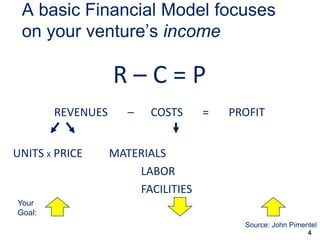

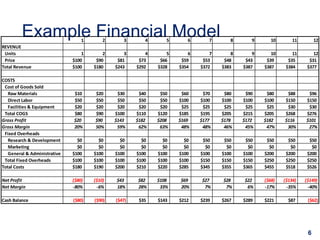

The document discusses the importance of financial modeling within the business model canvas, focusing on revenues and costs to ensure sustainability. It emphasizes the necessity of creating detailed financial models using both bottom-up and top-down approaches, providing examples of cash flow, gross profit, and net profit analysis. Additionally, it highlights the significance of sensitivity analysis to address potential profit fall-offs and enhance the model's viability through strategic marketing and operational adjustments.