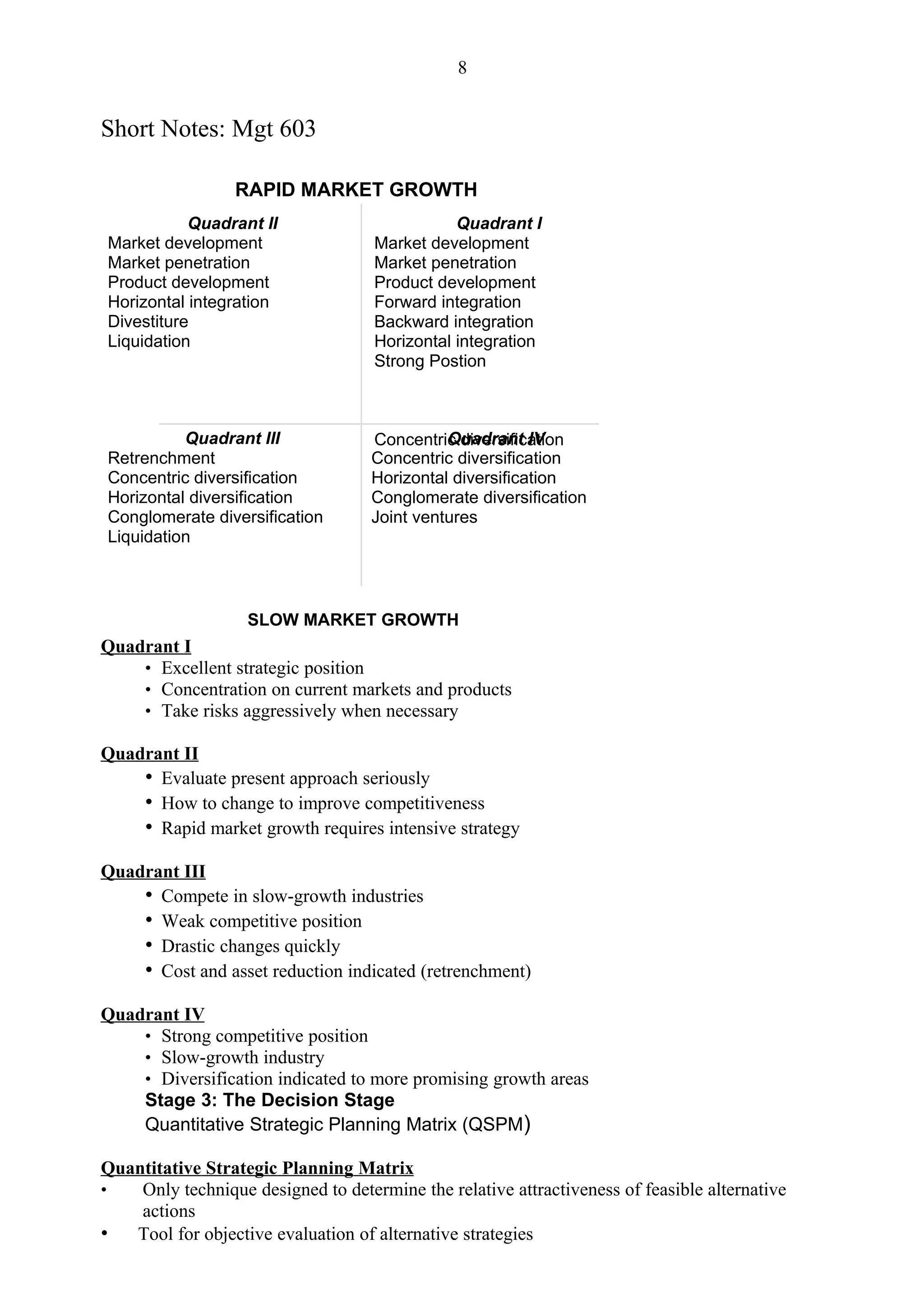

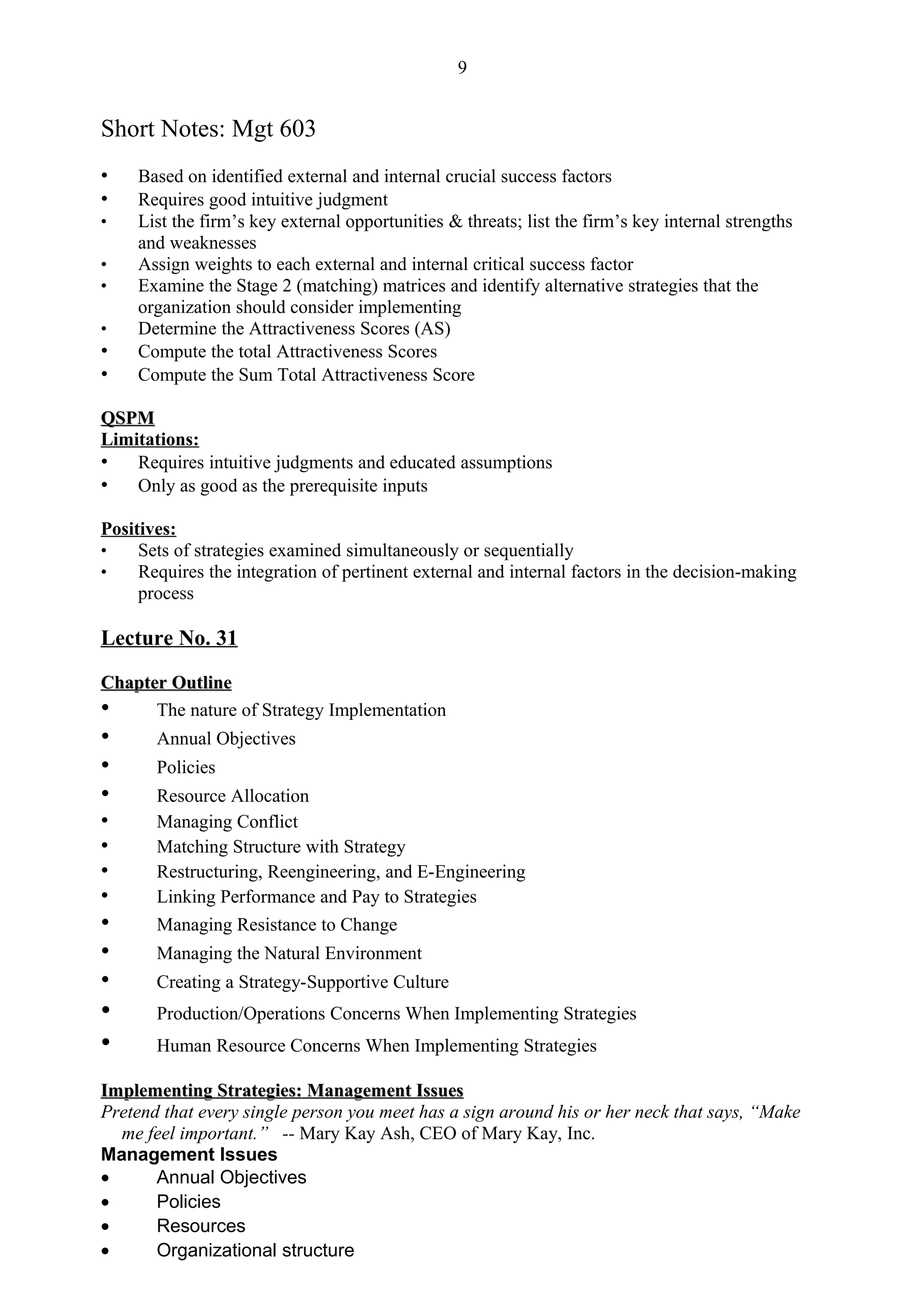

This document provides an outline and overview of strategic management concepts related to strategy analysis and choice. It discusses:

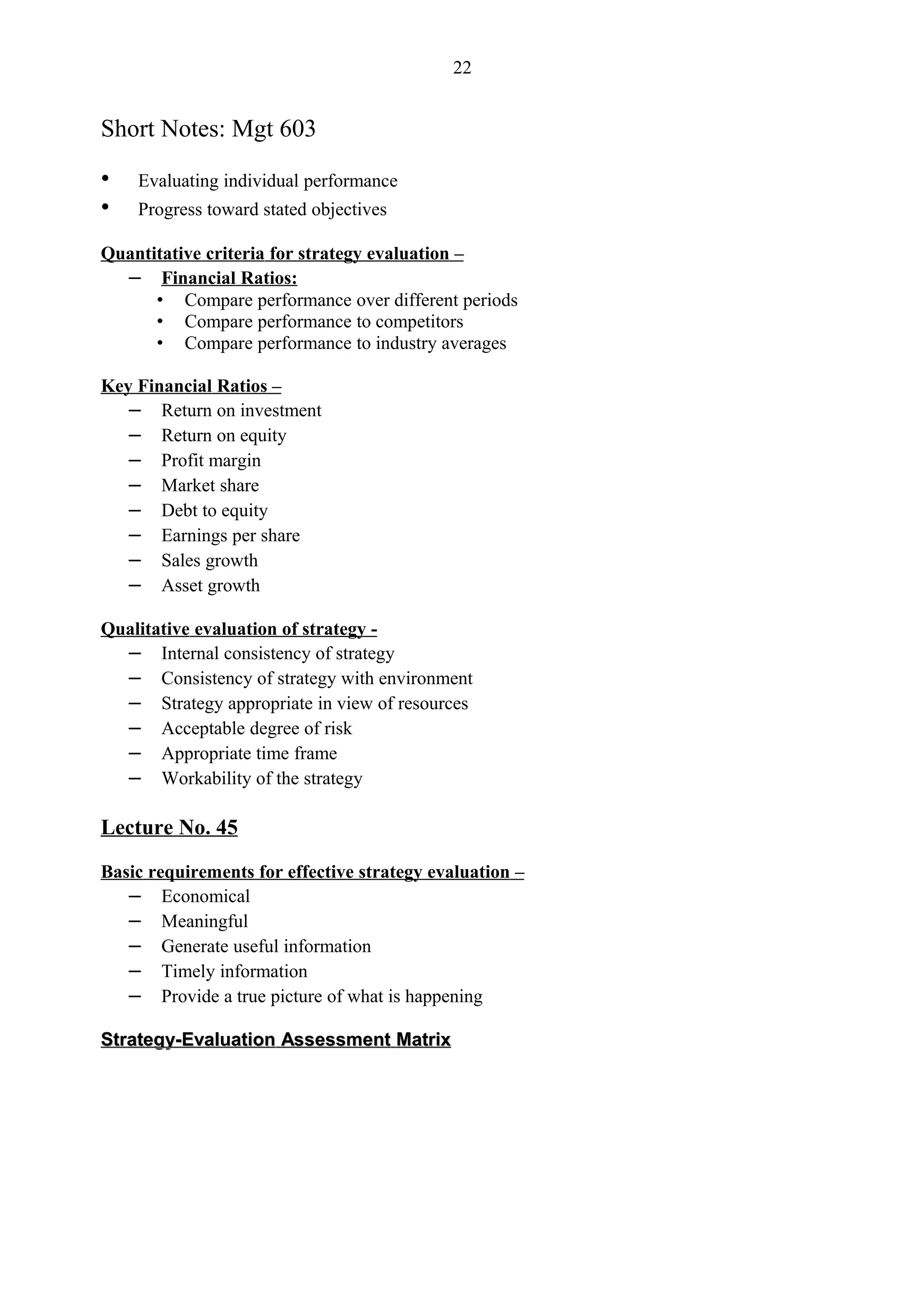

1) Three key stages in the strategy formulation framework - the input, matching, and decision stages. Various analytical tools are used at each stage like IFE, EFE, TOWS matrices.

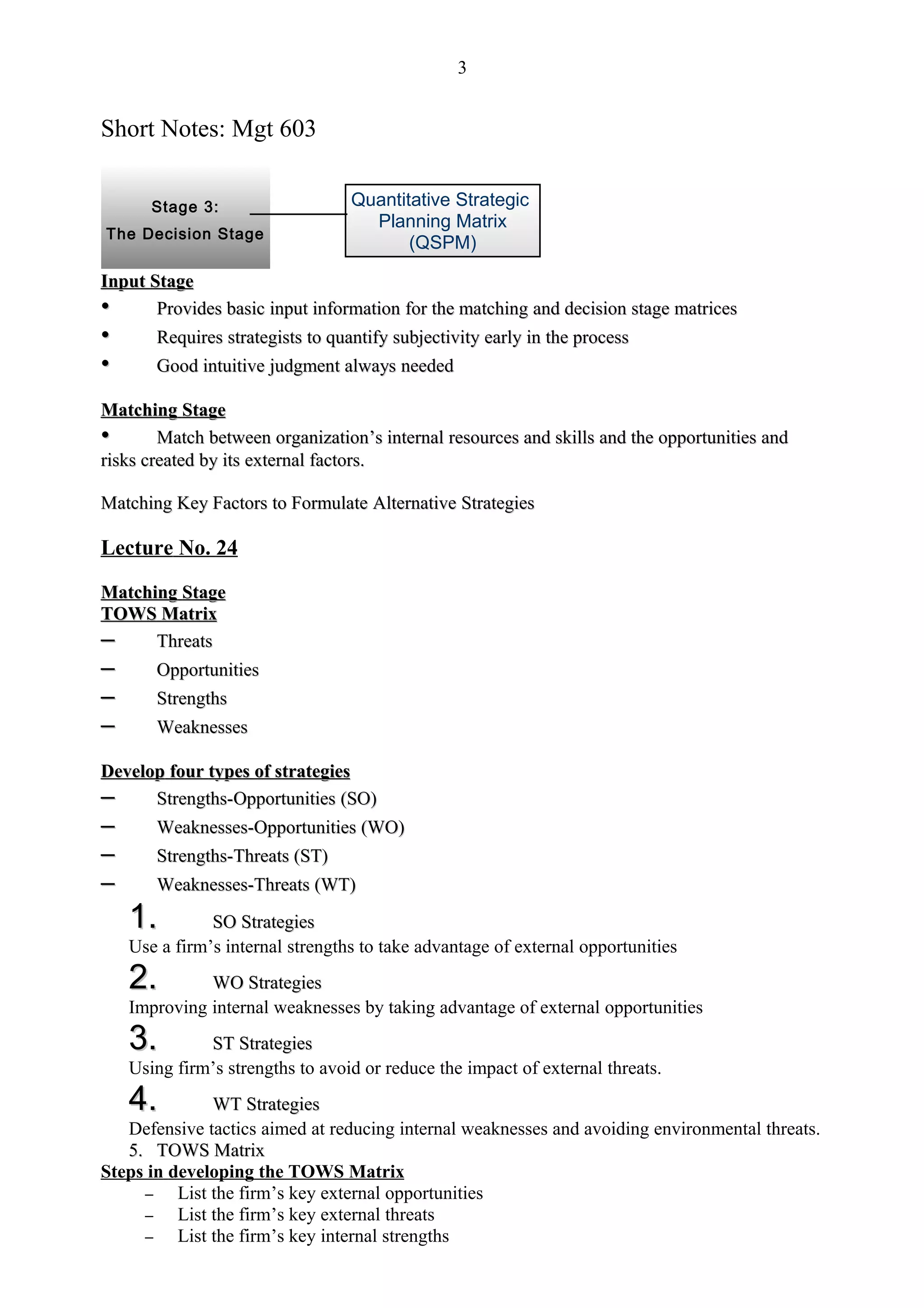

2) The TOWS matrix as a tool to match internal strengths and weaknesses to external opportunities and threats to generate alternative strategies. Four types of strategies - SO, WO, ST, WT - can be developed.

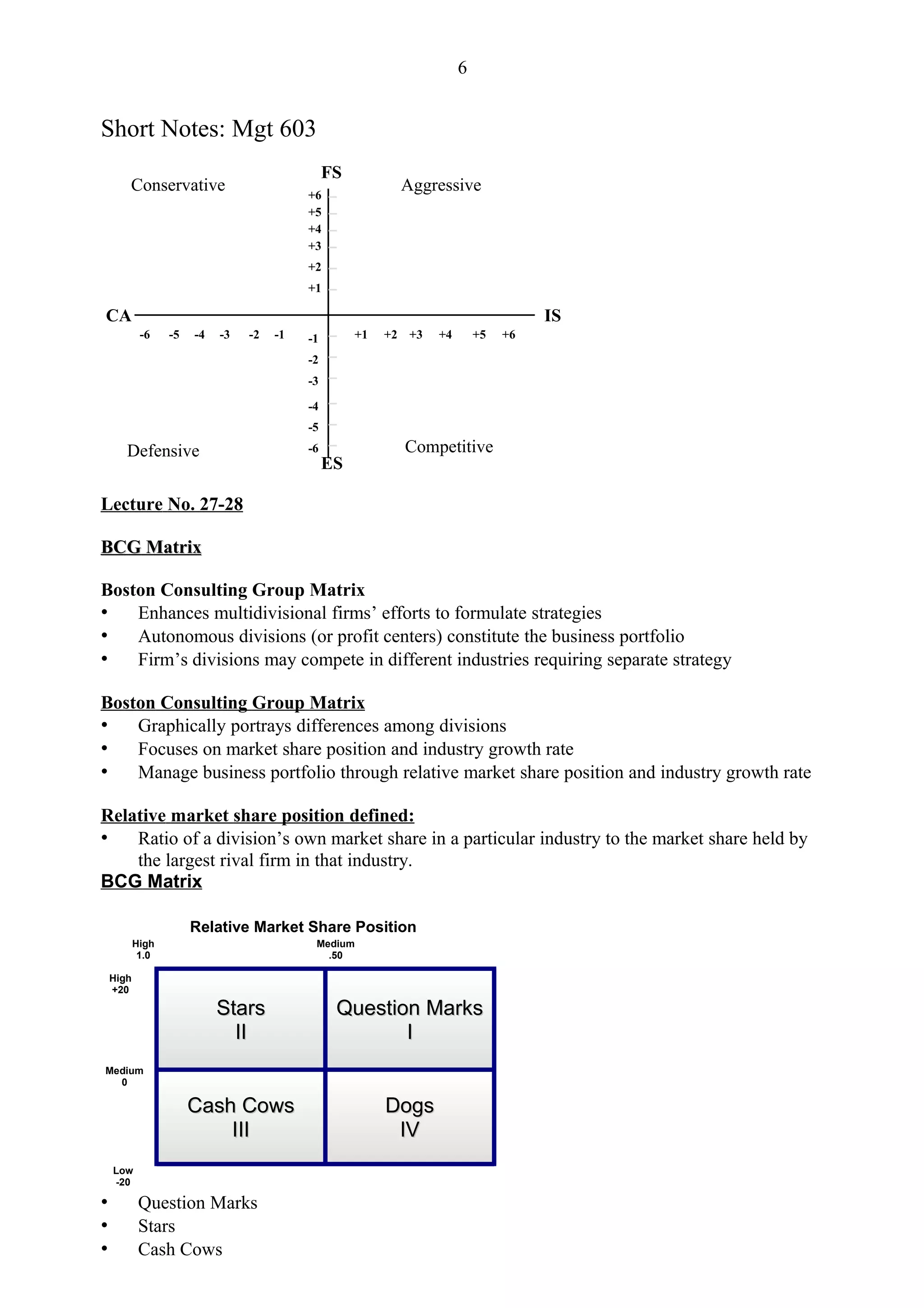

3) The SPACE matrix, another strategic planning tool that evaluates strategic position based on internal financial strength and competitive advantage and external environmental stability and industry strength to determine appropriate strategies.

![4

Short Notes: Mgt 603

– List the firm’s key internal weaknesses

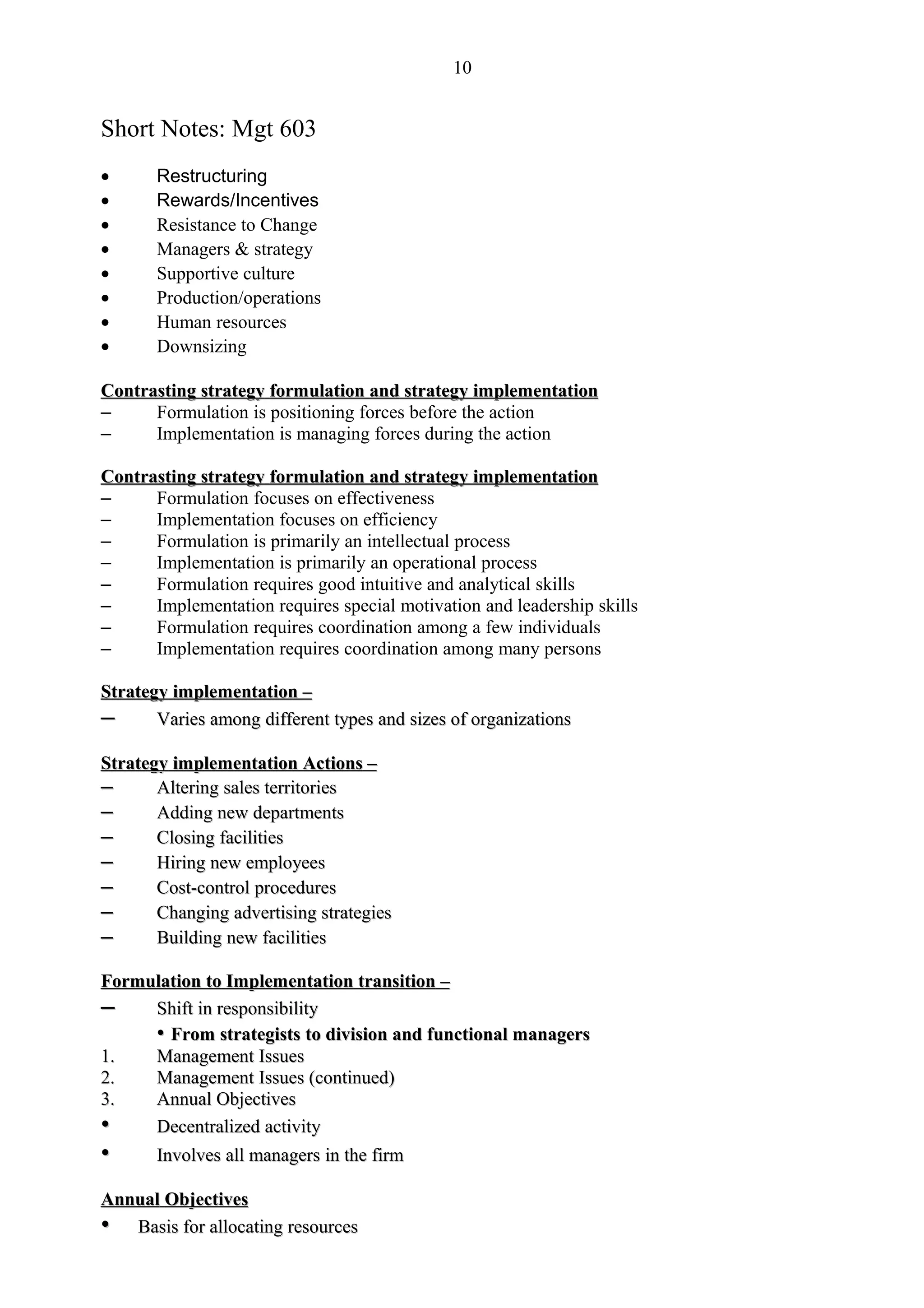

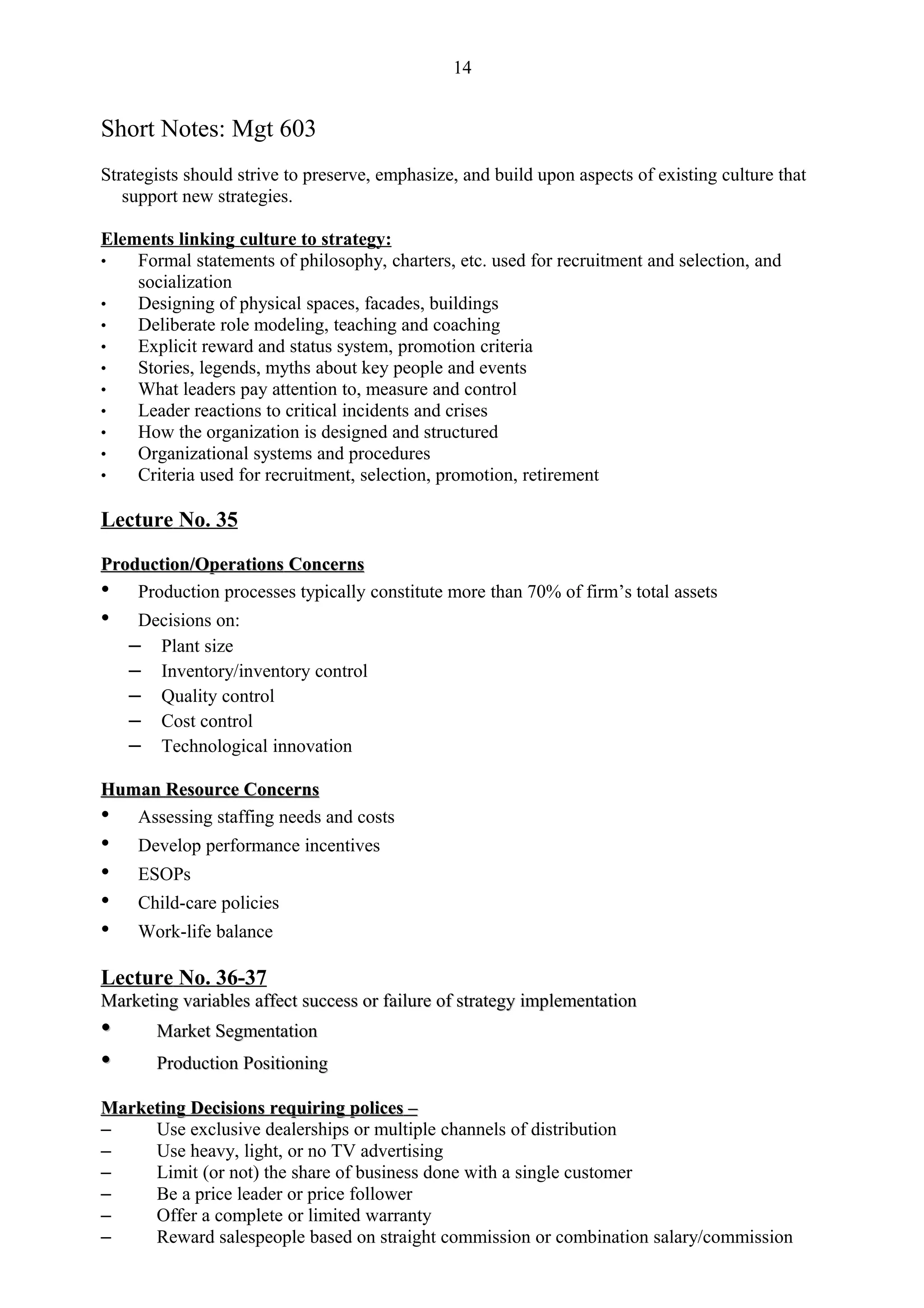

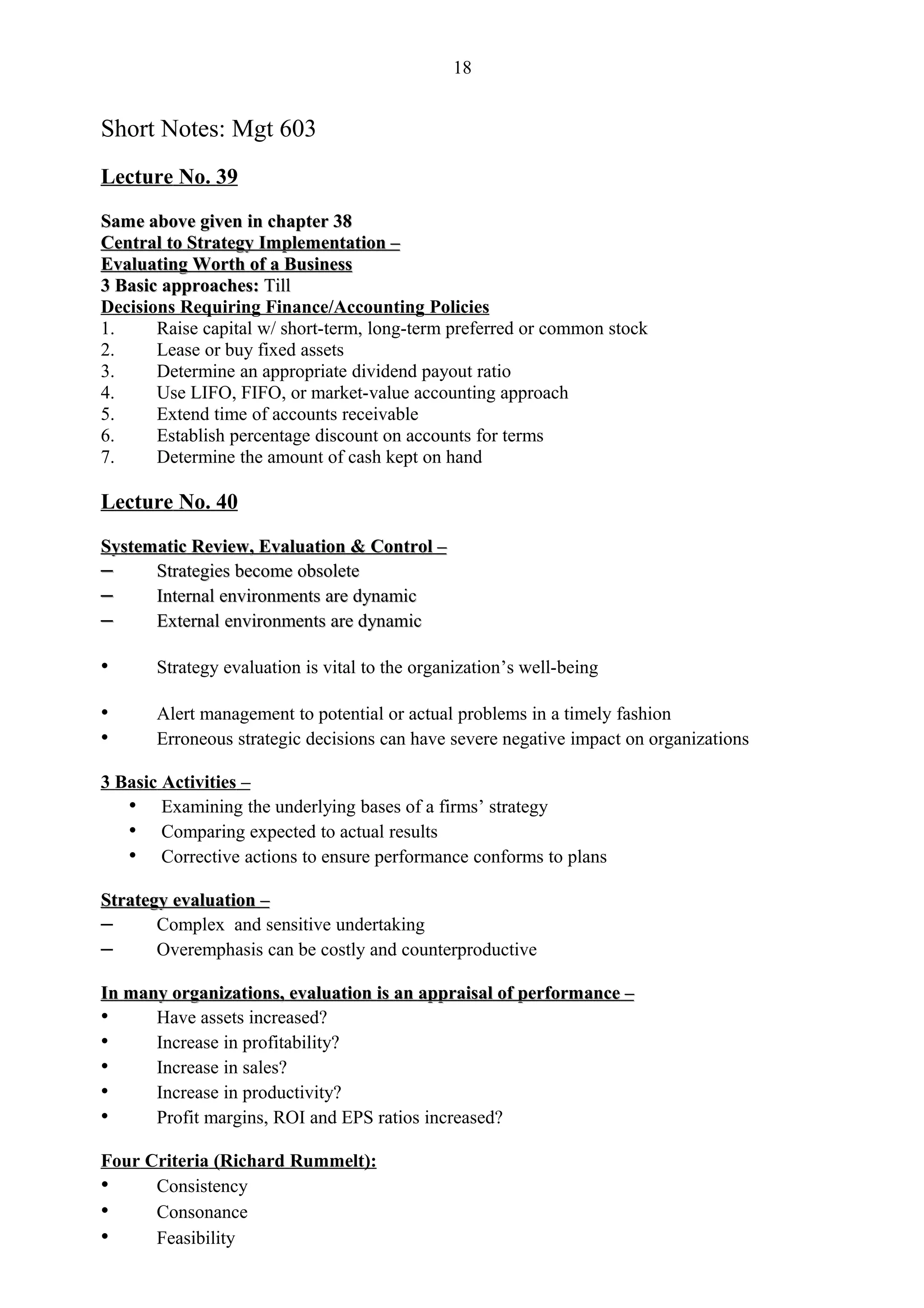

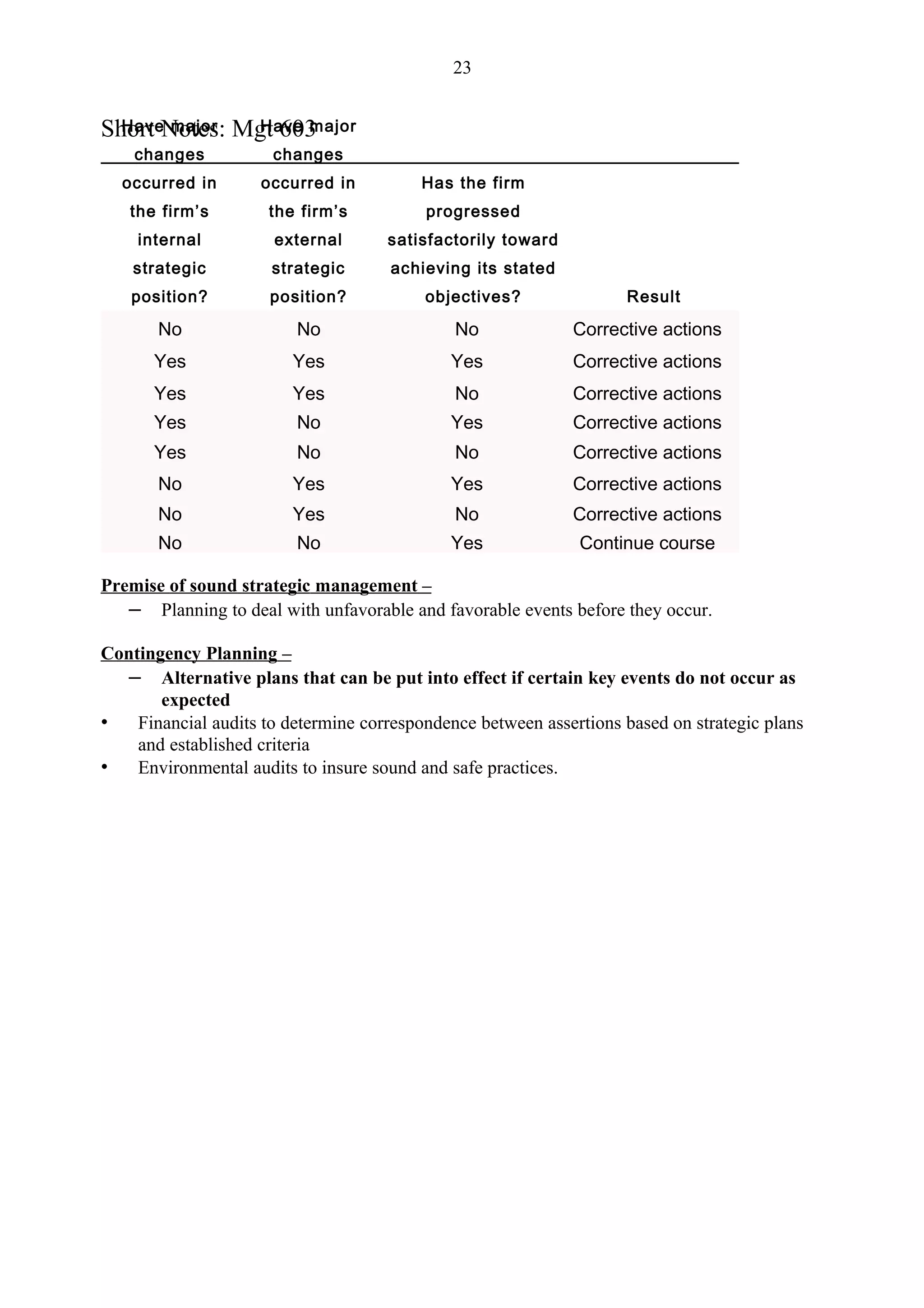

TOWS Matrix

Developing the TOWS Matrix

• Match internal strengths with external opportunities and record the resultant SO Strategies

• Match internal weaknesses with external opportunities and record the resultant WO

Strategies

• Match internal strengths with external threats and record the resultant ST Strategies

• Match internal weaknesses with external threats and record the resultant WT Strategies

Leave Blank Strengths-S Weaknesses-W

List Strengths List Weaknesses

Opportunities-O SO Strategies WO Strategies

List Opportunities Use strengths to take Overcome weaknesses

advantage of opportunities by taking advantage of

opportunities

Threats-T ST Strategies WT Strategies

List Threats Use strengths to avoid Minimize weaknesses

threats and avoid threats

Lecture No, 25-26

Formulation Framework

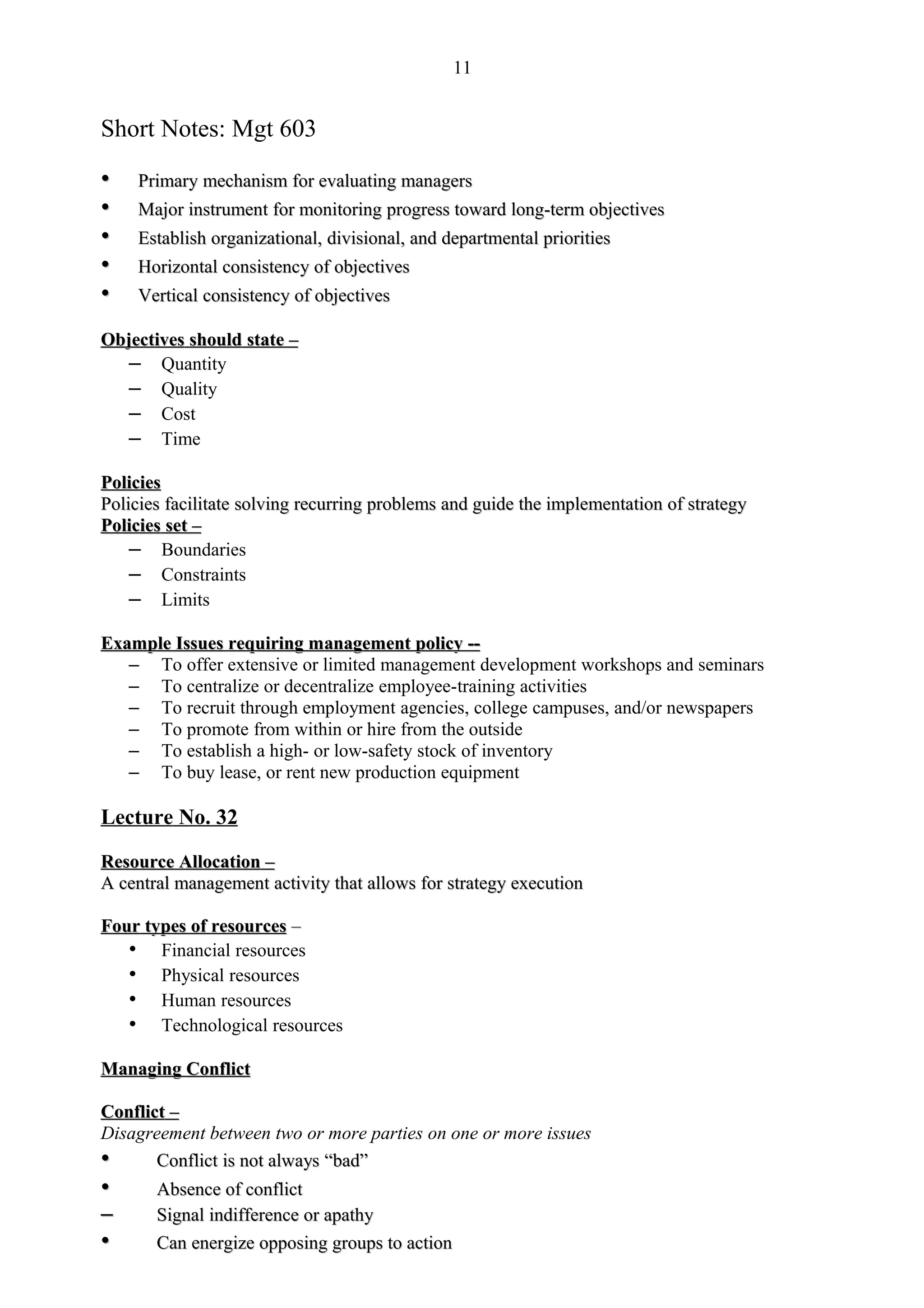

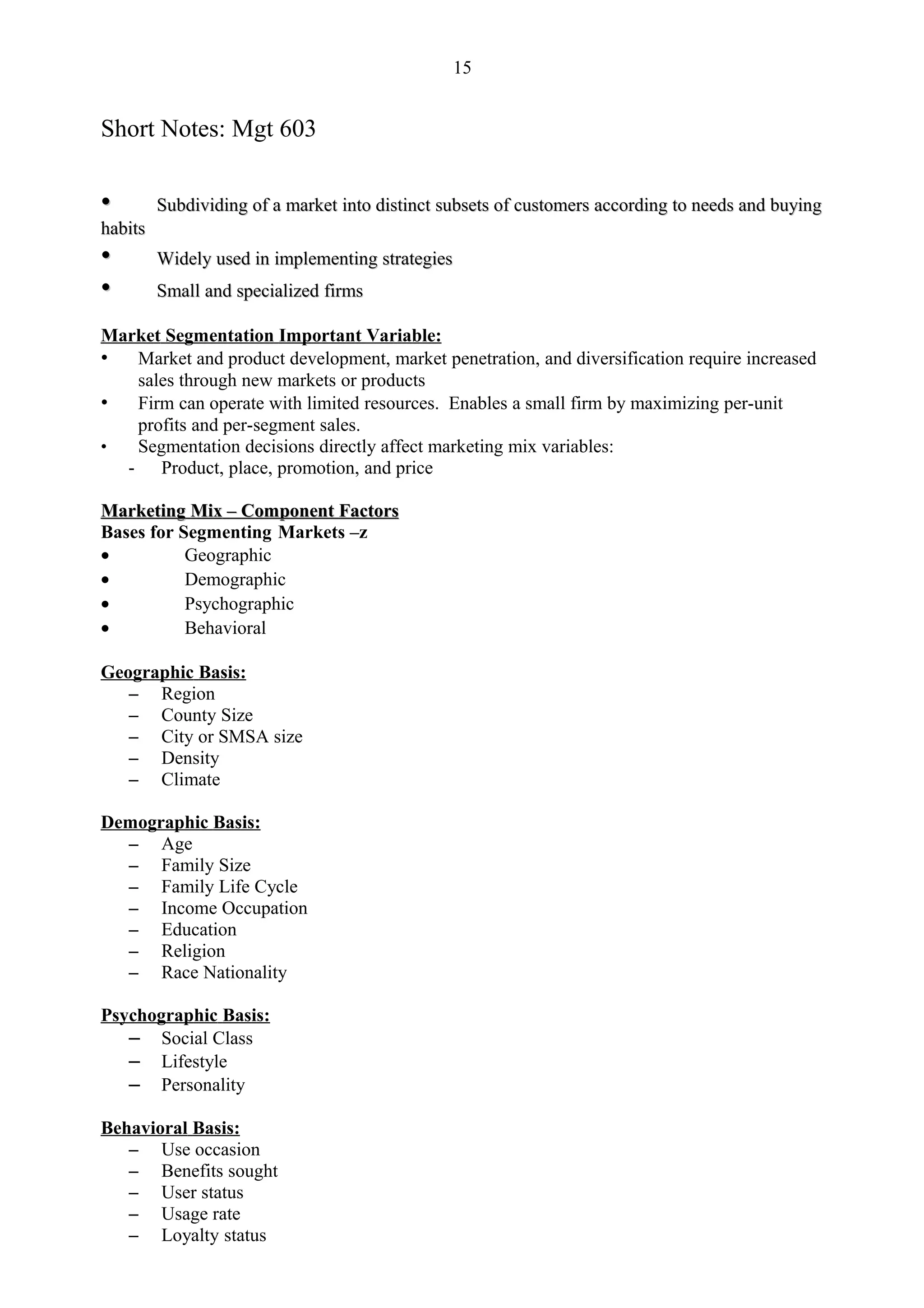

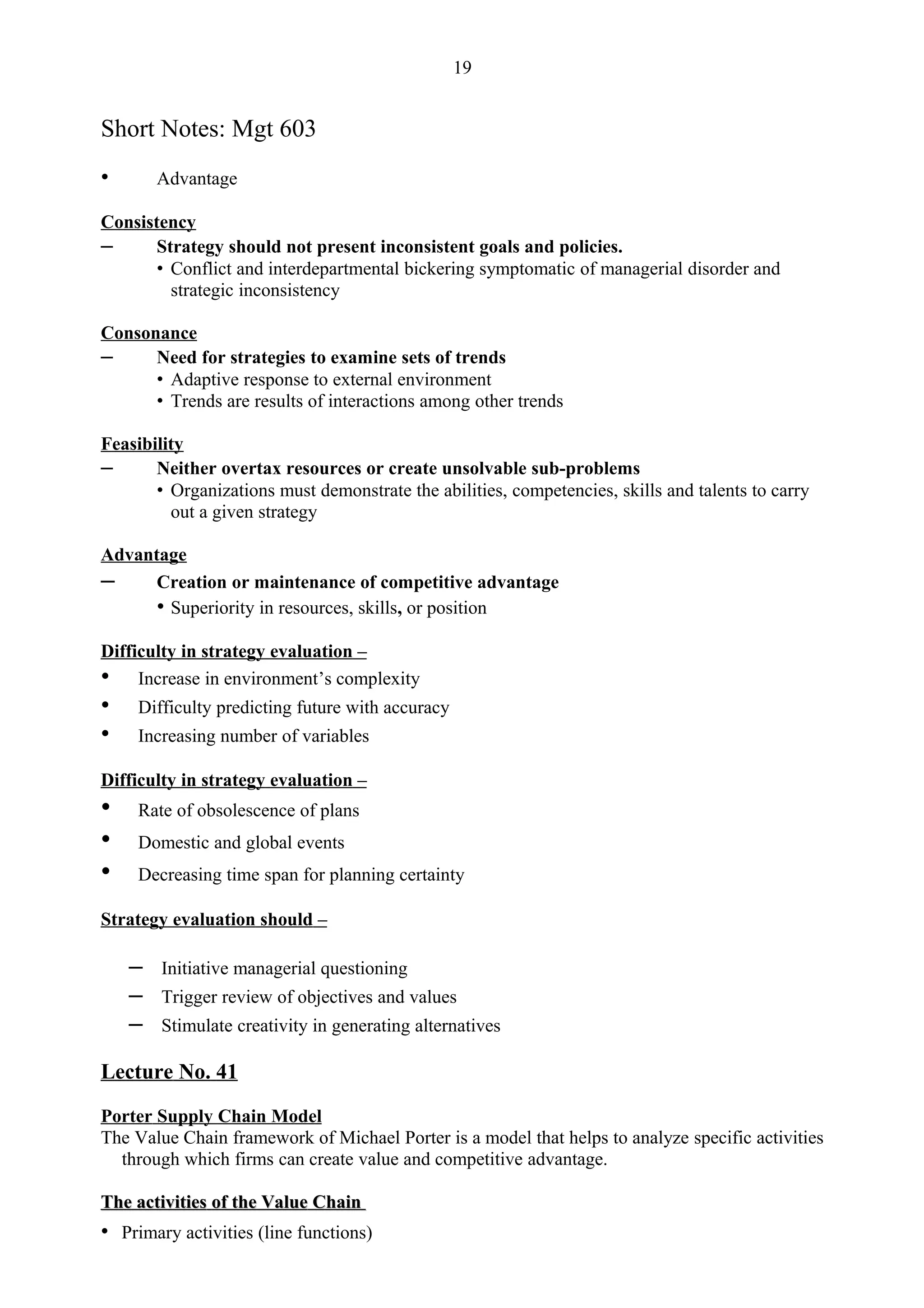

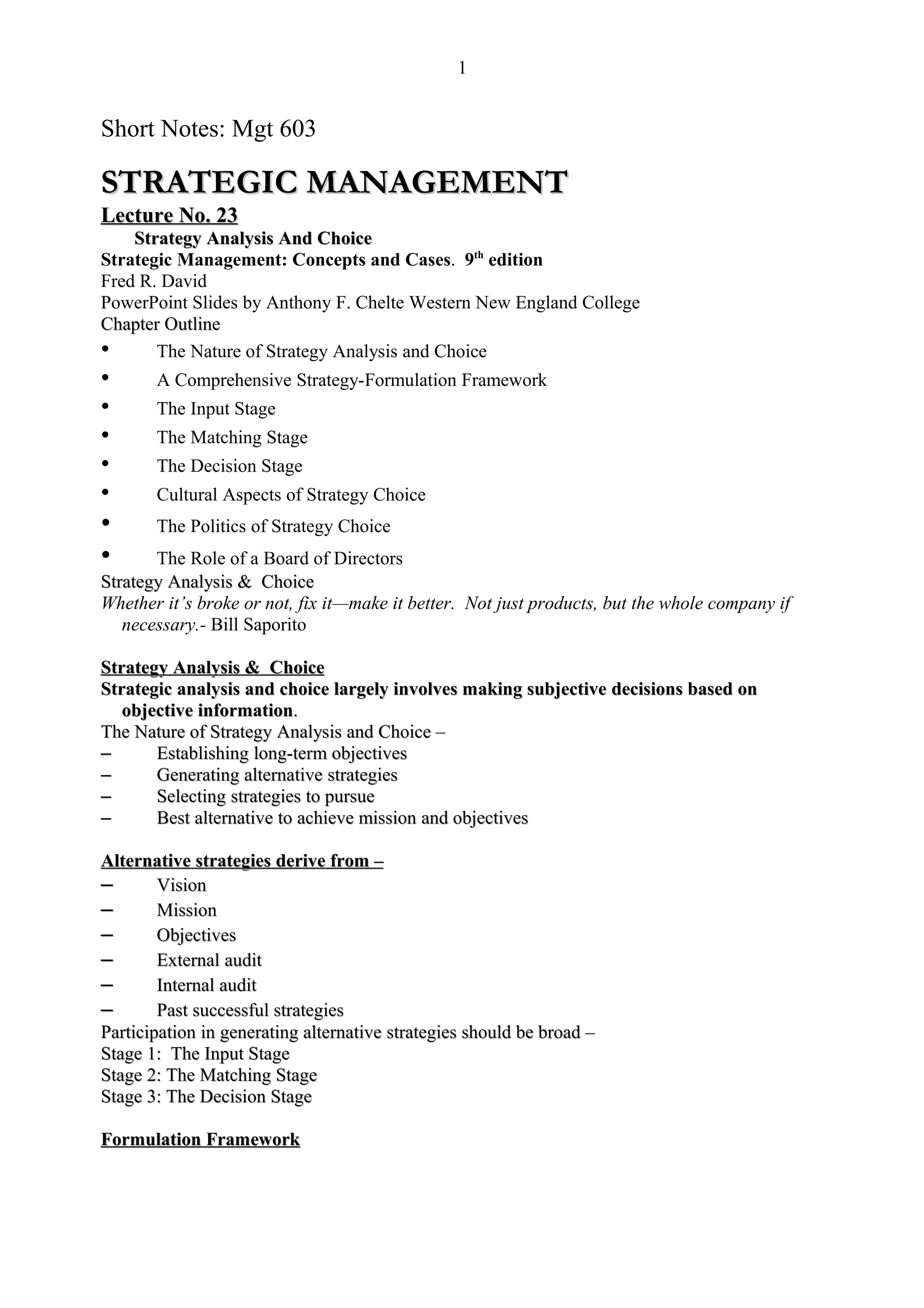

SPACE Matrix

Strategic Position and Action Evaluation Matrix

Four quadrant framework

Determines appropriate strategies

Aggressive

Conservative

Defensive

Competitive

Two Internal Dimensions

Financial Strength [FS]

Competitive Advantage [CA]

Two External Dimensions

Environmental Stability [ES]

Industry Strength [IS]

Overall Strategic position determined by:

– Financial Strength [FS]

– Competitive Advantage [CA]

– Environmental Stability [ES]](https://image.slidesharecdn.com/mgt603shortnotes-120911144945-phpapp01/75/Strategic-short-notes-4-2048.jpg)

![5

Short Notes: Mgt 603

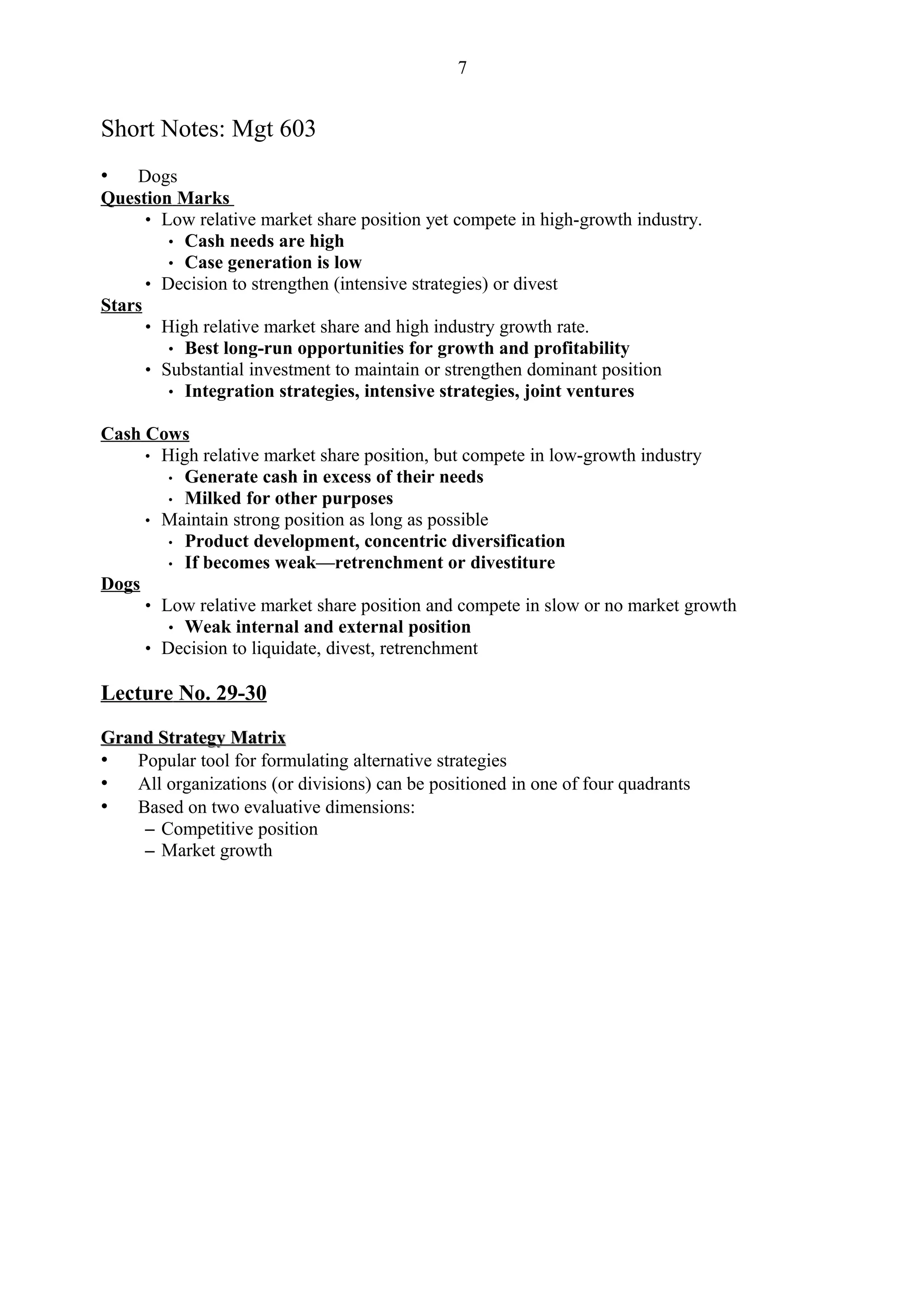

– Industry Strength [IS]

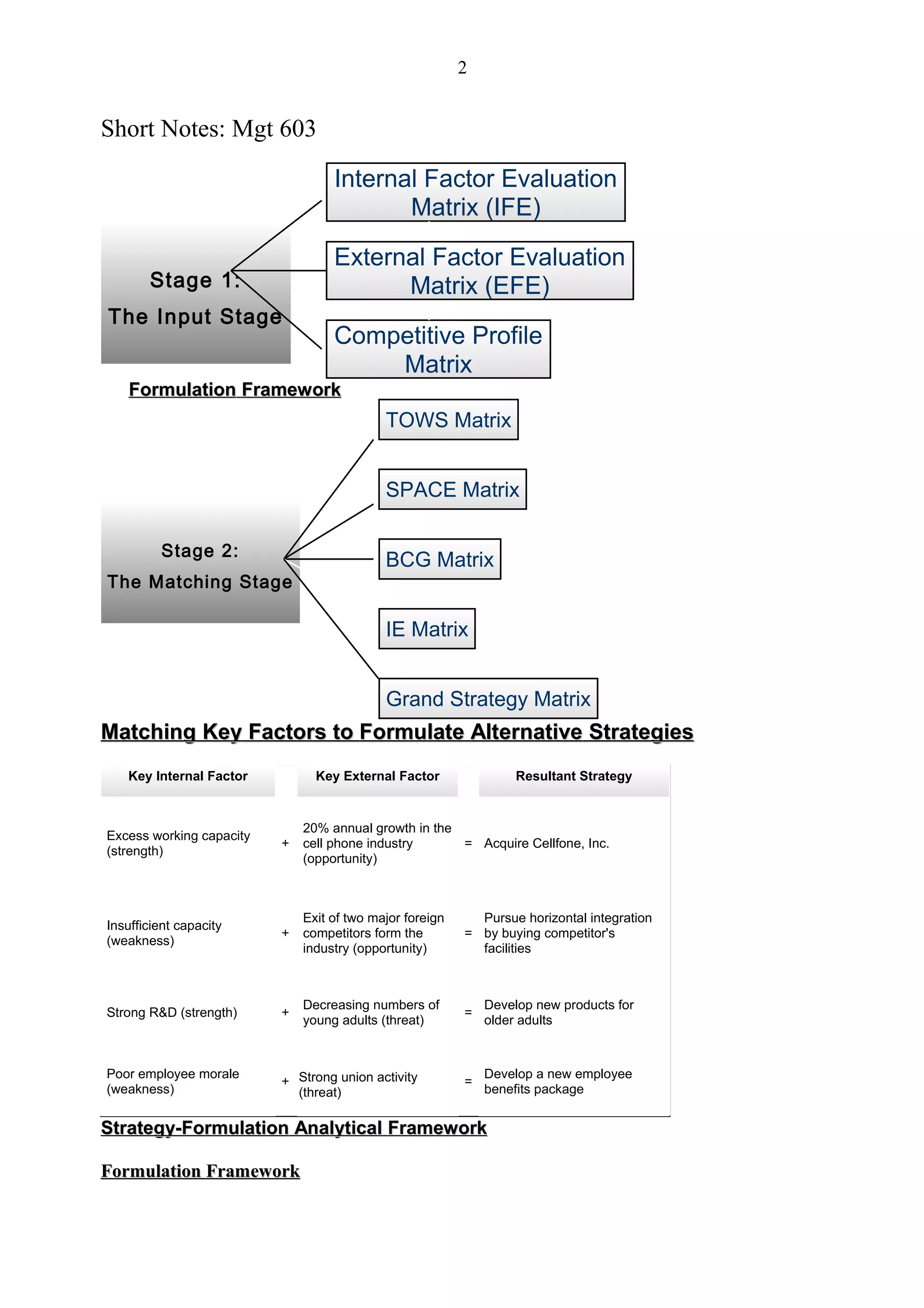

Developing the SPACE Matrix:

• EFE Matrix

• IFE Matrix

• Financial Strength

• Competitive Advantage

• Environmental Stability

• Industry Strength

• Select variables to define FS, CA, ES, & IS

• Assign numerical ranking from +1 (worst) to +6 (best) for FS and IS; Assign numerical

ranking from –1 (best) to –6 (worst) for ES and CA.

• Compute average score for FS, CA, ES, & IS

• Plot the average scores on the Matrix

• Add the two scores on the x-axis and plot point on X. Add the scores on the y-axis and plot

Y. Plot the intersection of the new xy point.

• Draw a directional vector from origin through the new intersection point.

• SPACE Factors

Internal Strategic Position External Strategic Position

Financial Strength (FS) Environmental Stability (ES)

Return on investment Technological changes

Leverage Rate of inflation

Liquidity Demand variability

Working capital Price range of competing products

Cash flow Barriers to entry

Ease of exit from market Competitive pressure

Risk involved in business Price elasticity of demand

Internal Strategic Position External Strategic Position

Competitive Advantage CA Industry Strength (IS)

Market share Growth potential

Product quality Profit potential

Product life cycle Financial stability

Customer loyalty Technological know-how

Competition’s capacity utilization Resource utilization

Technological know-how Capital intensify

Control over suppliers & distributors Ease of entry into market

Productivity, capacity utilization

SPACE Matrix](https://image.slidesharecdn.com/mgt603shortnotes-120911144945-phpapp01/75/Strategic-short-notes-5-2048.jpg)