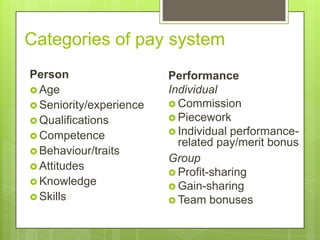

This document discusses various types of performance-linked pay programs. It describes individual incentive programs like commission and individual performance-related pay that reward individual output. Group programs like profit-sharing and gain-sharing that compensate employees based on group or organizational performance are also discussed. The document outlines some criticisms of traditional merit pay programs and contrasts performance-linked pay with other compensation approaches like salary and bonuses. Both the potential benefits of performance pay in improving motivation as well as the risks of damaging relationships and risk-taking are presented.