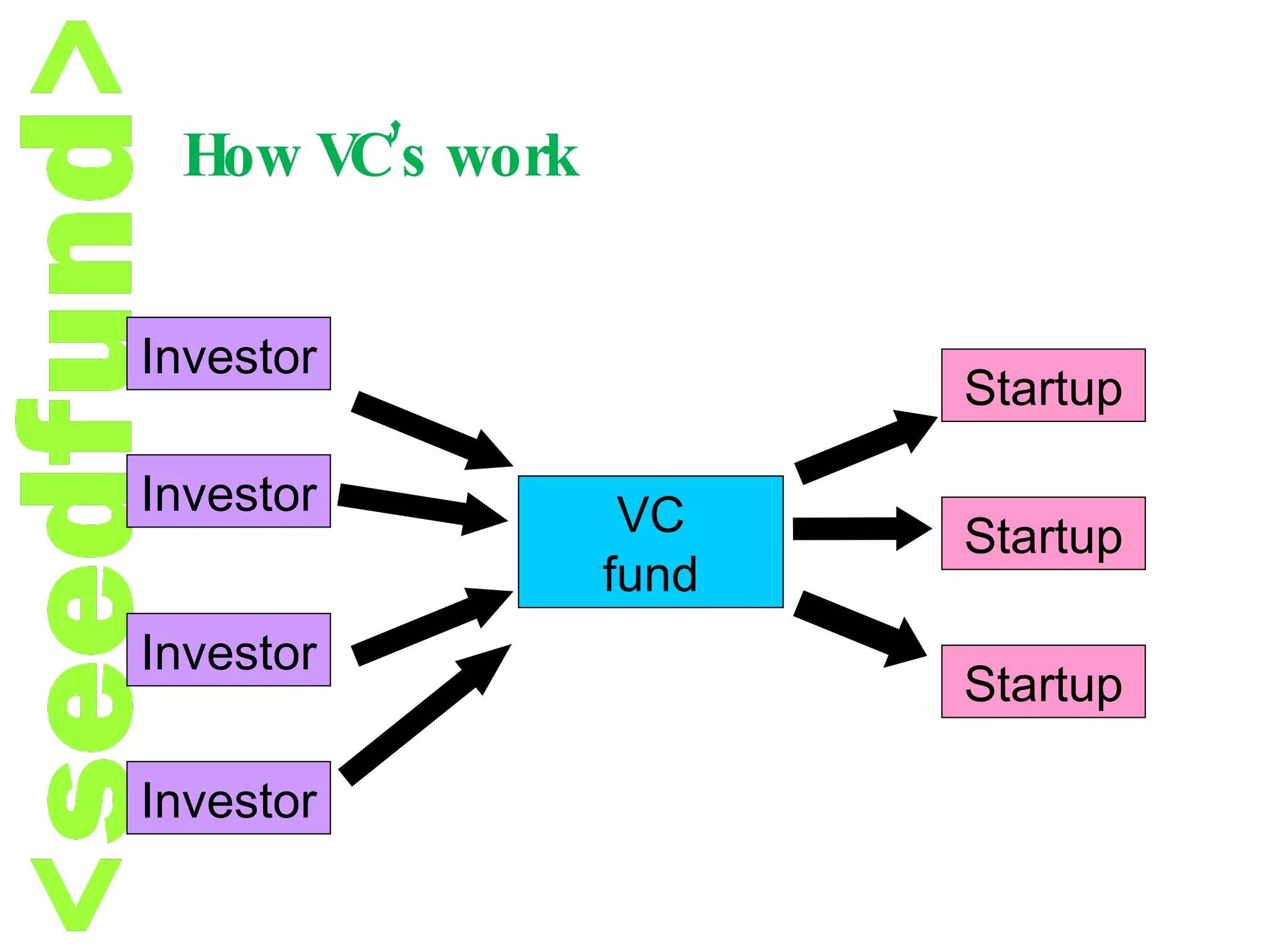

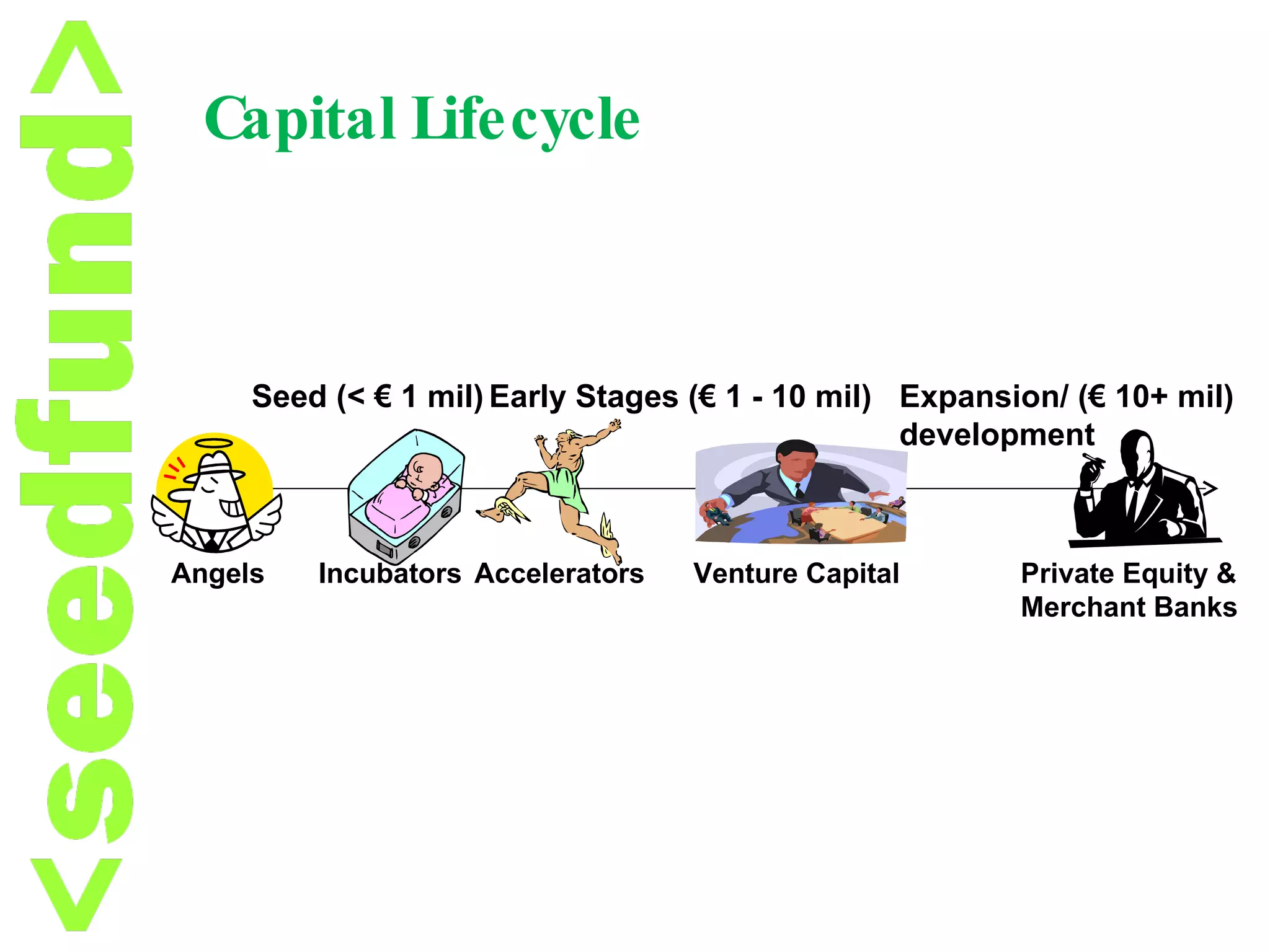

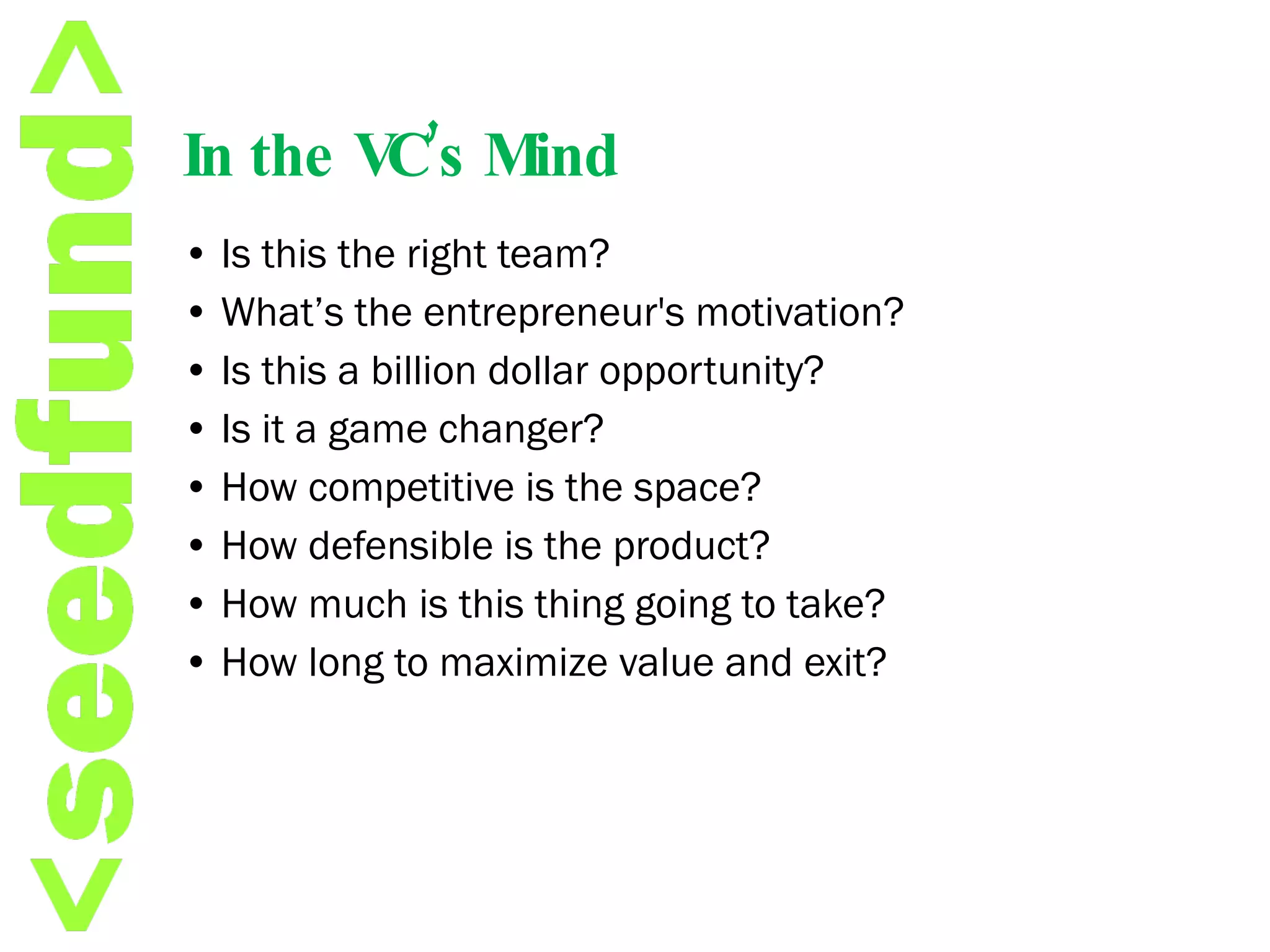

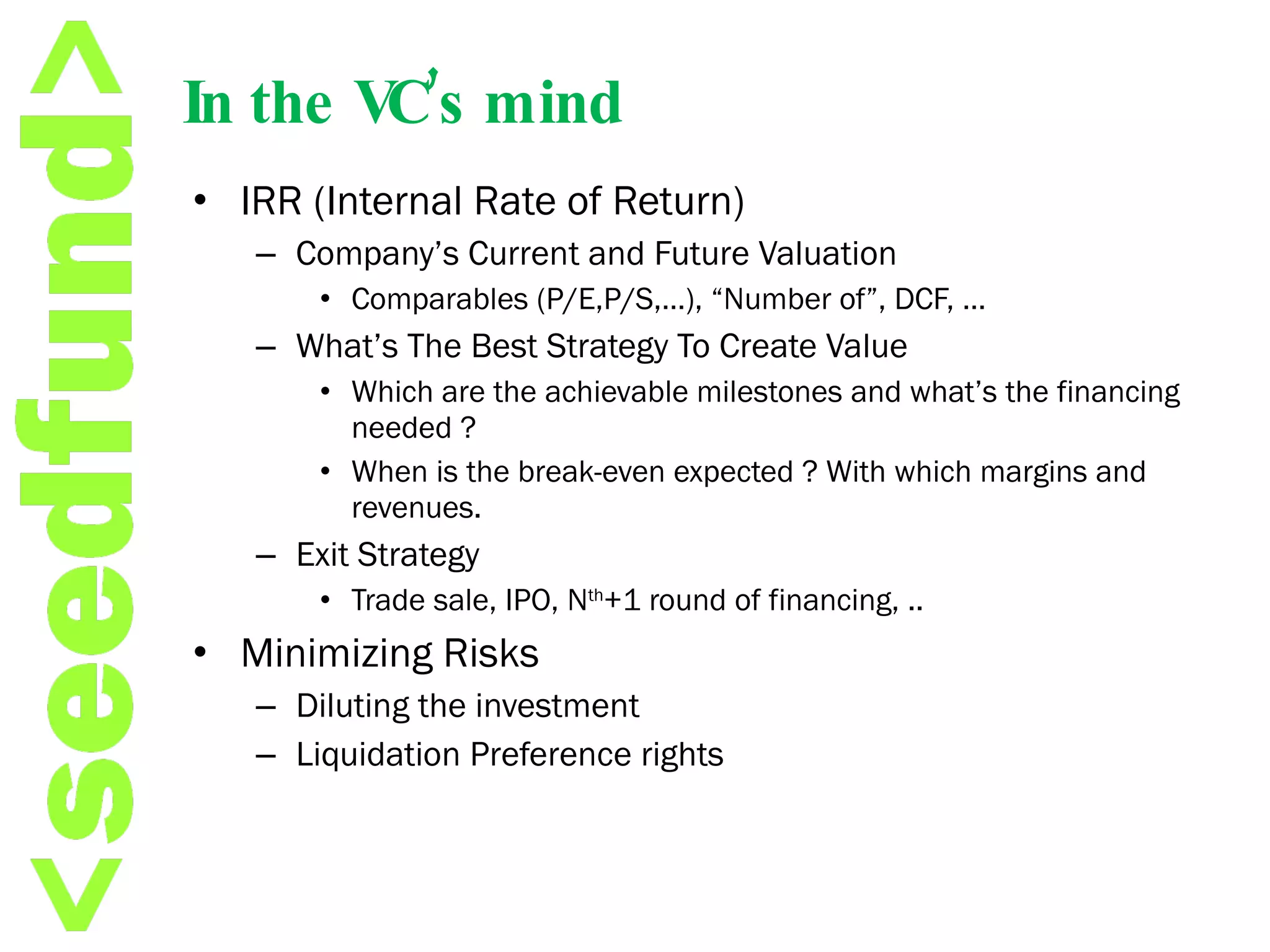

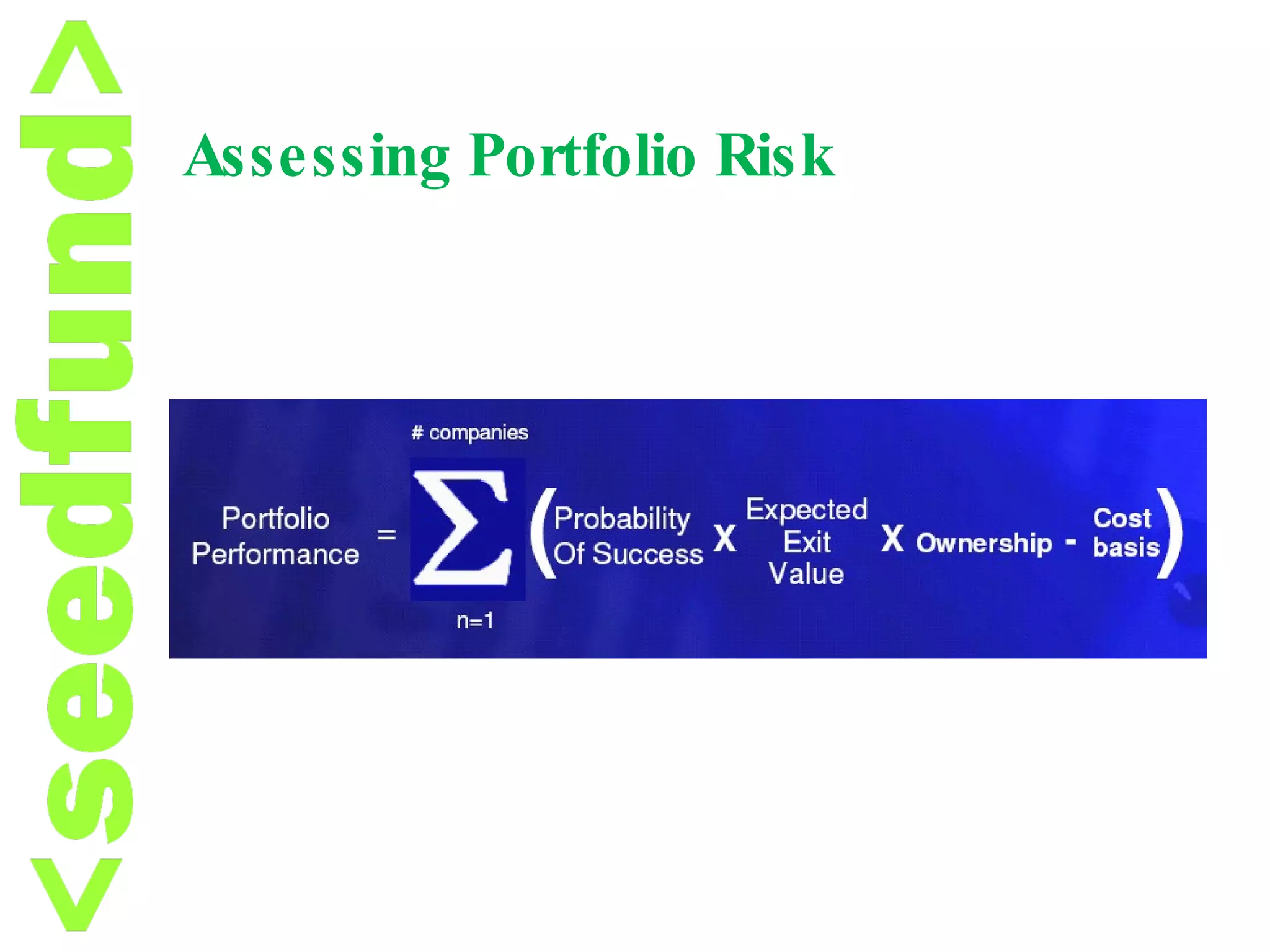

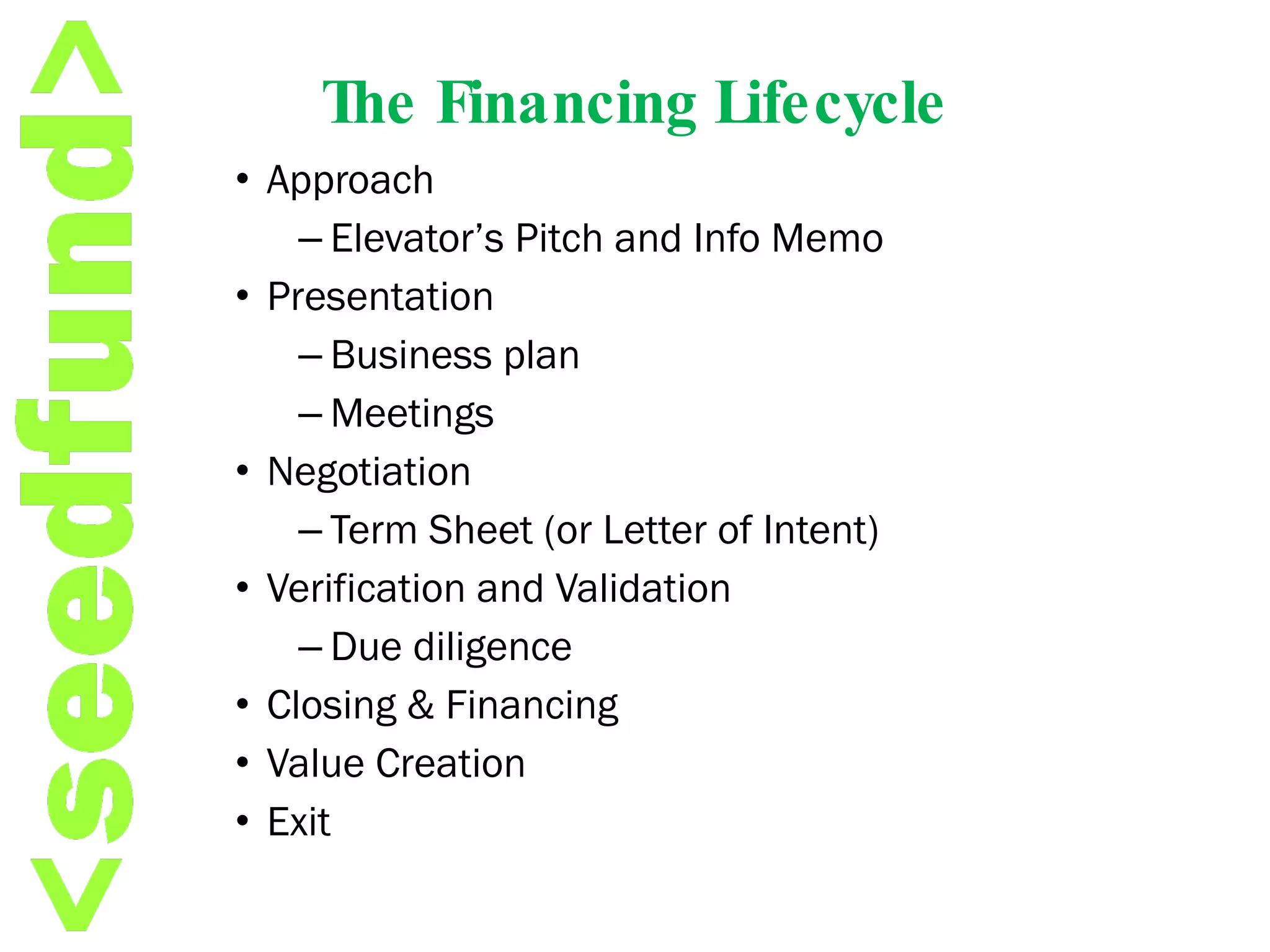

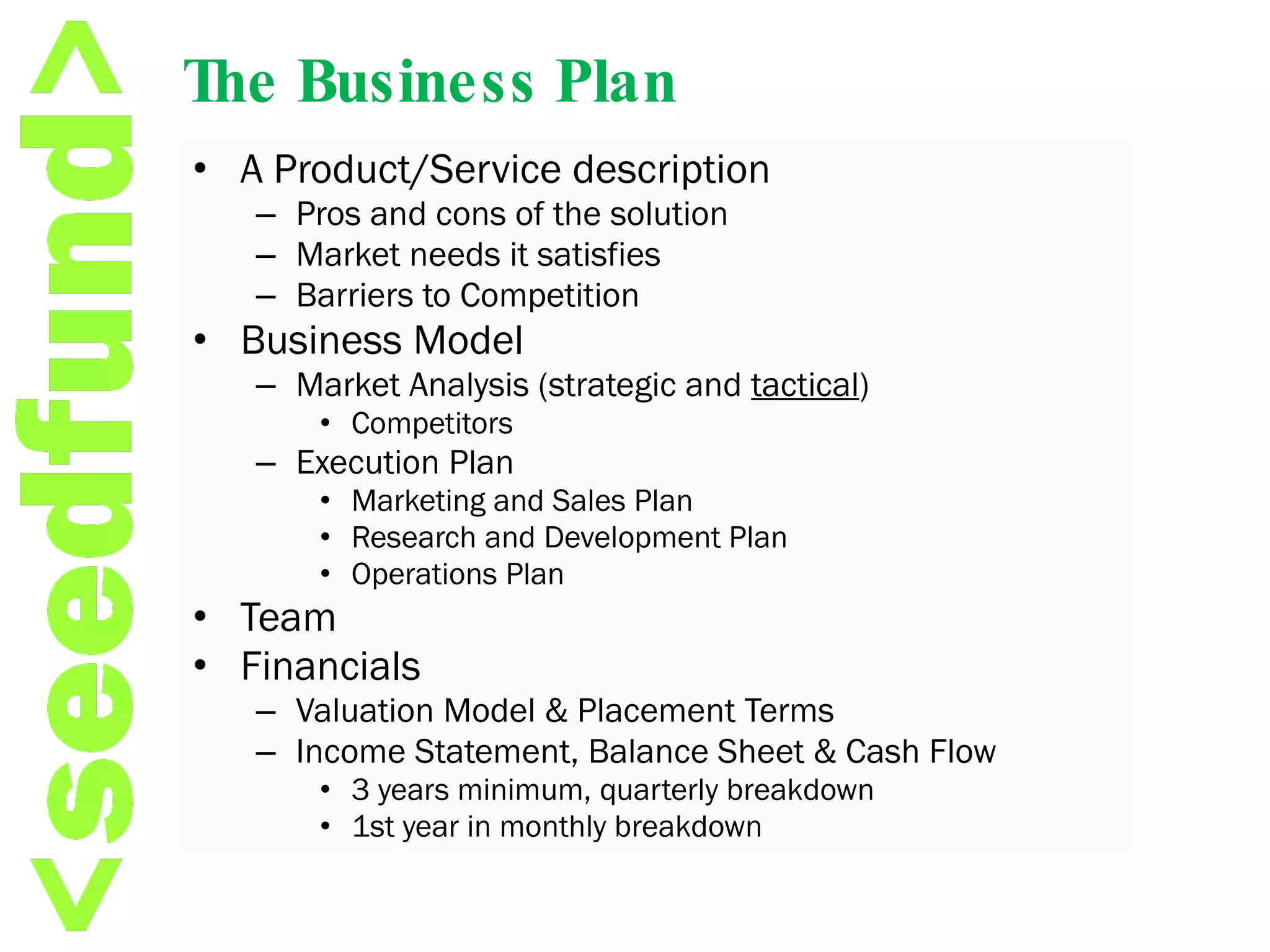

The document provides an overview of venture capital, defining it as a subset of private equity aimed at funding new products or services. It outlines the investment lifecycle, the roles of venture capitalists, attributes of effective VCs, and criteria for assessing both entrepreneurs and potential investments. Additionally, it discusses the business planning process for startups seeking funding, including key terms to consider in term sheets and current trends in VC investing.

![An Introduction To Venture Capital Anand Lunia Executive Director & CFO, SEEDfund [email_address]](https://image.slidesharecdn.com/vcintro-seedfund-byanandlunia-tiks08-21-2010-100913032610-phpapp02/75/Starting-Up-Introduction-to-venture-Capital-by-Anand-Lunia-1-2048.jpg)