This document discusses ARIMA (autoregressive integrated moving average) models for time series forecasting. It covers the basic steps for identifying and fitting ARIMA models, including plotting the data, identifying possible AR or MA components using the autocorrelation function (ACF) and partial autocorrelation function (PACF), estimating model parameters, checking the residuals to validate the model fit, and choosing the best model. An example analyzes quarterly US GNP data to demonstrate these steps.

![ARIMA Models [tSeriesR.2010.Ch3.Lab-3]

Theodore Grammatikopoulos∗

Tue 6th

Jan, 2015

Abstract

In previous articles 1 and 2, we introduced autocorrelation and cross-correlation func-

tions (ACFs and CCFs) as mathematical tools to investigate relations that may occur

within and between time series at various lags. We explained how to build linear mod-

els based on classical regression theory for exploiting the associations indicated by

the ACF or CCF. Here, we discuss time domain methods which are appropriate when

we are dealing with possibly non-stationary, shorter time series. These data series are

the rule rather than the exception in many applications, and the methods examined

here are the necessary ingredient of a successful forecasting.

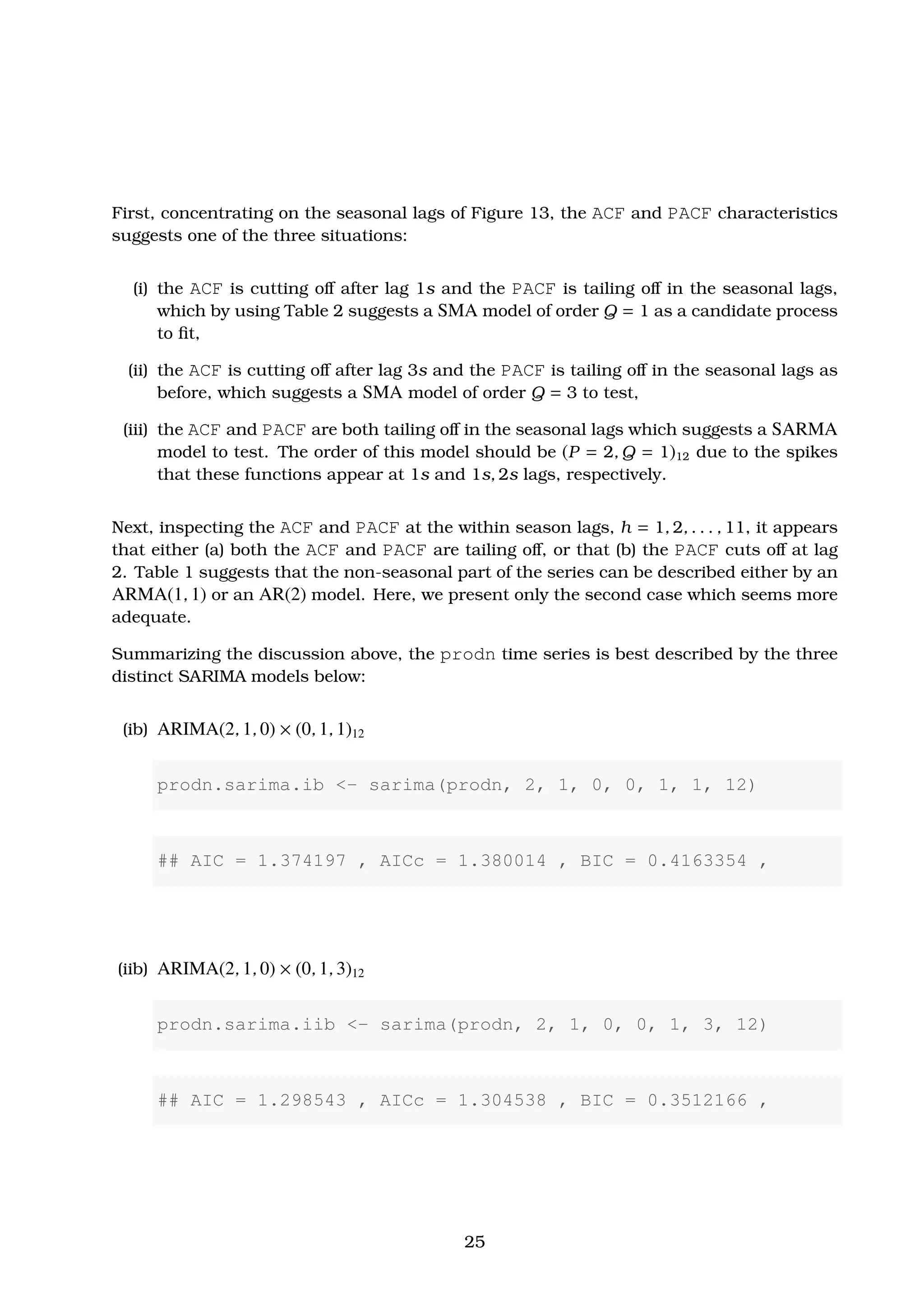

Classical regression is often insufficient for explaining all of the interesting dy-

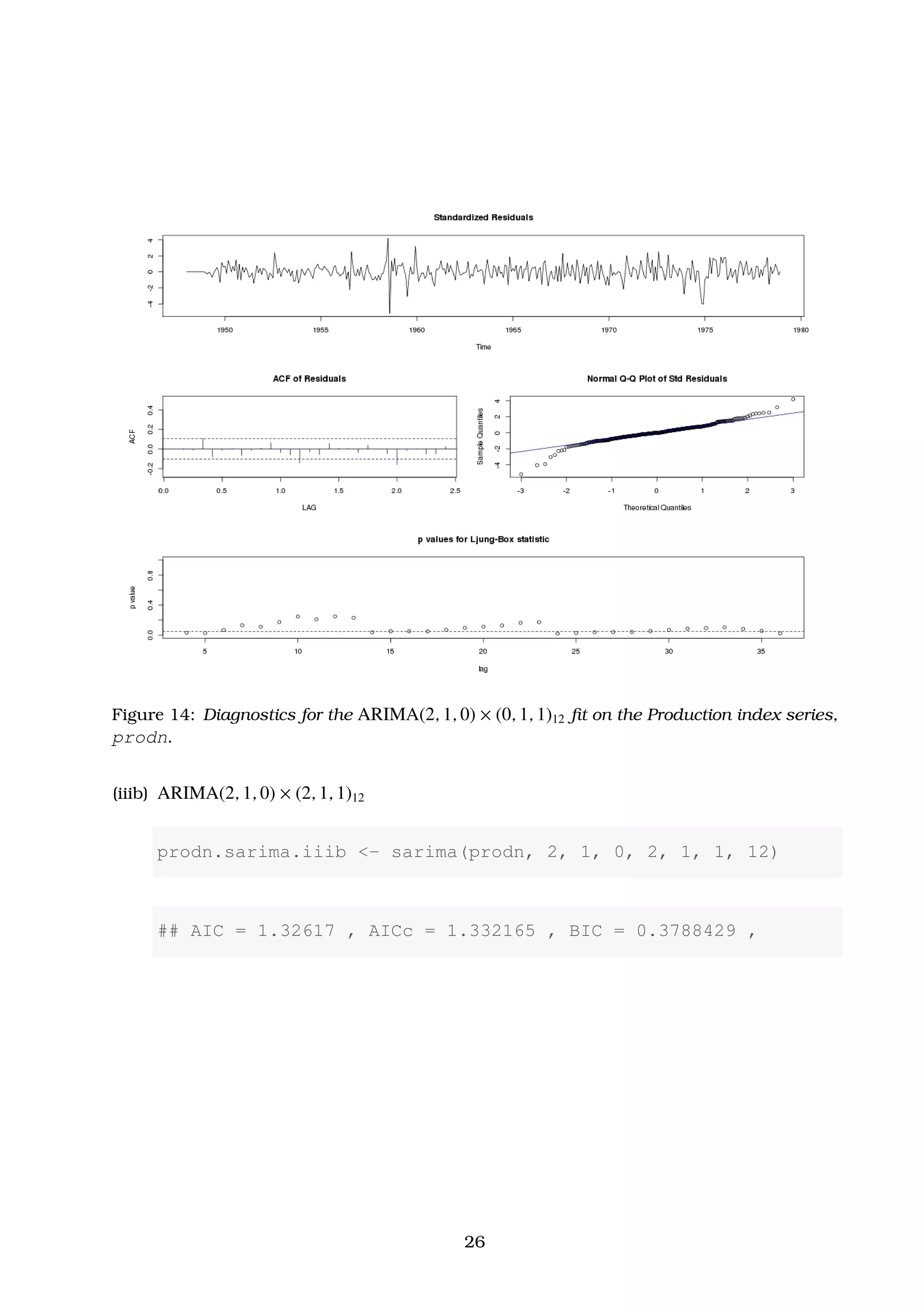

namics of a time series. For example, the ACF of the residuals of the simple linear

regression fit to the global temperature data (gtemp) reveals additional structure in

the data which is not captured by the regression (see Example 2.1 of article 2). Instead,

the correlation as a phenomenon that may be generated through lagged linear rela-

tions leads to proposing the autoregressive (AR) and autoregressive moving average

(ARMA) models. Have to also describe non-stationary processes leads to the autore-

gressive integrated moving average (ARIMA) model [Box and Jenkins, 1970]. Here we

discuss shortly the so-called Box-Jenkins method for identifying a plausible ARIMA

model, and see how it can be actually applied through practical examples. We also

apply techniques for parameter estimation and forecasting for these models.

## OTN License Agreement: Oracle Technology Network -

Developer

## Oracle Distribution of R version 3.0.1 (--) Good Sport

## Copyright (C) The R Foundation for Statistical Computing

## Platform: x86_64-unknown-linux-gnu (64-bit)

D:20150106215920+02’00’

∗

e-mail: tgrammat@gmail.com

1](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-1-2048.jpg)

![2 Estimation

Example 2.1. Yule-Walker (YW) Estimation of the Recruitment Series (rec)

Solution. In Example 1.1 we fit an AR(2) model to the recruitment series using regression.

Here, we calculate the coefficients of the same model using Yule-Walker estimation in R.

The coefficients of the estimated model are nearly identical with the ones found in Example

1.1.

# YW Estimation of an AR(2) - rec series

rec.yw <- ar.yw(rec, order = 2)

rec.yw$x.mean # = 62.26278 (mean estimate)

## [1] 62.26278

rec.yw$ar # = 1.3315874, -.4445447 (AR parameter estimates)

## [1] 1.3315874 -0.4445447

sqrt(diag(rec.yw$asy.var.coef)) # = .04222637, .04222637 (

standard errors)

## [1] 0.04222637 0.04222637

rec.yw$var.pred # = 94.79912 (error variance estimate)

## [1] 94.79912

# 24-month ahead Forecast

rec.pr <- predict(rec.yw, n.ahead = 24)

U <- rec.pr$pred + rec.pr$se

L <- rec.pr$pred - rec.pr$se

minx <- min(rec, L)

maxx <- max(rec, U)

dev.new()

opar <- par(no.readonly = TRUE)

5](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-5-2048.jpg)

![par(opar)

ts.plot(rec, rec.pr$pred, xlim = c(1980, 1990), ylim = c(minx,

maxx), ylab = "rec", main = "24-month ahead forecast of

Recruitment Seriesn[rec, Yule-Walker (red,blue), MLE(

green)]")

lines(rec.pr$pred, col = "red", type = "o")

lines(U, col = "blue", lty = "dashed")

lines(L, col = "blue", lty = "dashed")

Figure 3: Twenty-four month ahead forecast for the Recruitment series rec. The actual

data shown are from about January 1980 to September 1987, and then the forecasts plus

and minus one standard error are displayed. The plot has been produced by fitting an

AR(2) process using first Yule-Walker estimation (red curve with blue upper and lower

bounds) and MLE (green curves) afterwards.

6](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-6-2048.jpg)

![5. Model diagnostics. This step includes the analysis of the residuals as well as model

comparisons.

ˆ First, we produce a time plot of the innovations (or residuals), xt − xt

t−1

, or of

the standardized innovations

et = (xt − xt

t−1

)/ (Pt

t−1

) . (2)

Here, xt

t−1

is the one-step-ahead prediction of xt (based on the fitted model) and

Pt

t−1

is the estimated one-step-ahead error variance. If the model provides a good

fit to the observational data, the standardized residuals, et, should behave as

et ∼ N(0, 1) . (3)

However, unless the time series is Gaussian, it is not enough that the residuals

are uncorrelated. For example, it is possible in the non-Gaussian case to have

an uncorrelated process for which values contiguous in time are highly depen-

dent. An important class of such models are the so-called, GARCH models.

ˆ In case that a time plot of residuals appears marginal normality a histogram

of the residuals may be extremely helpful. In addition to this, a normal prob-

ability plot or a Q-Q plot can help in identifying departures from normality.

For details of this test as well as additional tests for multivariate normality

consult [Johnson and Wichern, 2013].

ˆ Another test to search for possible departure from normality is to inspect the

sample autocorrelations of the residuals, ρe(h), for any patterns or large values.

Recall that, for a white noise sequence

ρe(h) ∼ iid N(0, 1/n) . (4)

Divergences from this expected result and beyond its expected error bounds,

±2/

√

n, suggest that the fitted model can be improved. For details consult [Box

and Pierce, 1970] and [McLeod, 1978].

ˆ A more general test takes into consideration the magnitudes of ρe(h) as a group.

For example, it may be the case that, individually, each ρe(h) is slightly less

in magnitude than the expected error bounds, 2/

√

n, but the ρe(h) as a whole

follows collectively a different statistic than the one expected by an iid N(0, 1/n)

distribution. More specifically, the statistic of interest to perform this test is

Ljung-Box-Pierce

Statistic

: Q = n(n + 2)

H

h=1

ρe

2

(h)

n − h

n→∞

−−−−→ XH−p−q . (5)

The value H in eq. (5) above is chosen somewhat arbitrarily, typically, H = 20.

Then, under the null hypothesis of model adequacy, Q

n→∞

−−−−→ XH−p−q. Thus, we

9](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-9-2048.jpg)

![would reject the null hypothesis at level α if the value of Q exceeds the (1 − α)

quantile of X2

H−p−q distribution. For details consult [Box and Pierce, 1970],

[Ljung and Box, 1978] and [Davies et al., 1977]. The basic idea is that providing

wt describes white noise, the n ρw

2

(h), for h = 1, . . . , H, are asymptotically

independent χ2

1 random variables, which in turn means n H

h=1 ρw

2

(h) ∼ X2

H .

The loss of p + q degrees of freedom in eq. (5) is because the test involves ACF

of residuals from ARMA(p, q) model fit.

6. Model choice. In this final step of model fitting we must decide which model we will

retain for forecasting. The most popular criteria to do so are AIC, AICc and BIC.

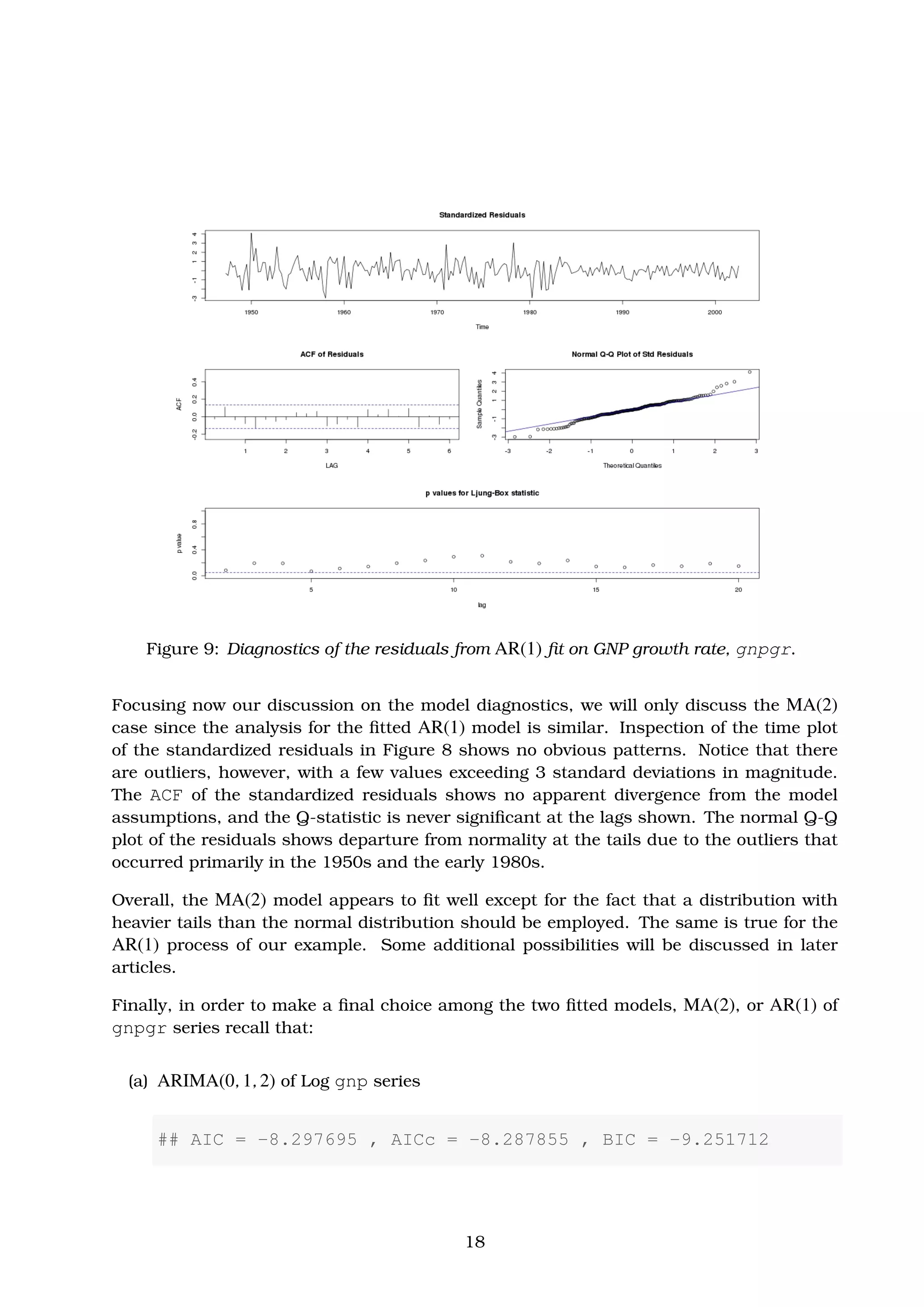

Example 3.1. Analysis of GNP Data. Here, we consider the analysis of quarterly U.S. GNP

from 1947 to 2002, gnp, having n = 223 observations. The data are real U.S. gross national

product in billions of dollars and have been seasonally adjusted. The data were obtained

from the Federal Reserve Bank of St. Louis (http://research.stlouisfed.org) and

they are provided by the astsa package of [Shumway and Stoffer, 2013]. We are going to

make a preliminary exploratory data analysis, determine if we need to transform our data

and make a preliminary claim of possible ARIMA(p, d, q) models to fit. We will estimate

the model parameters and make a first conclusion on the performance of the produced fits.

Finally, we decide which model we will retain for forecasting and make an actual forecast.

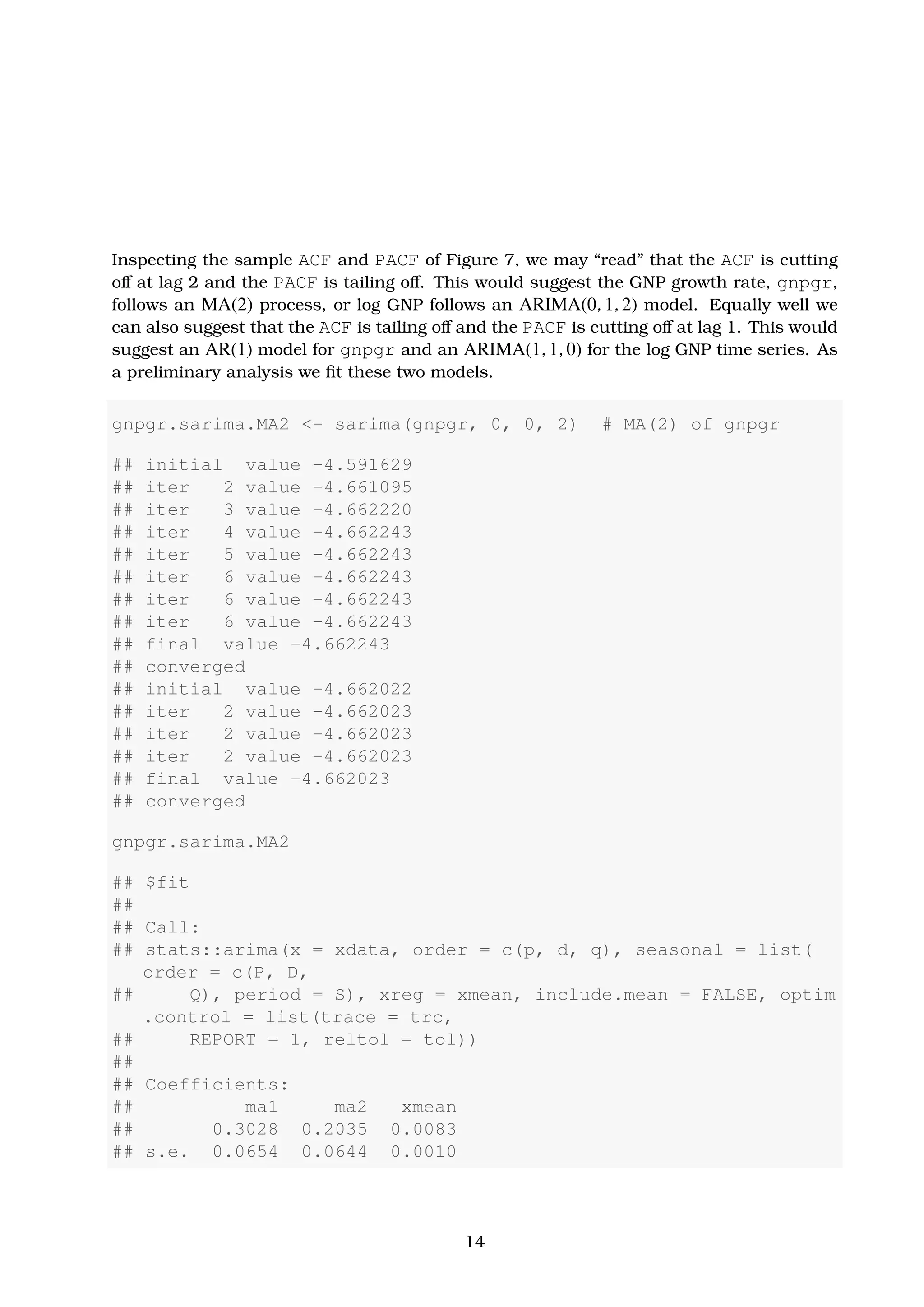

Solution. To have a first idea of the gnp data series, yt, we produce a time plot of the data

alongside with its sample ACF. As shown in Figure 4, the gnp time series appears a strong

trend of growing GNP with time, and it is not clear that the variance is also increasing.

The sample ACF, on the other hand, decay slowly with growing lag, h, indicating that we

should differ the time series first.

par(opar)

par(mfrow = c(2, 1), mar = c(3, 4.1, 4.1, 3), oma = c(0, 0, 3,

0))

plot(gnp, xlab = "Time", ylab = "gnp")

acf(gnp, 50, xlab = "Lag", ylab = "ACF") # Maximum 50 Lags

title(main = "Quarterly U.S. GNP (gnp)", outer = TRUE)

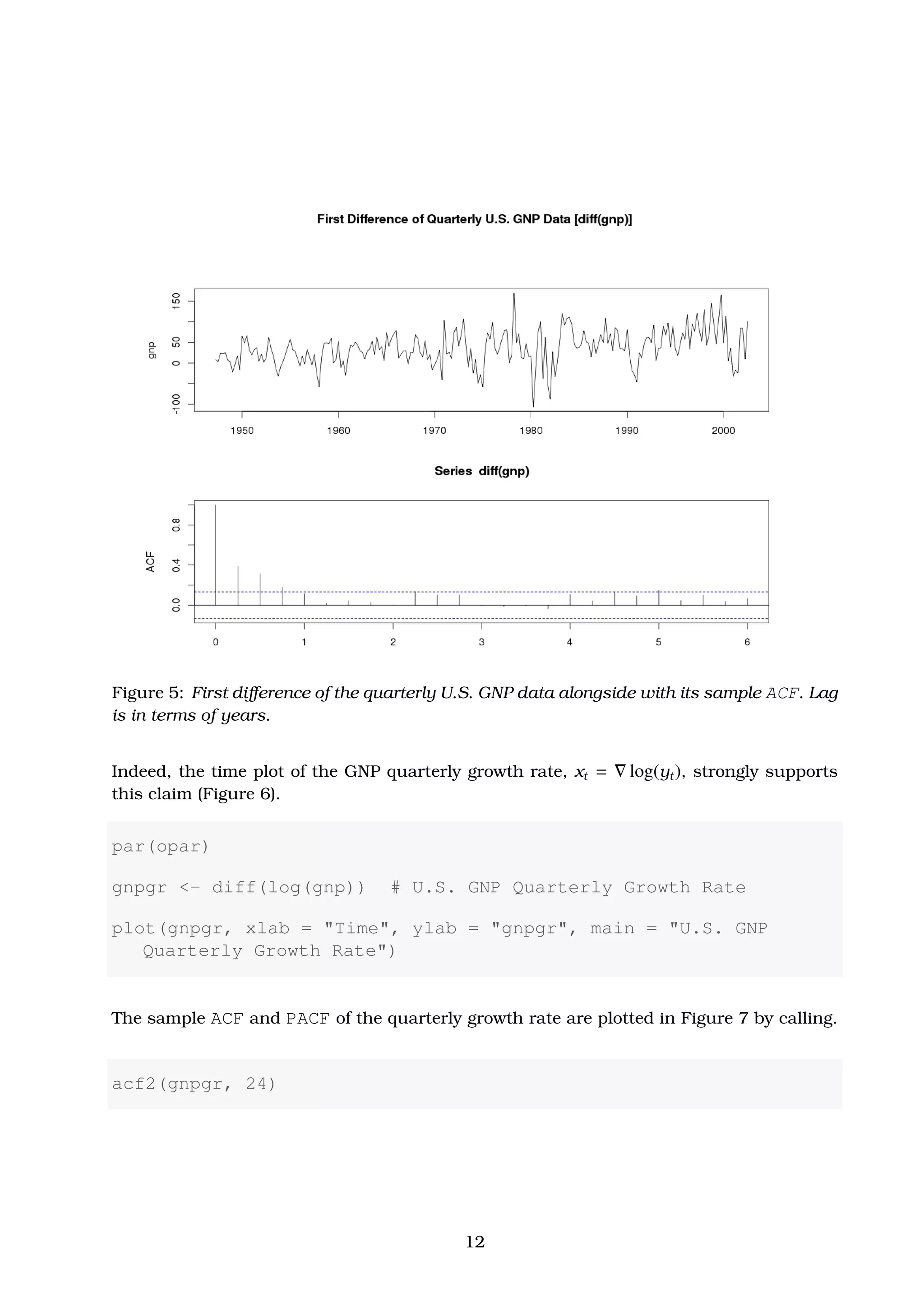

Differencing the gnp time series once and re-plotting this new data series diff(gnp), we

observe in Figure 5 that the strong growing trend has been removed and a larger variability

in the second half of the time plot has been revealed. This suggests that an additional

log-transform of the gnp data may result in a more stable process.

10](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-10-2048.jpg)

![par(opar)

par(mfrow = c(2, 1), mar = c(3, 4.1, 4.1, 3), oma = c(0, 0, 3,

0))

plot(diff(gnp), xlab = "Time", ylab = "gnp")

acf(diff(gnp), 24, xlab = "Lag", ylab = "ACF") # Maximum 50 Lags

title(main = "First Difference of Quarterly U.S. GNP Data [diff(

gnp)]",

outer = TRUE)

Figure 4: Quarterly U.S. GNP from 1947 to 2002 alongside with its sample ACF. Lag is in

terms of years.

11](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-11-2048.jpg)

![##

## sigma^2 estimated as 8.919e-05: log likelihood = 719.96, aic

= -1431.93

##

## $AIC

## [1] -8.297695

##

## $AICc

## [1] -8.287855

##

## $BIC

## [1] -9.251712

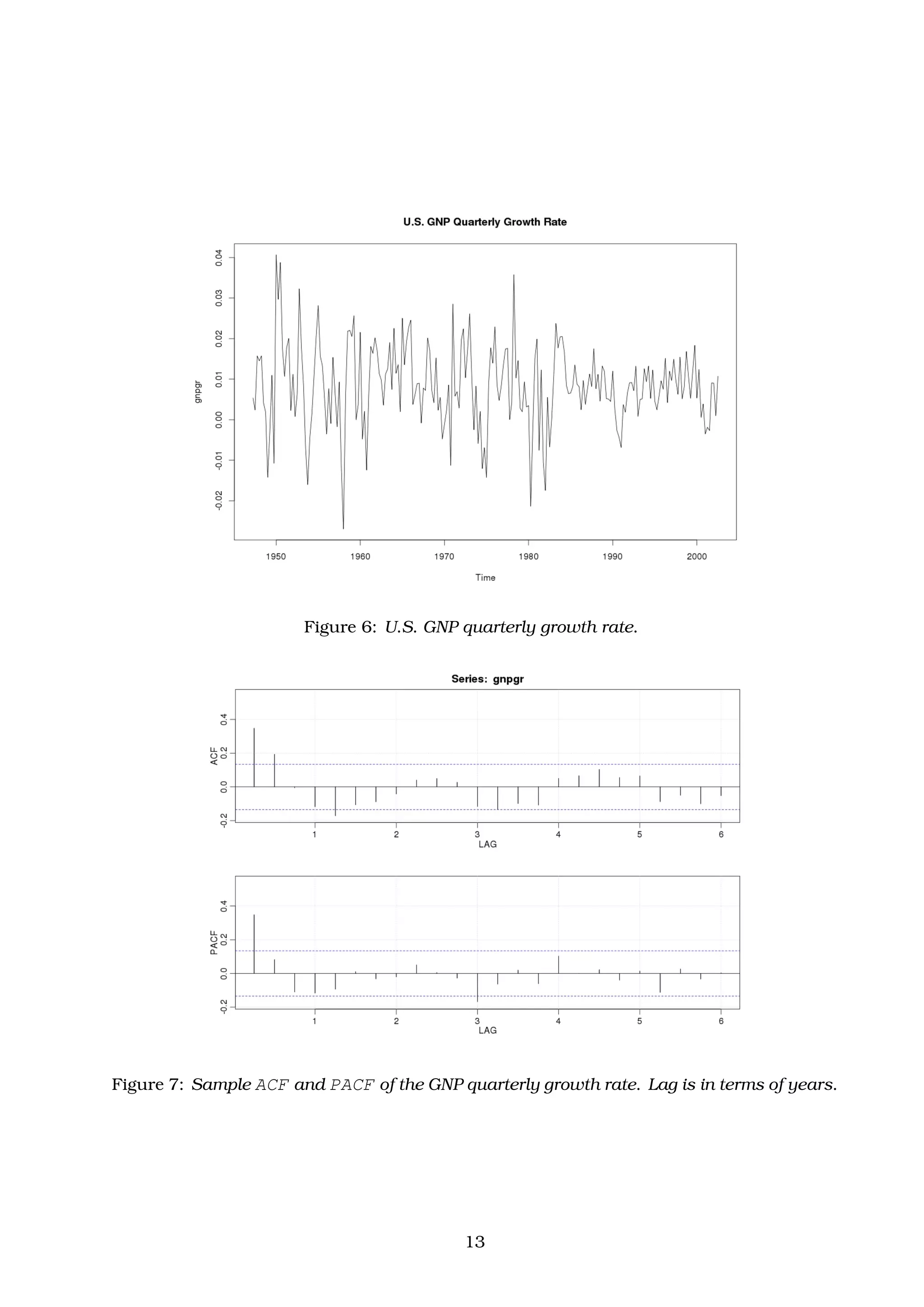

That is using MLE to fit the MA(2) model for the growth rate, xt, the estimated model is

found to be

xt = 0.0083(0.0010) + 0.3028(0.0654)wt−1 + 0.2035(0.0644)wt−2 + wt , (6)

where σw = 8.919 × 10−05

. The values in parentheses are the corresponding estimated

errors. Note, that all of the regression coefficients are significant, including the constant∗

.

In this example, not including a constant assumes the average quarterly growth rate is

zero, whereas in fact the average quarterly growth rate is about 1% (Figure 6).

The estimated AR(1) model, on the other hand, is calculated as follows.

gnpgr.sarima.AR1 <- sarima(gnpgr, 1, 0, 0) # AR(1) of gnpgr

## initial value -4.589567

## iter 2 value -4.654150

## iter 3 value -4.654150

## iter 4 value -4.654151

## iter 4 value -4.654151

## iter 4 value -4.654151

## final value -4.654151

## converged

## initial value -4.655919

## iter 2 value -4.655921

∗

Some software packages do not fit a constant in a differenced model.

15](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-15-2048.jpg)

![##

## Coefficients:

## ar1 xmean

## 0.3467 0.0083

## s.e. 0.0627 0.0010

##

## sigma^2 estimated as 9.03e-05: log likelihood = 718.61, aic

= -1431.22

##

## $AIC

## [1] -8.294403

##

## $AICc

## [1] -8.284898

##

## $BIC

## [1] -9.263748

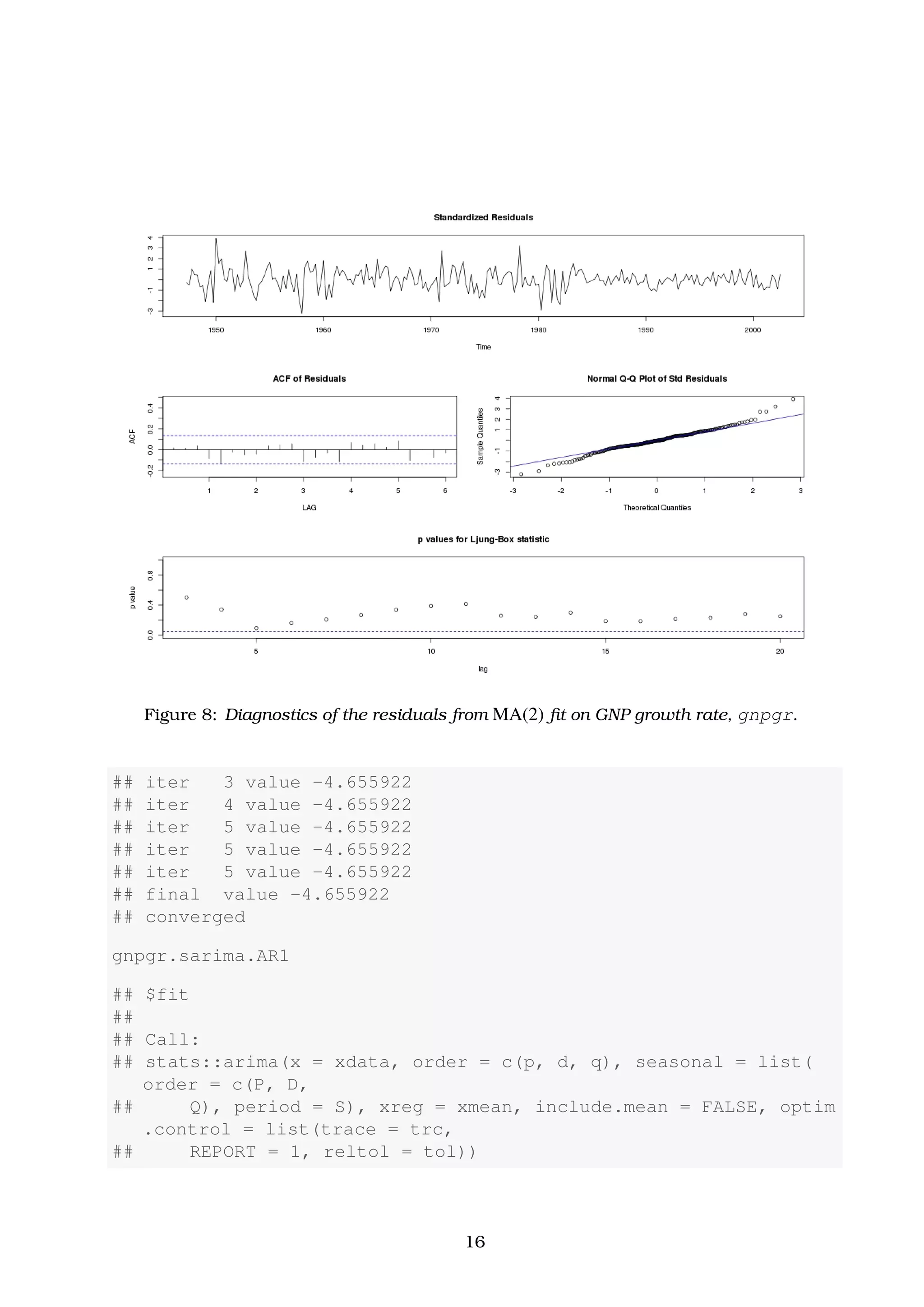

Thus, the AR(1) model for the growth rate, xt, is found to be

xt = 0.0083(0.0010)(1 − 0.3467) + 0.3467(0.0627)xt−1 + wt , (7)

where σw = 9.03 × 10−05

and the intercept now is 0.0083(1 − 0.3467) ≈ 0.005.

Before we discuss the produced diagnostics of these two models, we can make a first

comparison among them. They are nearly the same. This is because the fitted AR(1)

model is similar to the MA(2) one, providing that it is written in its causal form.

ARMAtoMA(ar = 0.3467, ma = 0, 10)

## [1] 3.467000e-01 1.202009e-01 4.167365e-02 1.444825e-02

## [5] 5.009210e-03 1.736693e-03 6.021115e-04 2.087520e-04

## [9] 7.237433e-05 2.509218e-05

That is the fitted AR(1) model in its causal form can be approximated by the MA(2) model

xt ≈ 0.35wt−1 + 0.12wt−2 + wt .

This process is indeed similar with the fitted MA(2) model of eq. (6).

17](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-17-2048.jpg)

![where wt is a Gaussian white noise process, i.e. wt ∼ iid N(0, 1). This general model is

denoted as ARIMA(p, d, q) × (P, D, Q)s.

Building SARIMA Models

Selecting the appropriate SARIMA model for a given set of data is not an easy task, but a

rough description of how doing so is the following:

1. We determine the difference (seasonal or ordinary) operators (if any) that produce a

roughly stationary series.

2. We evaluate the ACF and PACF functions of the remaining stationary data series

and using the general properties of Tables 1 and 2, we determine a preliminary set

of ARMA/SARMA models to test.

3. Given this preliminary set of ARIMA(p, d, q) × (P, D, Q)s models we proceed with their

parameter estimation. To do so we use either (a) the method of Yule-Walker Esti-

mation (YW) or (b) the method of Maximum Likelihood and Least Square Estimation

(MLE), which is more precise for large data samples.

4. Then, by using the same criteria mentioned in Section 3 (see “Model diagnostics”),

we can judge whether these models are satisfactory enough to further consider.

5. Finally, we decide which model will retain for forecasting based on their AIC, AICc

and/or BIC statistics.

Example 4.1. The Federal Reserve Board Production Index. Given the monthly time

series of “Federal Reserve Board Production Index”, prodn, which is provided by the astsa

package of [Shumway and Stoffer, 2013] and includes the monthly values of the index for

the period 1948-1978, we now fit a preliminary set of SARIMA models and finally select the

best one to make a forecast for the next 12 months.

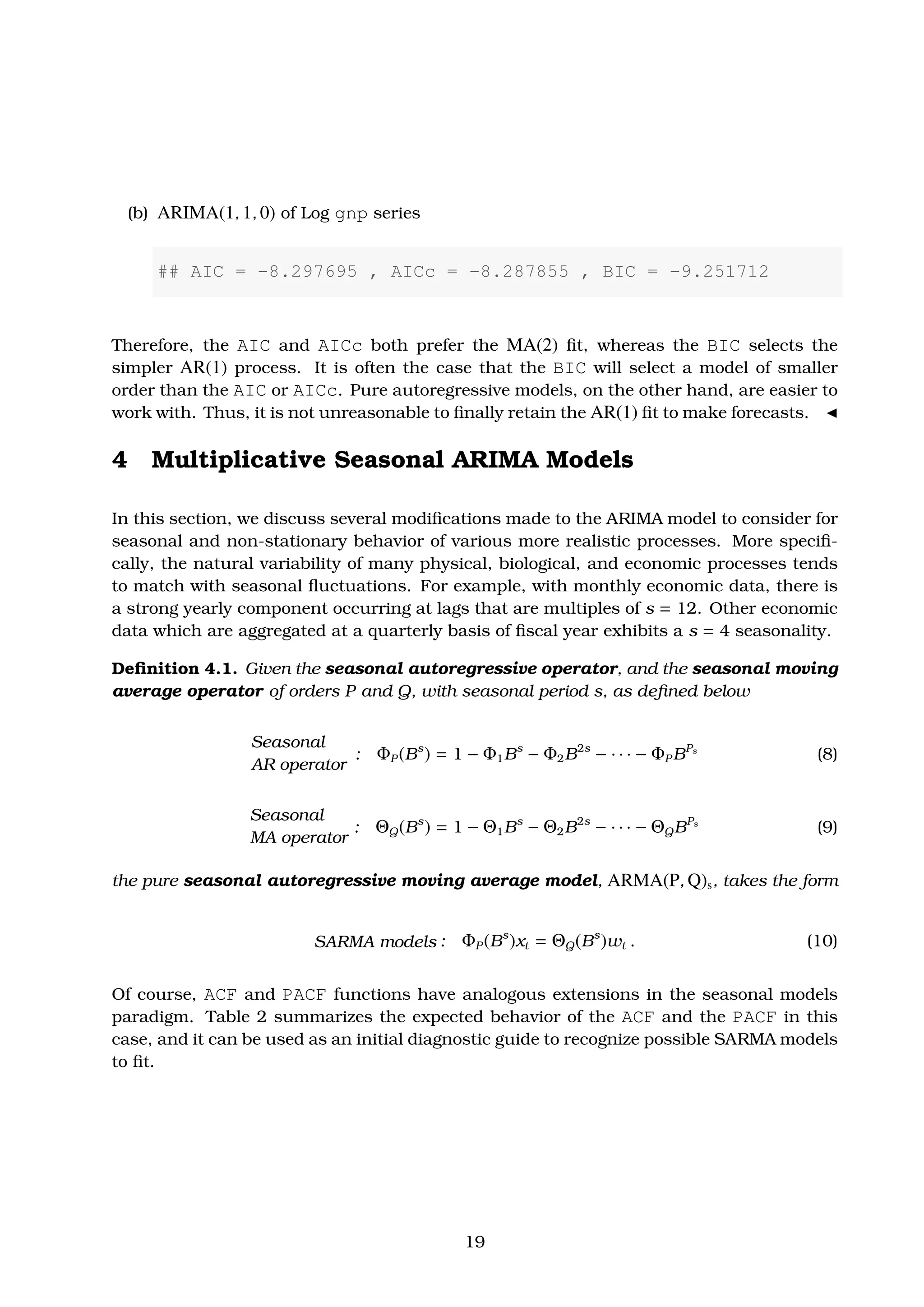

Solution. First we provide a time plot of the prodn time series (Figure 10). In Figure 11

we also plot the ACF and PACF functions for this time series.

par(opar)

plot(prodn, main = "Monthly Federal Reserve Board Production

Indexn[prodn{astsa}, 1948-1978]")

par(opar)

acf2(prodn, 50)

21](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-21-2048.jpg)

![Figure 10: Monthly values of the “Federal Reserve Board Production Index”, [prodn, 1948 -

1978]

Figure 11: ACF and PACF of the prodn series.

22](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-22-2048.jpg)

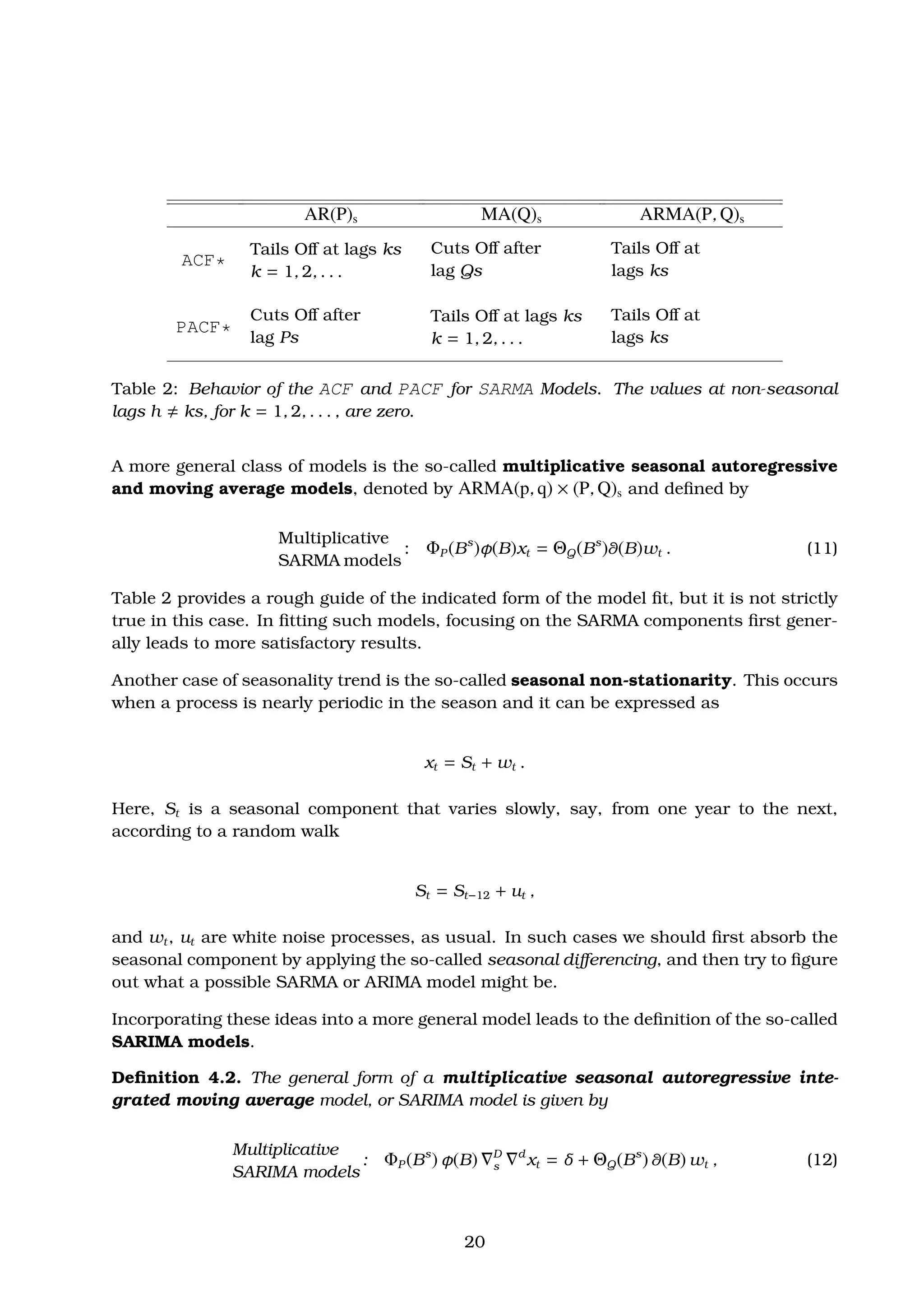

![Figure 16: Diagnostics for the ARIMA(2, 1, 0) × (2, 1, 1)12 fit on the Production index series,

prodn.

## ar1 ar2 sma1 sma2 sma3

## 0.3038 0.1077 -0.7393 -0.1445 0.2815

## s.e. 0.0526 0.0538 0.0539 0.0653 0.0526

##

## sigma^2 estimated as 1.312: log likelihood = -563.98, aic =

1139.97

##

## $AIC

## [1] 1.298543

##

## $AICc

## [1] 1.304538

##

## $BIC

## [1] 0.3512166

28](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-28-2048.jpg)

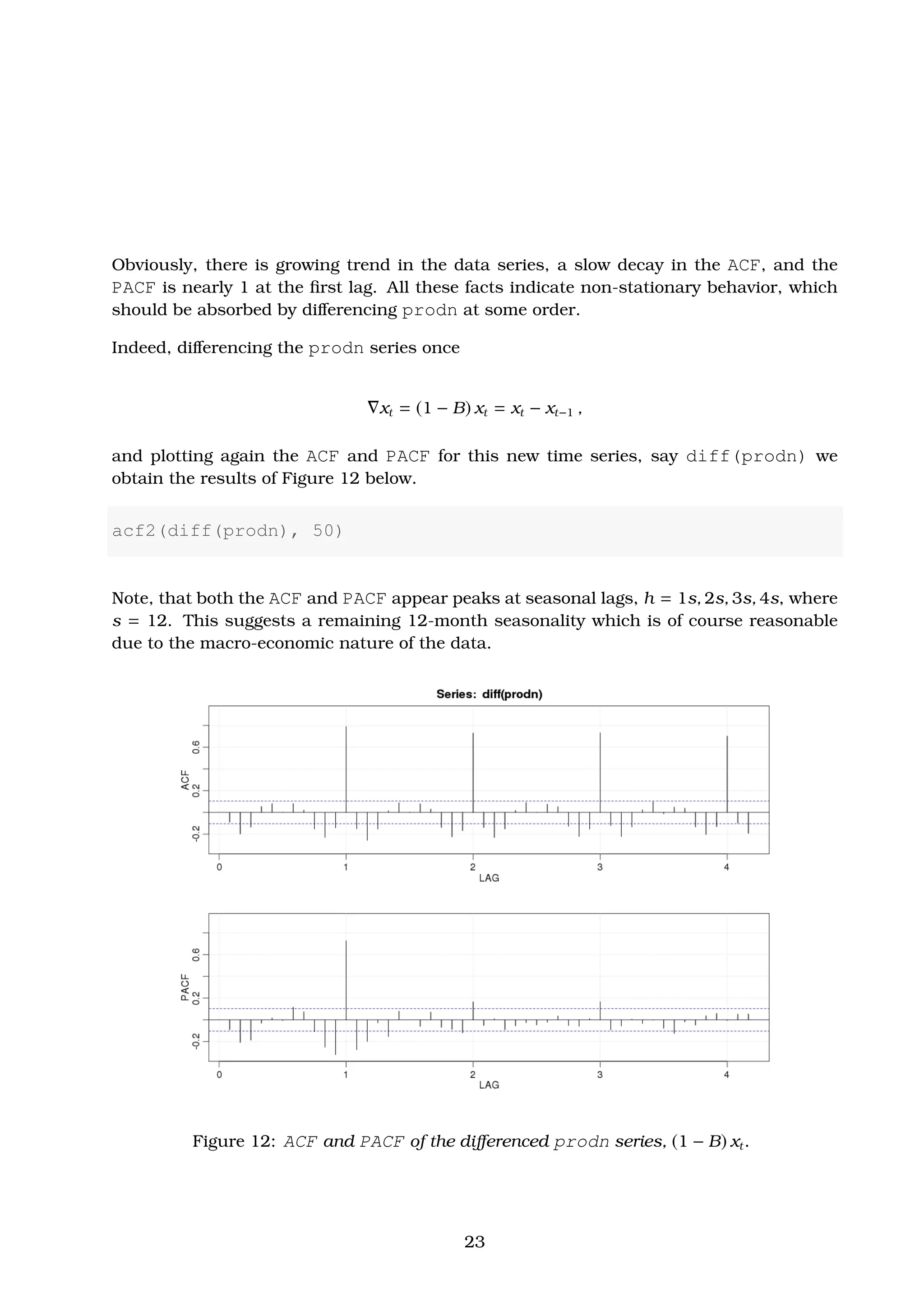

![or in operator form

1 − 0.3038(0.0526) B − 0.1077(0.0538) B2

12 xt =

= 1 − 0.7393(0.0539) B12

− 0.1445(0.0653) B24

+ 0.2815(0.0526) B36

wt ,

with σ2

w = 1.312.

Finally, we actually make forecasts for the next 12 months using this fitted model, i.e.

(iib) ARIMA(2, 1, 0) × (0, 1, 3)12. These are shown in Figure 17 below.

prodn.sarima.iib.fore <- sarima.for(prodn, 12, 2, 1, 0, 0, 1,

3, 12) # 12-month forecast

title(main = "Federal Reserve Board Production IndexnForecasts

and Error Bound Limits [prodn{astsa}, 1948-1978]",

outer = FALSE)

Figure 17: Forecasts and error bounds for the “Federal Reserve Board Production Index”,

prodn series, based on ARIMA(2, 1, 0) × (0, 1, 3)12 fitted model [case (iib)].

29](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-29-2048.jpg)

![References

[Box and Pierce, 1970] Box, G. and Pierce, D. (1970). Distributions of residual auto-

correlations in autoregressive integrated moving average models. J. Am. Stat. Assoc.,

72:397–402.

[Box and Jenkins, 1970] Box, G. E. P. and Jenkins, G. M. (1970). Time Series Analysis

Forecasting and Control. Holden-Day, San Francisco.

[Davies et al., 1977] Davies, N., Triggs, C., and Newbold, P. (1977). Significance levels of

the box-pierce portmanteau statistic in finite samples. Biometrica, 64:517–522.

[Johnson and Wichern, 2013] Johnson, R. A. and Wichern, D. W. (2013). Applied Multi-

variate Statistical Analysis. Pearson, 6th ed. 2013 edition.

[Ljung and Box, 1978] Ljung, L. and Box, G. E. P. (1978). On a measure of lack of fit in a

time series. Biometrica, 65:297–303.

[McLeod, 1978] McLeod, A. (1978). On the distribution of residual autocorrelations in

box-jenkins models. J. R. Stat. Soc., B(40):296–302.

[Shumway and Stoffer, 2013] Shumway, R. H. and Stoffer, D. S. (2013). Time Series Anal-

ysis and Its Applications: With R Examples (Springer Texts in Statistics). Springer,

softcover reprint of hardcover 3rd ed. 2011 edition.

30](https://image.slidesharecdn.com/ydqcxn5vtqizjoun2as1-signature-e1de5ad681d661531c2467ca0d3e475440809ccfdbcb78c5369a1bb749945888-poli-141230090527-conversion-gate01/75/ARIMA-Models-Lab-3-30-2048.jpg)