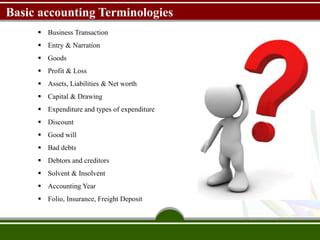

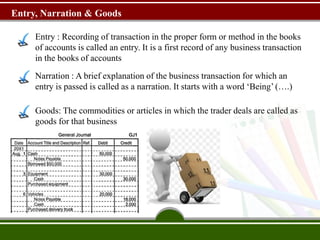

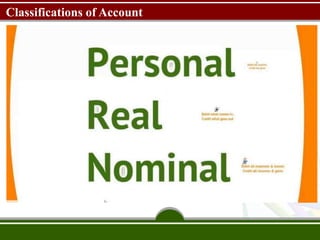

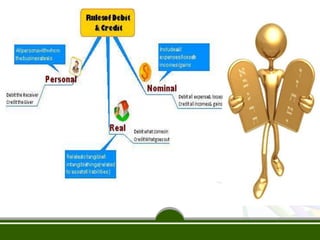

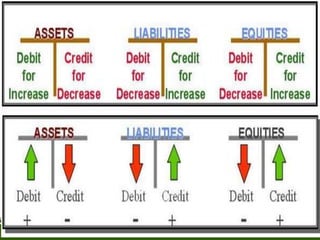

This document defines key accounting terms and concepts such as bookkeeping, accounting, accounting principles, and accounting transactions. It discusses the meaning and objectives of bookkeeping, the features of accounting, basic accounting terminology, and the branches and concepts of accounting. The key points covered include defining bookkeeping as the process of recording business transactions, outlining the objectives of bookkeeping such as maintaining permanent records and determining profit and loss, and explaining basic terms like assets, liabilities, debits, and credits.