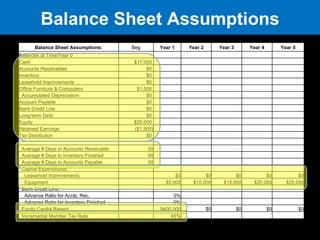

The document provides information on integrating financial statements for startups. It discusses the importance of having accurate income statements, balance sheets, and cash flow statements to understand business profitability, stability, and liquidity. Common mistakes made by startups are listed, such as not understanding revenue drivers or underestimating costs. Recommendations are given for financial statement formats and assumptions. Sample financial statements including income statements, balance sheets, and cash flow statements are presented for a fictional startup called EZ Vein over a five year period.