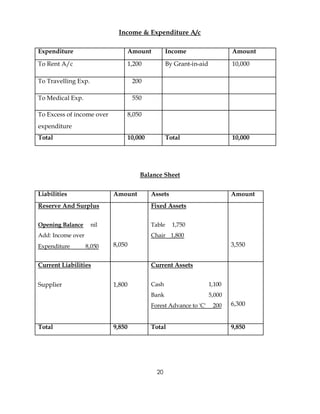

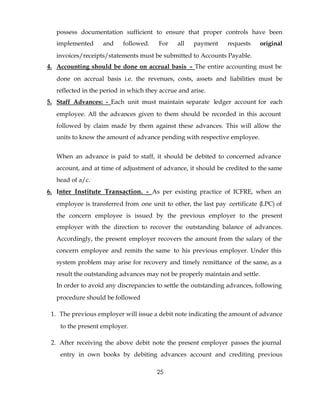

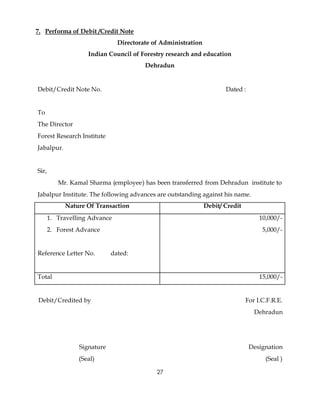

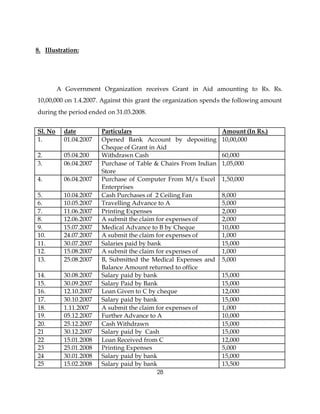

The document provides guidance on implementing a double entry accounting system. It discusses key accounting concepts like the accounting equation, debits and credits, journals, ledgers, trial balance, income/expense accounts and balance sheets. Examples are provided to illustrate double entry for typical transactions like purchases, sales, payments and receipts. The guidelines aim to help organizations transition from a single entry to a more rigorous double entry system of accounting.