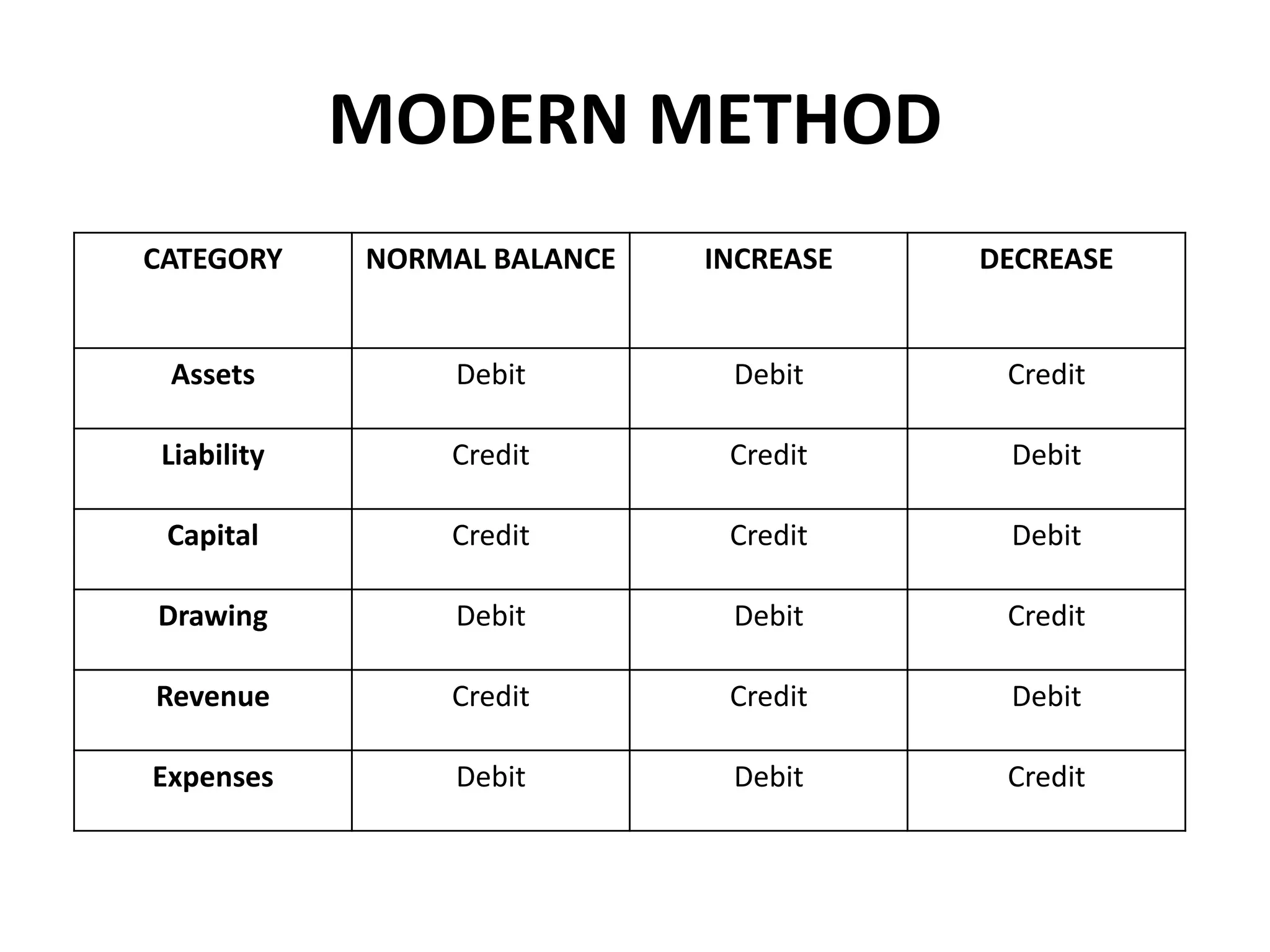

The document discusses the double entry system of accounting and rules of debit and credit. It defines different types of accounts like personal, real and nominal accounts. It explains the traditional and modern methods of recording transactions in double entry system. Under traditional method, the golden rules of debiting and crediting different account types are explained. Several examples of common business transactions are provided along with identification of accounts and debit/credit treatment as per accounting rules.