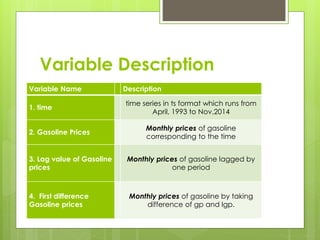

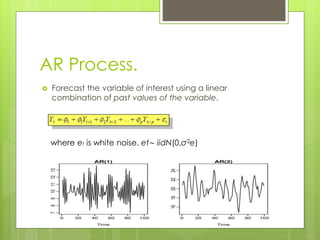

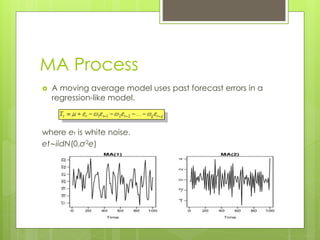

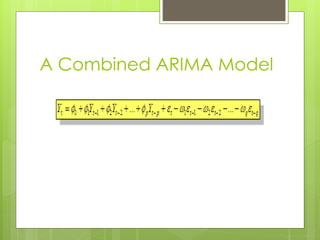

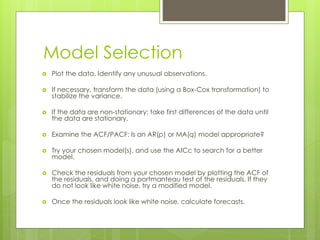

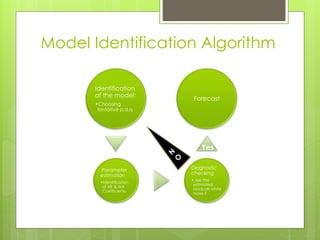

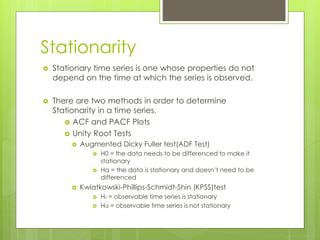

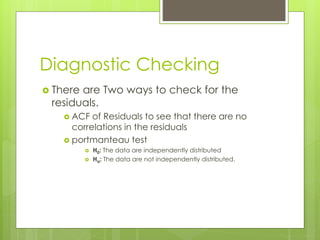

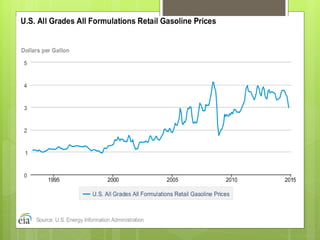

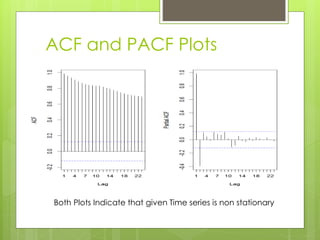

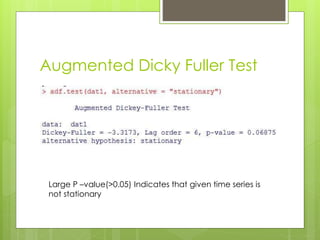

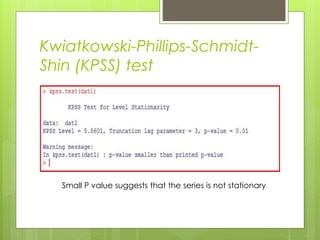

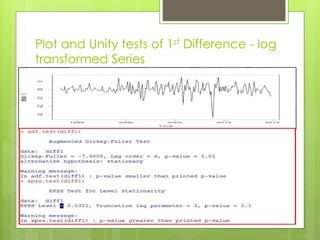

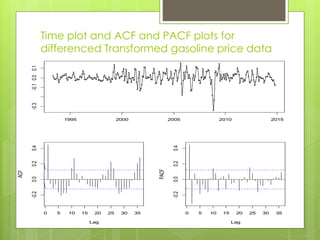

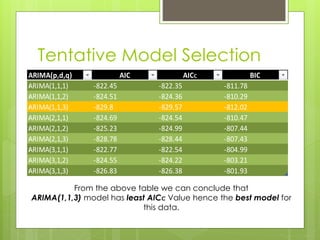

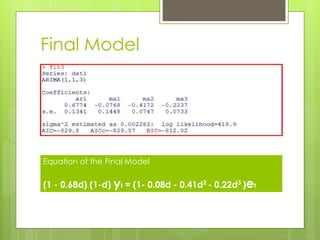

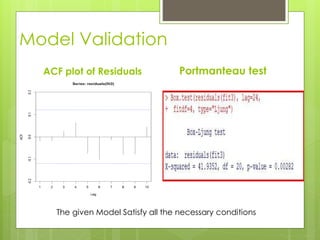

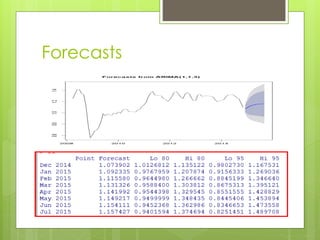

This document discusses forecasting gasoline prices in the United States using an ARIMA model. It provides background on gasoline, including its consumption and retail prices. The objective is to understand price volatility due to supply and demand constraints. Data on US gasoline prices from 1993-2014 is obtained from the EIA. After checking for stationarity and transforming the data, an ARIMA(1,1,3) model is identified as best. This model reveals gasoline prices are significantly related to past prices and unobserved factors. The validated model is used to forecast future gasoline prices.