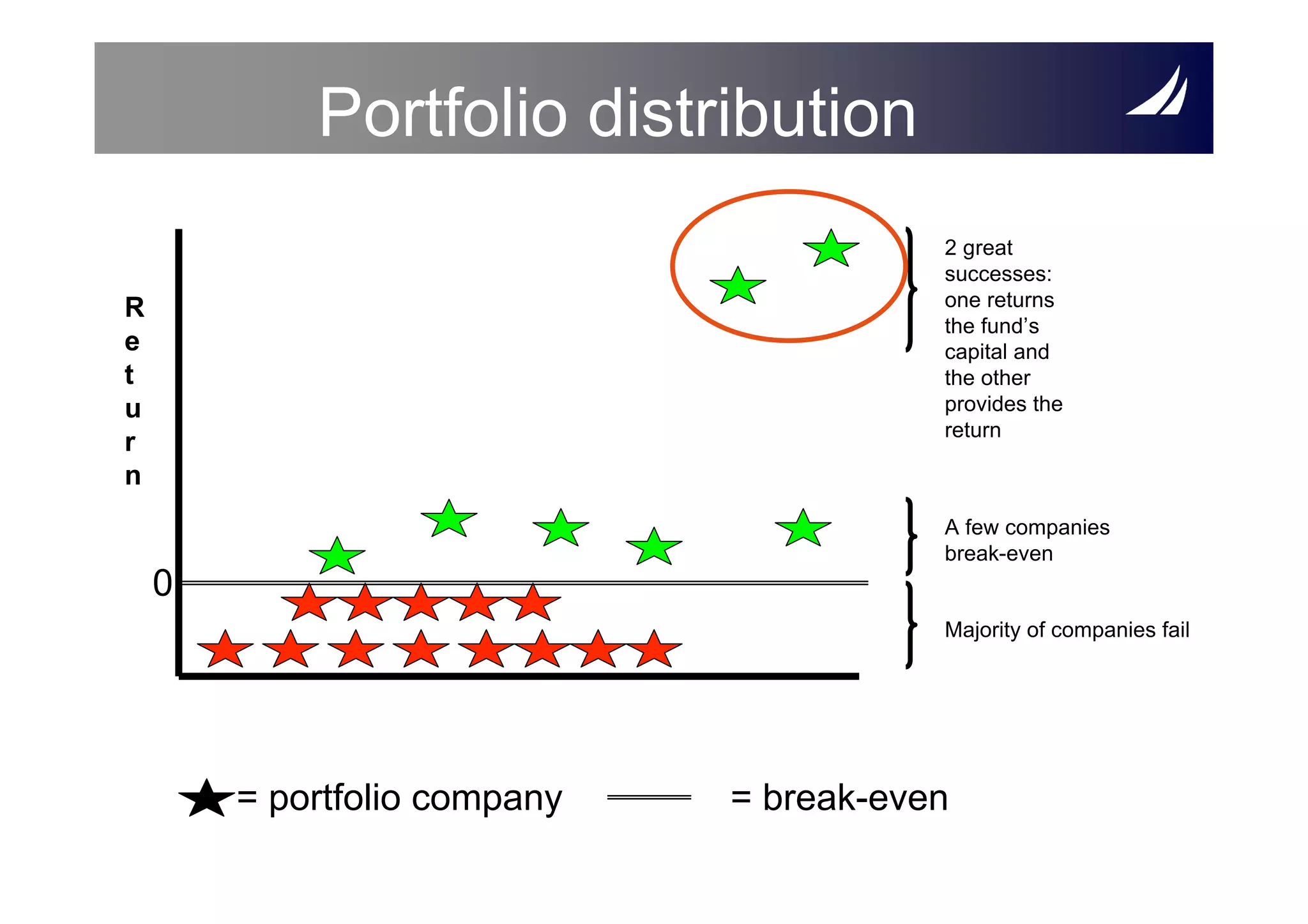

Venture capitalists (VCs) are professional investors who provide equity financing to young, privately-owned companies, primarily in the technology sector, with the goal of achieving substantial returns on investment. Upon receiving and analyzing investment proposals, VCs invest in a small percentage of companies, often requiring significant growth potential and a capable entrepreneurial team. Despite high risks, VCs aim for returns of at least 10 times their initial investment over a 4-5 year horizon, with portfolio strategies reflecting the expectation that many investments will fail.