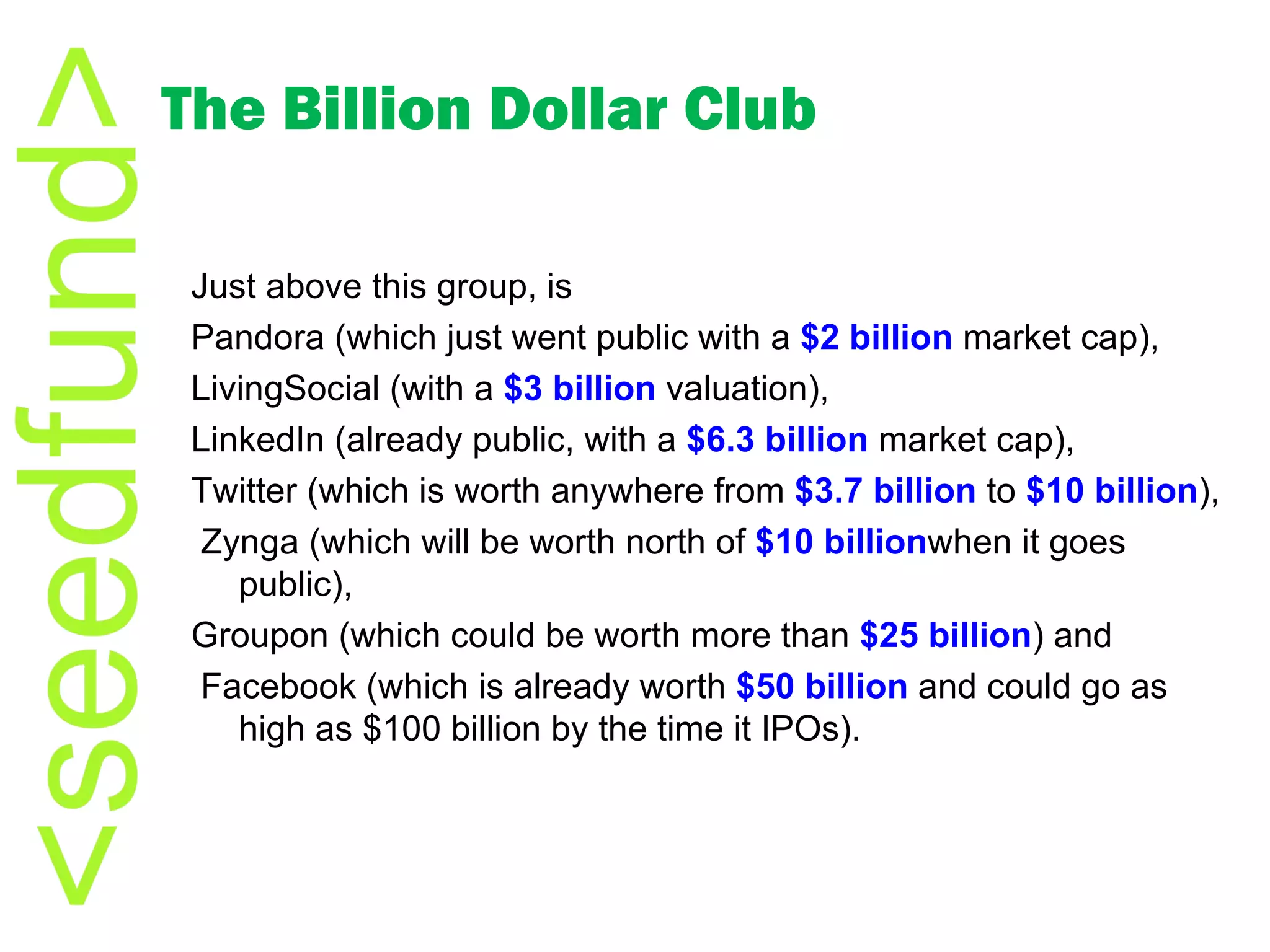

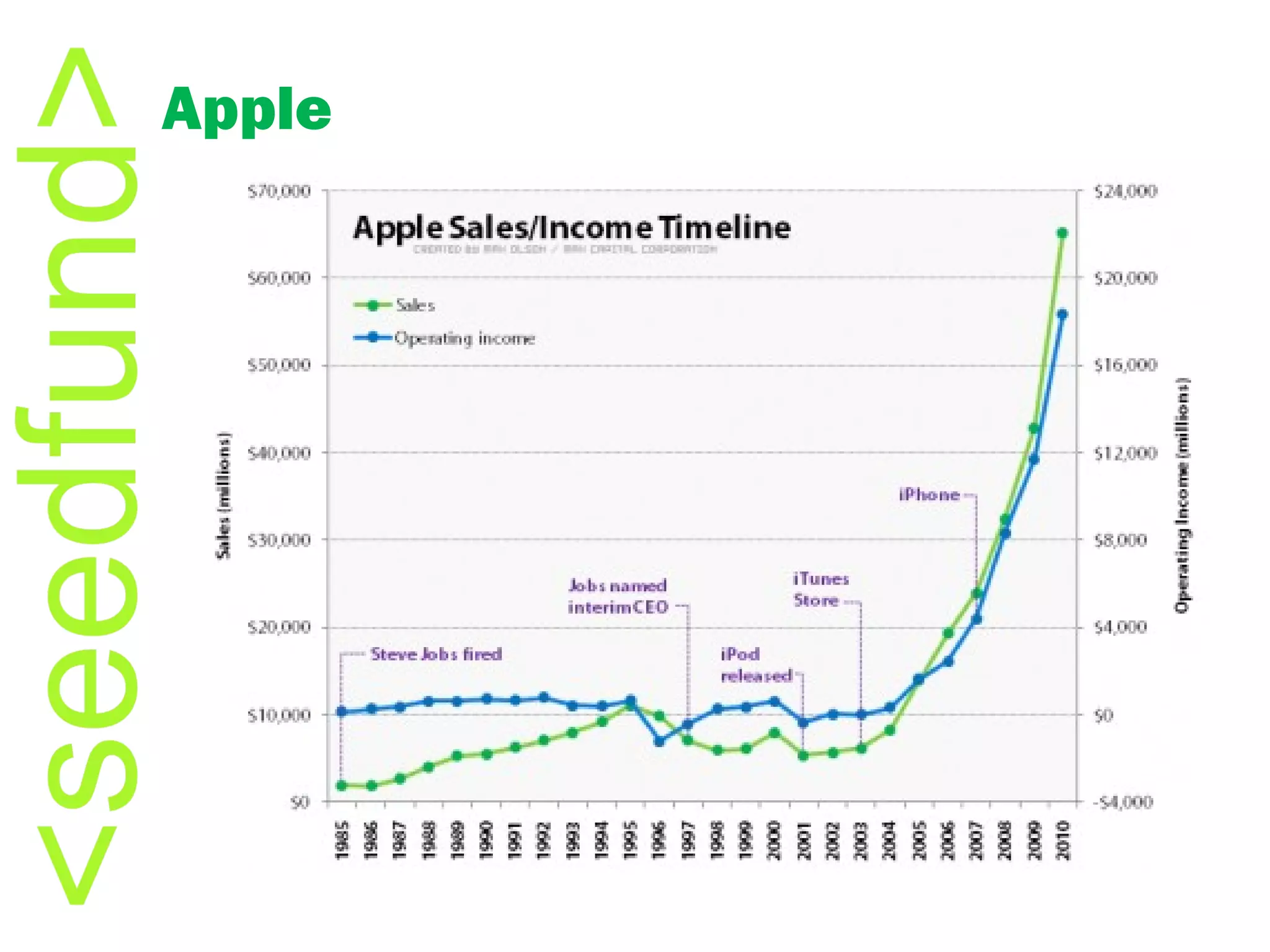

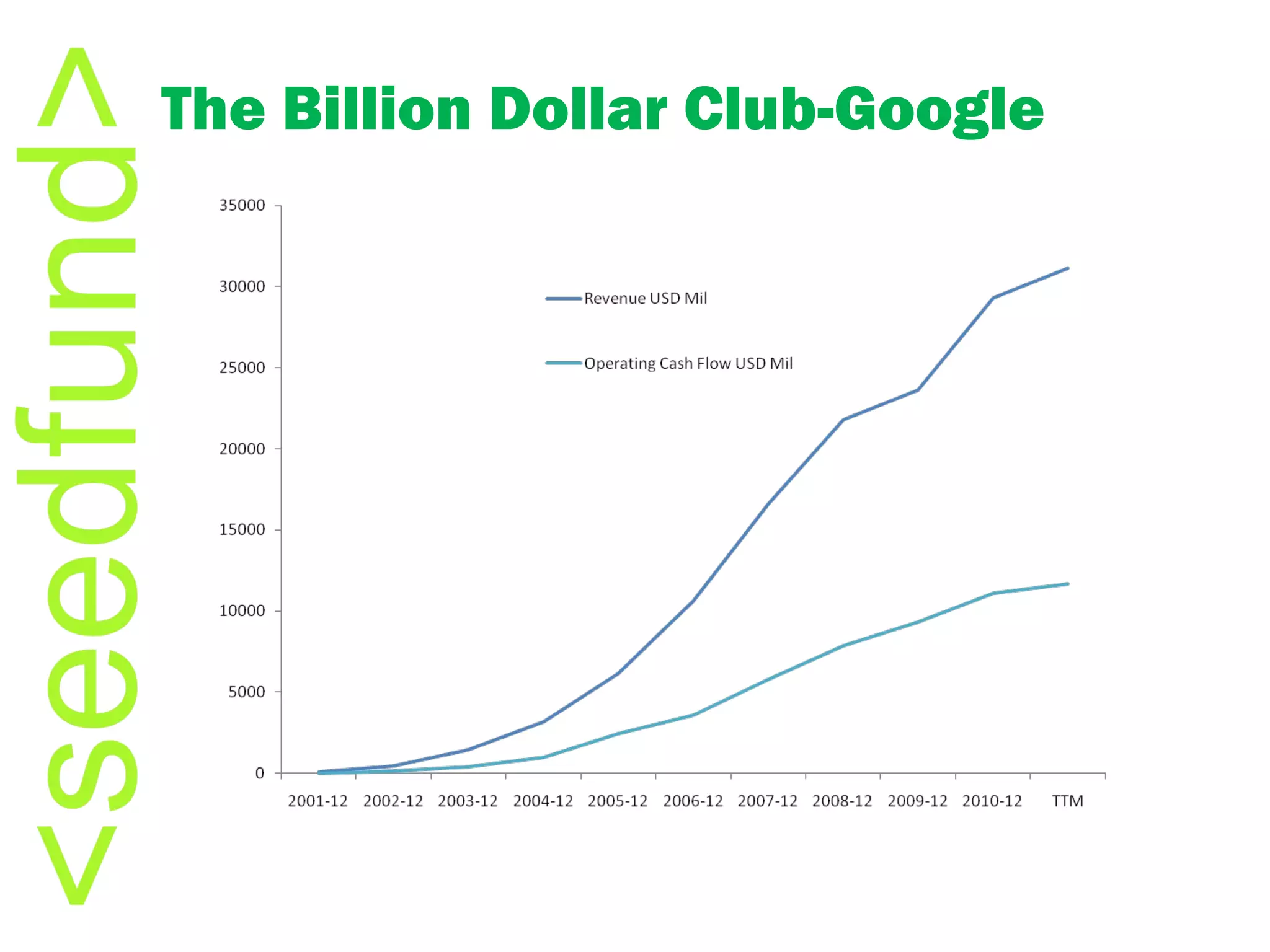

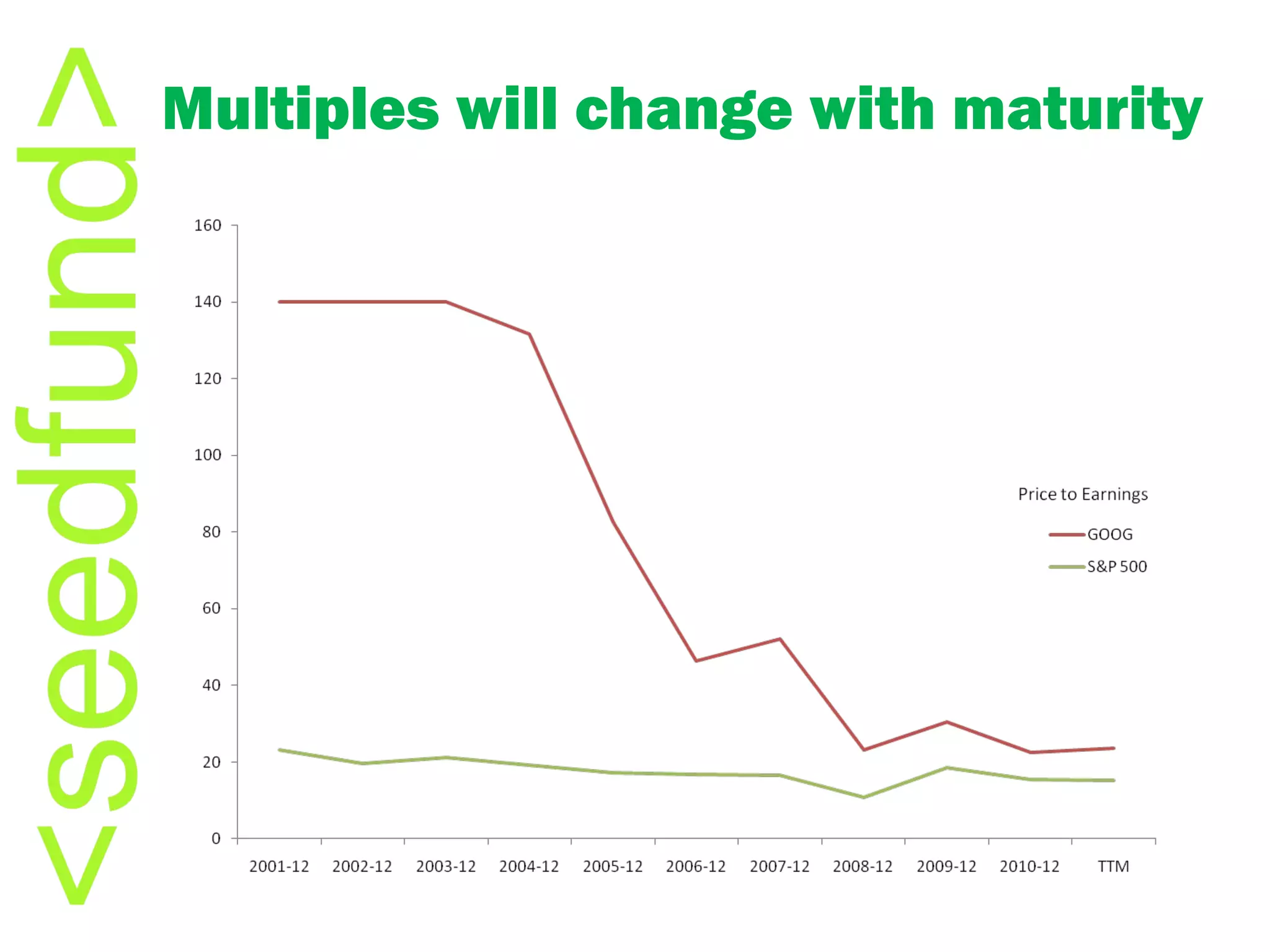

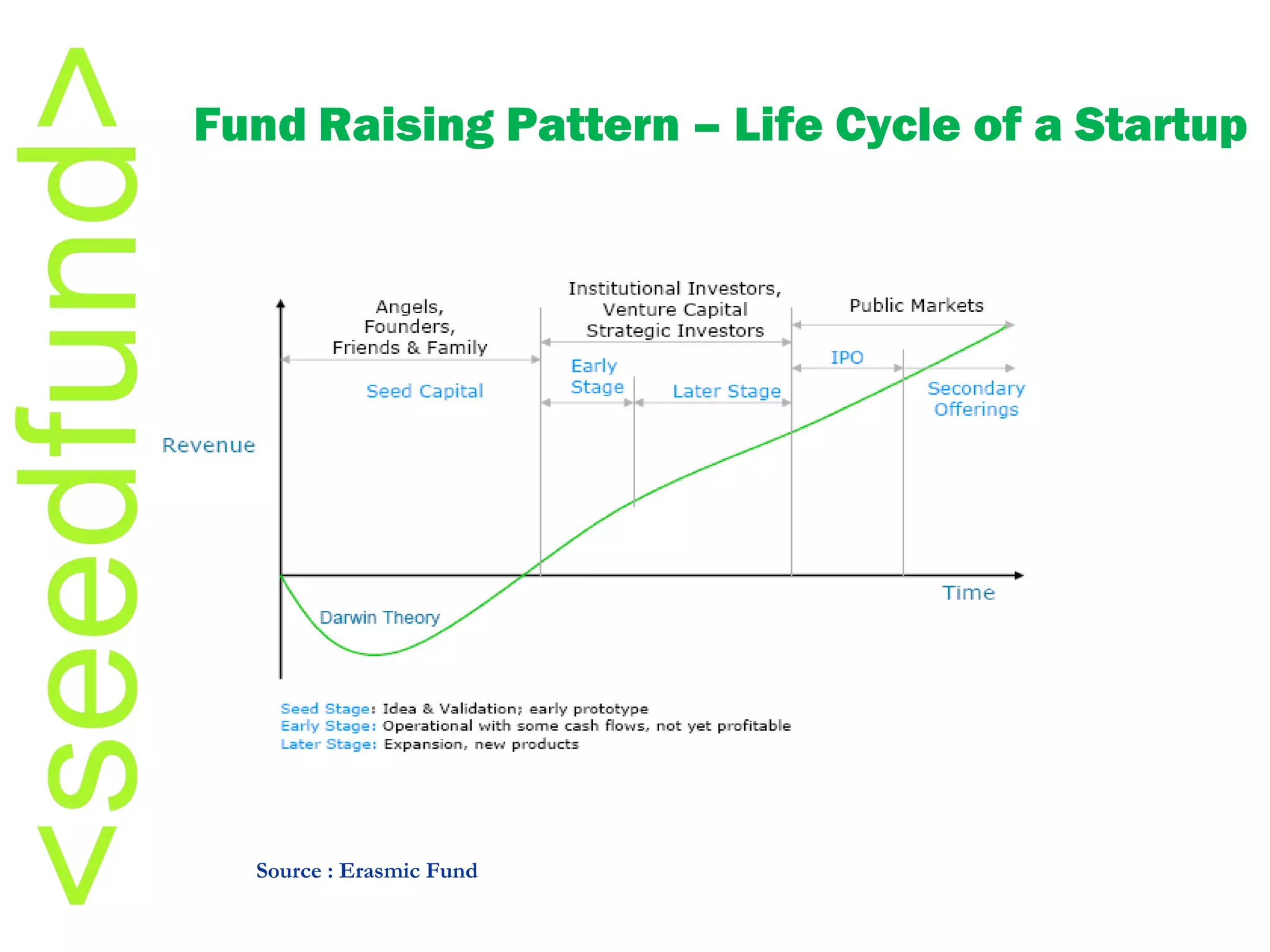

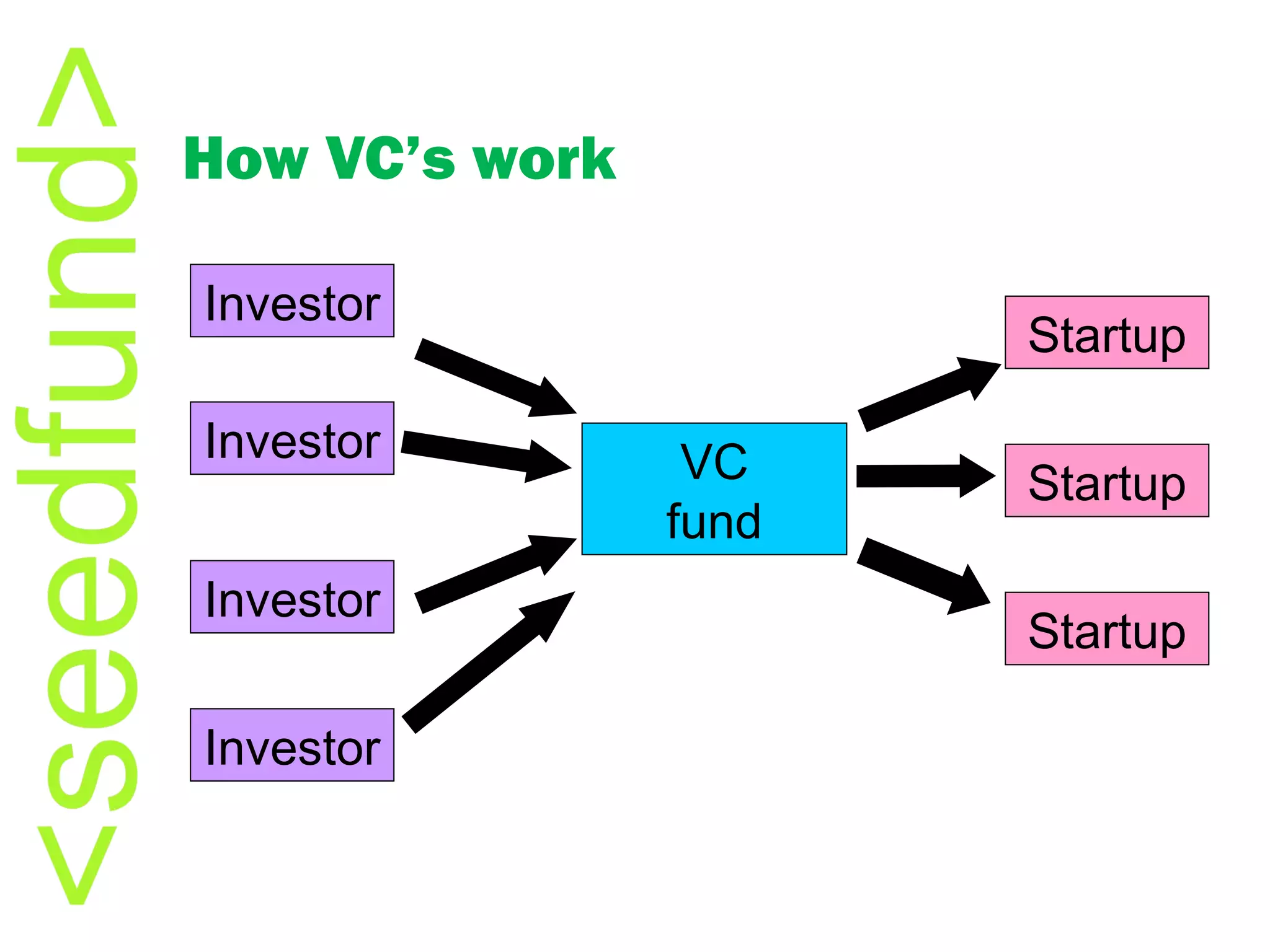

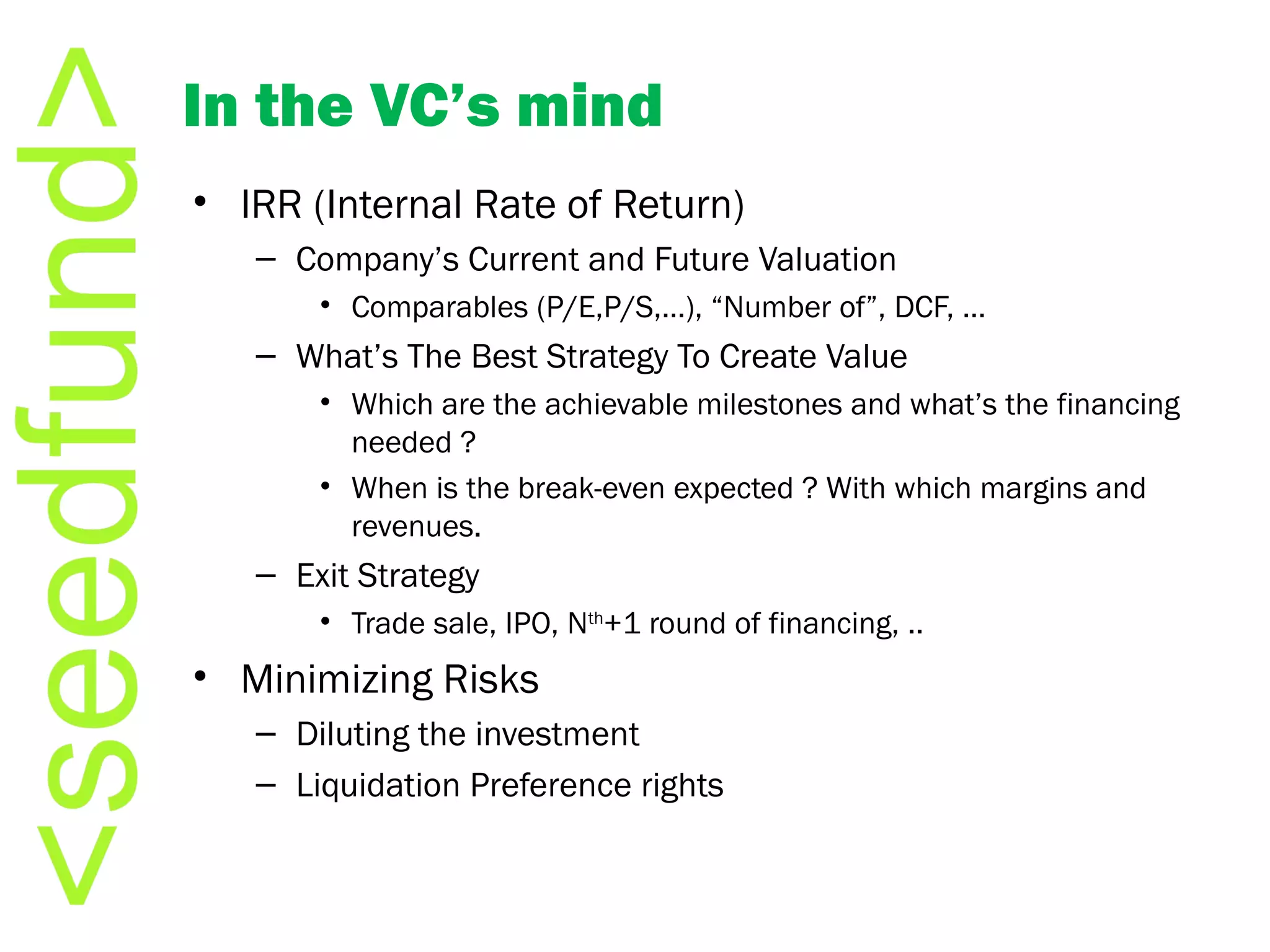

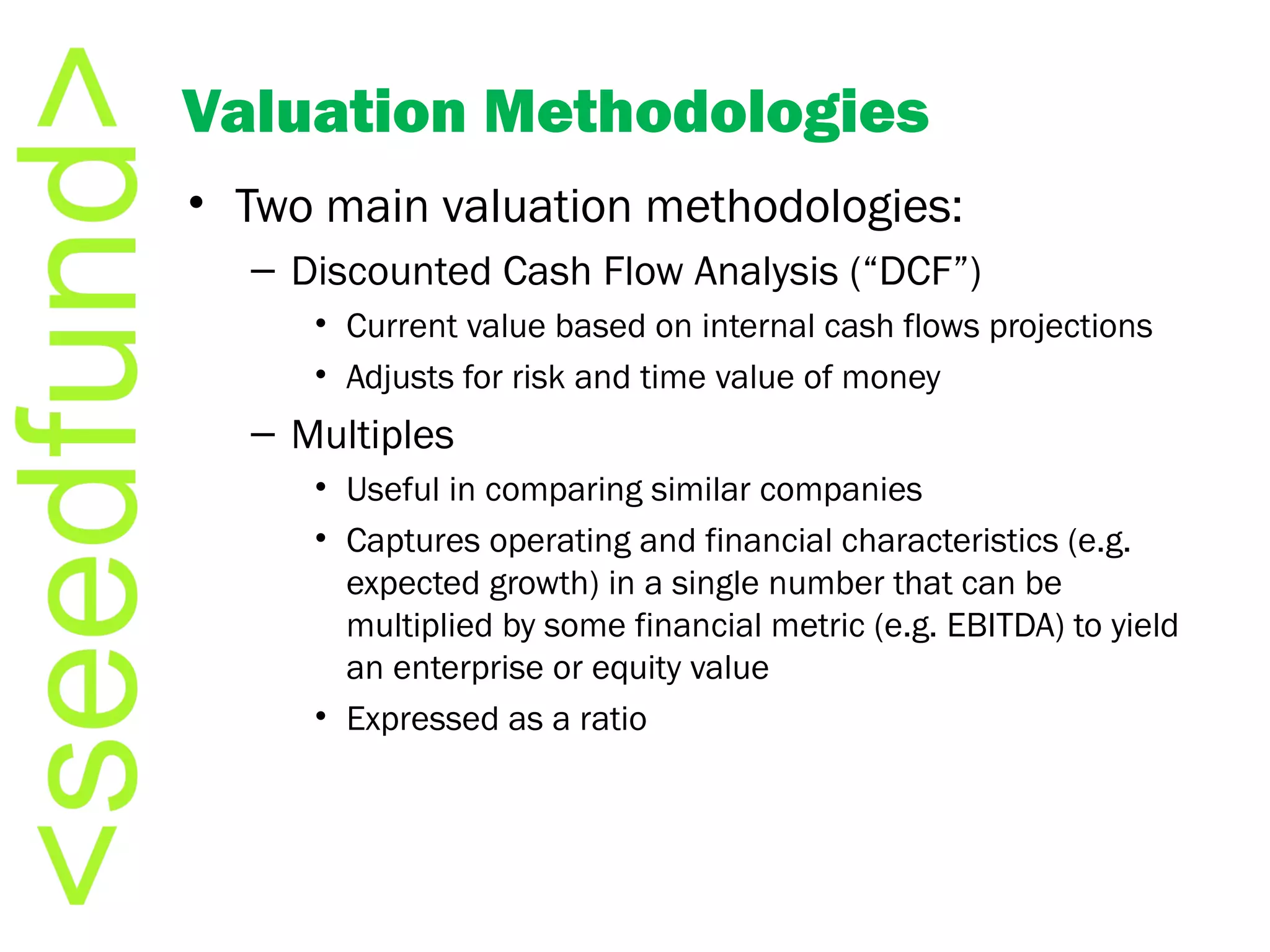

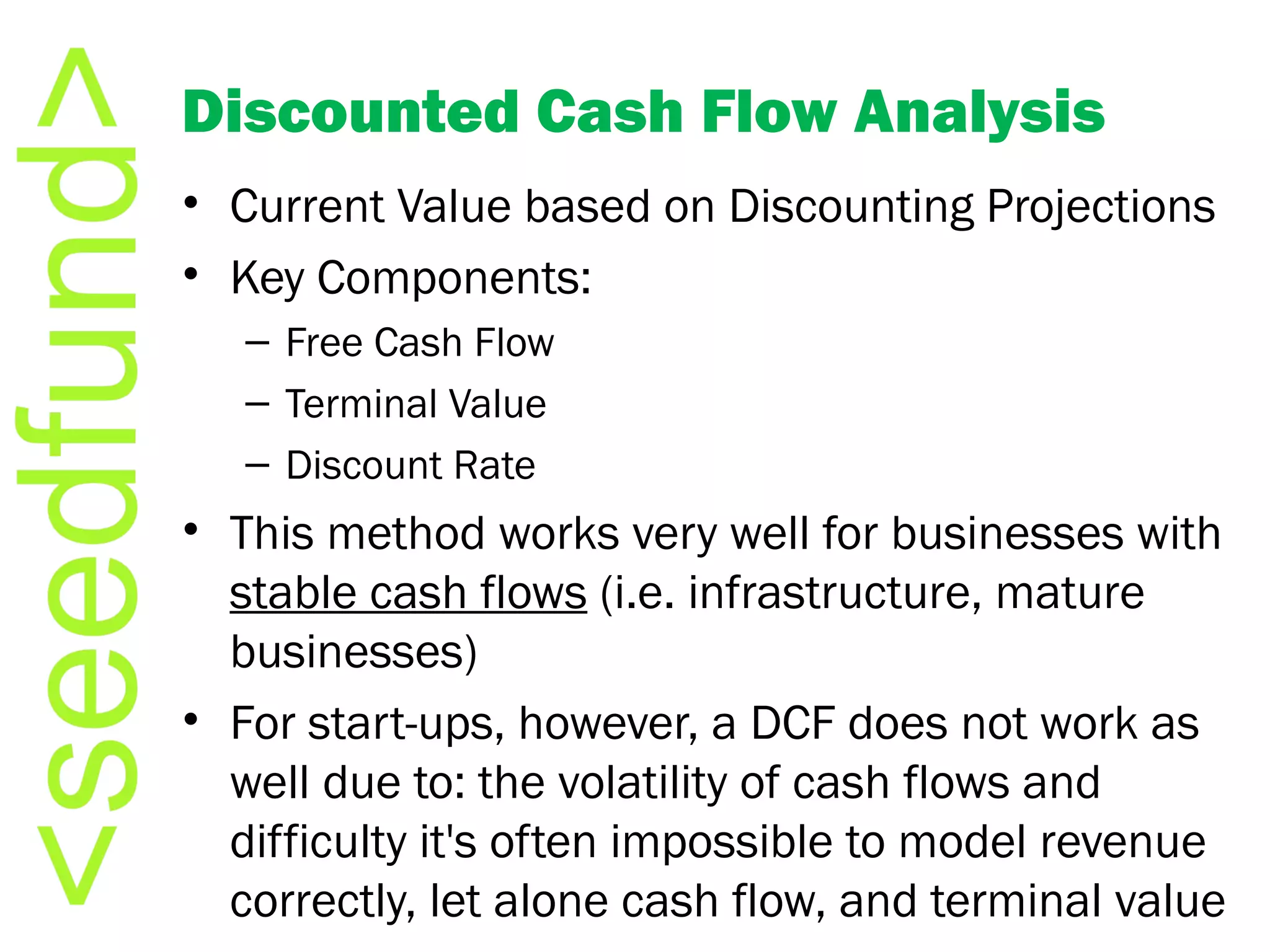

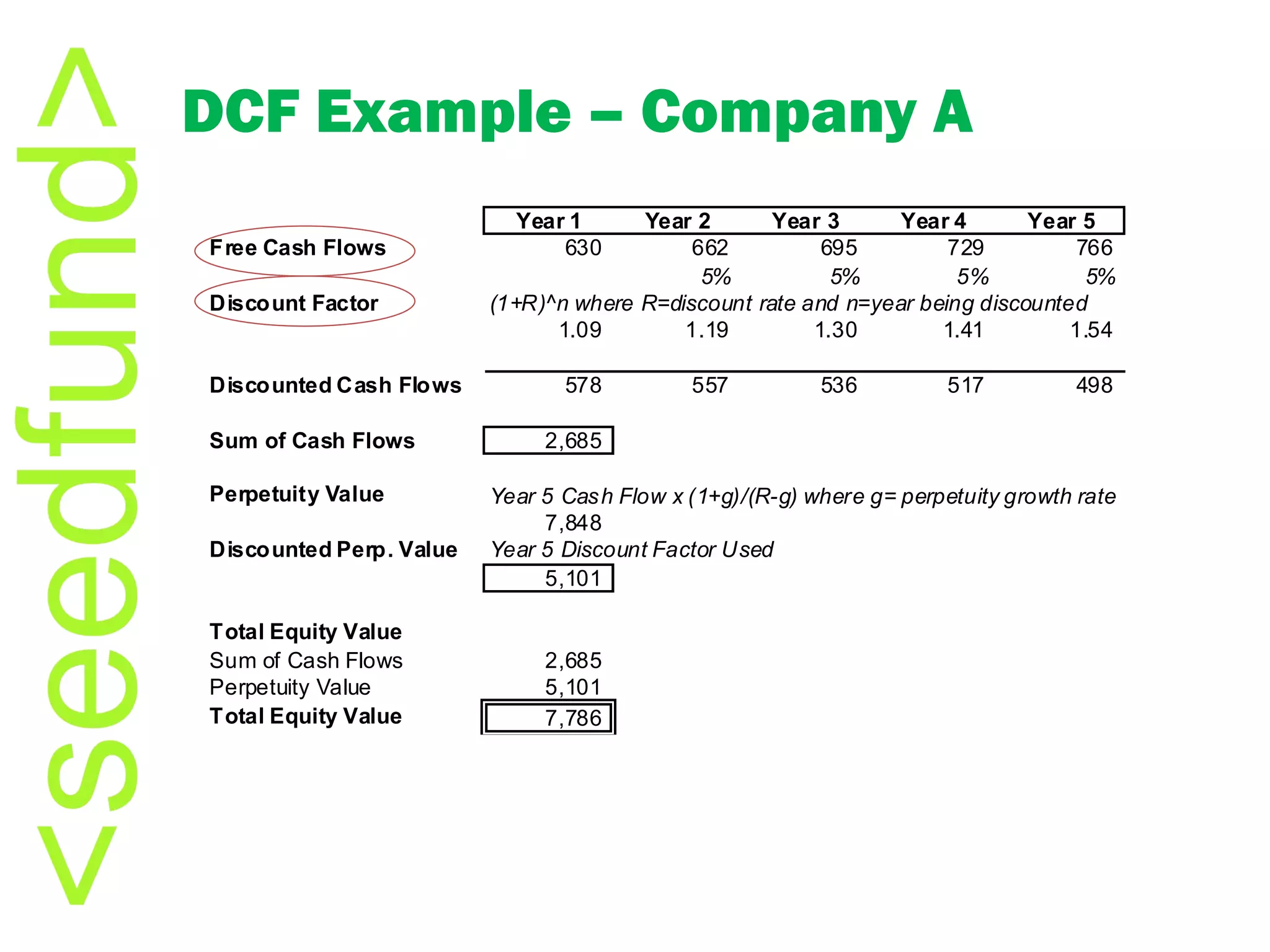

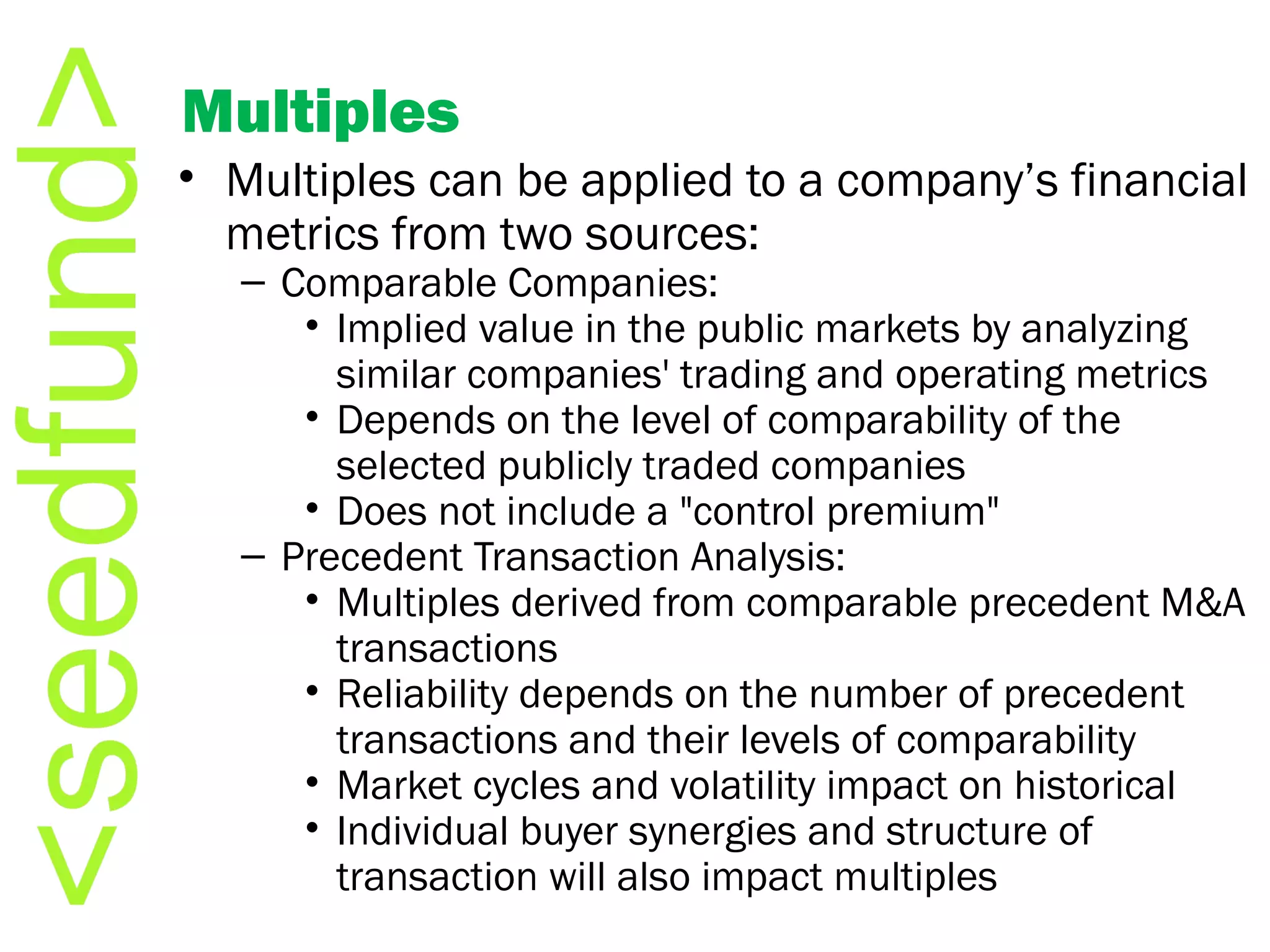

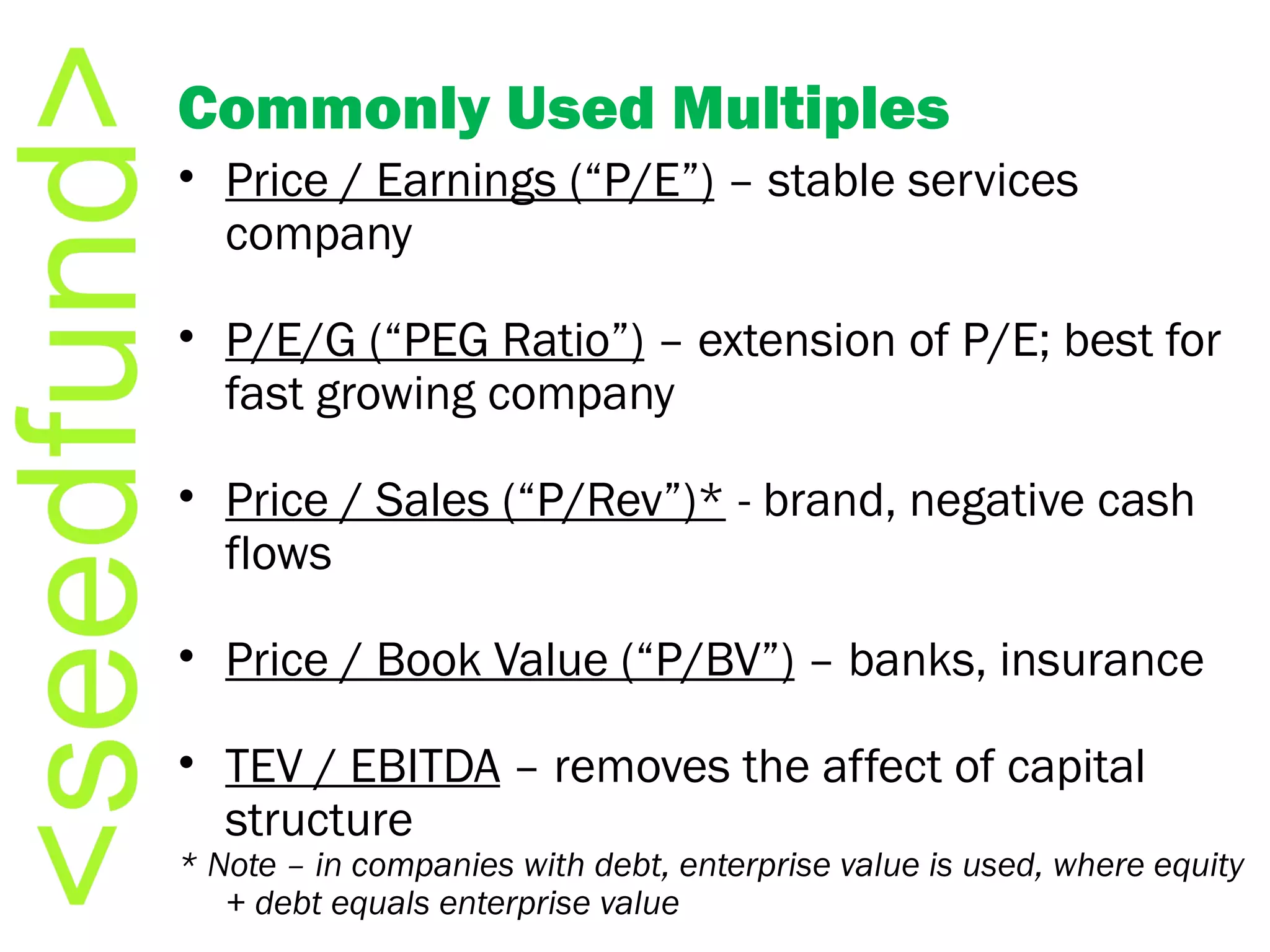

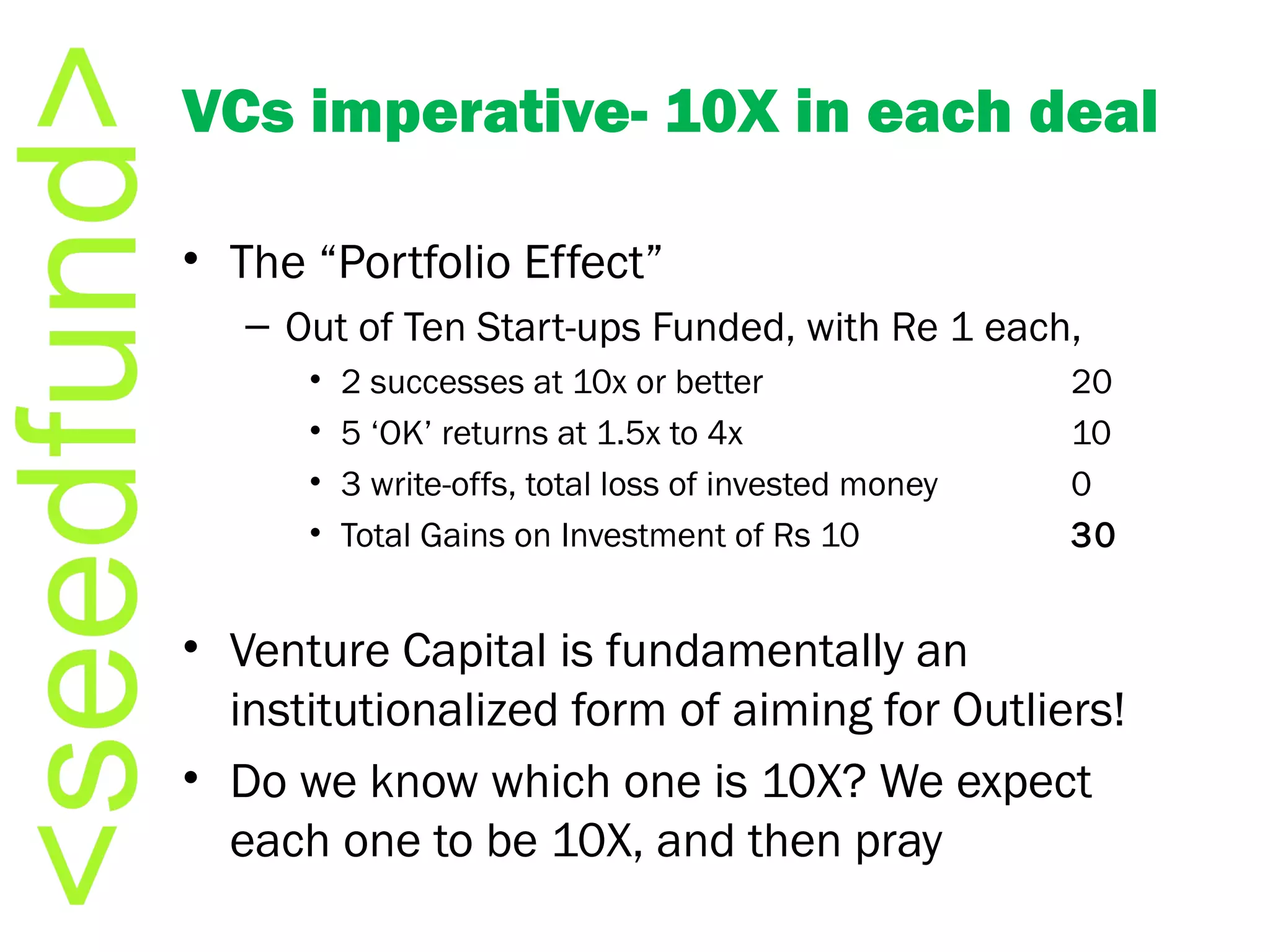

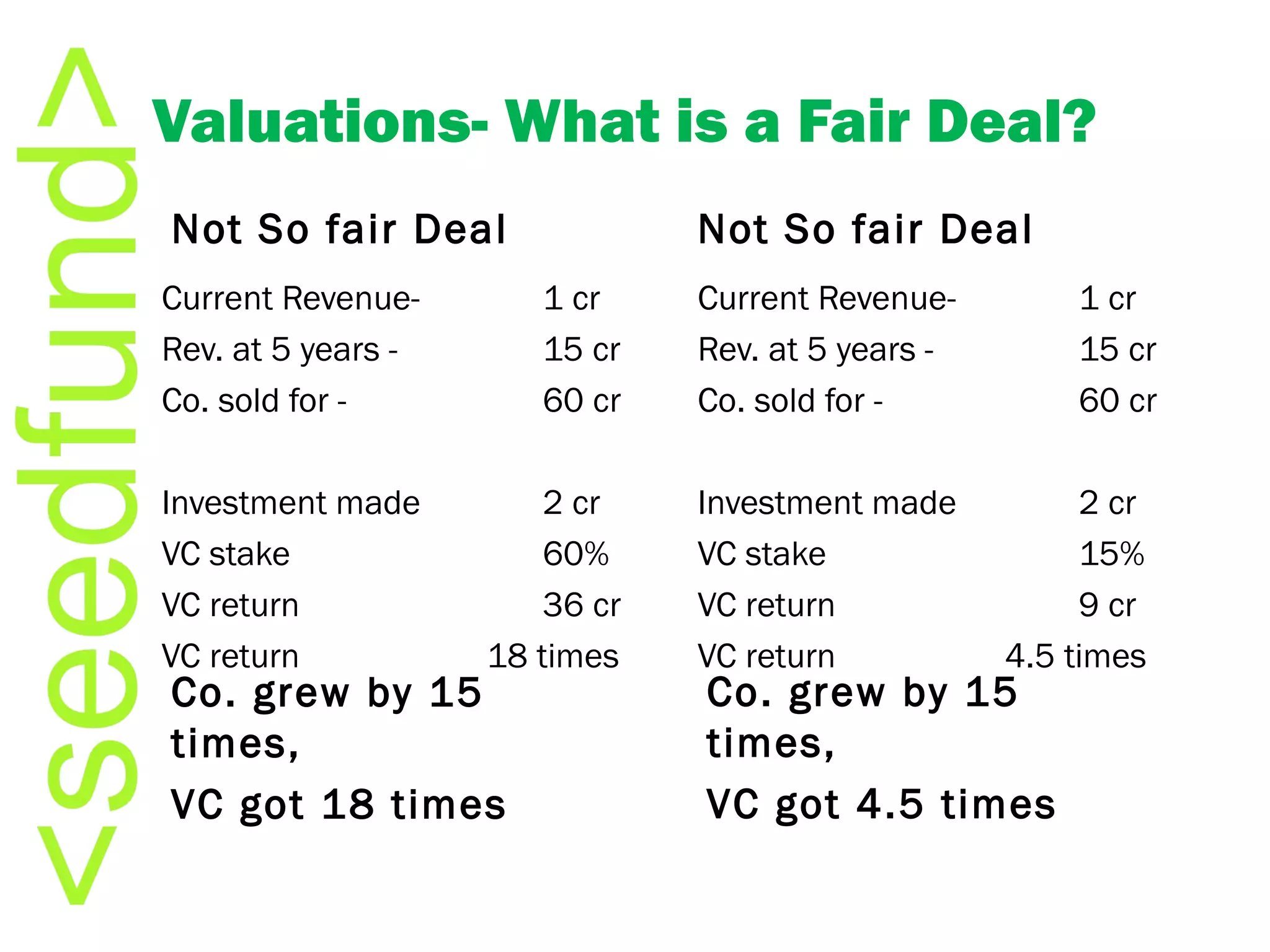

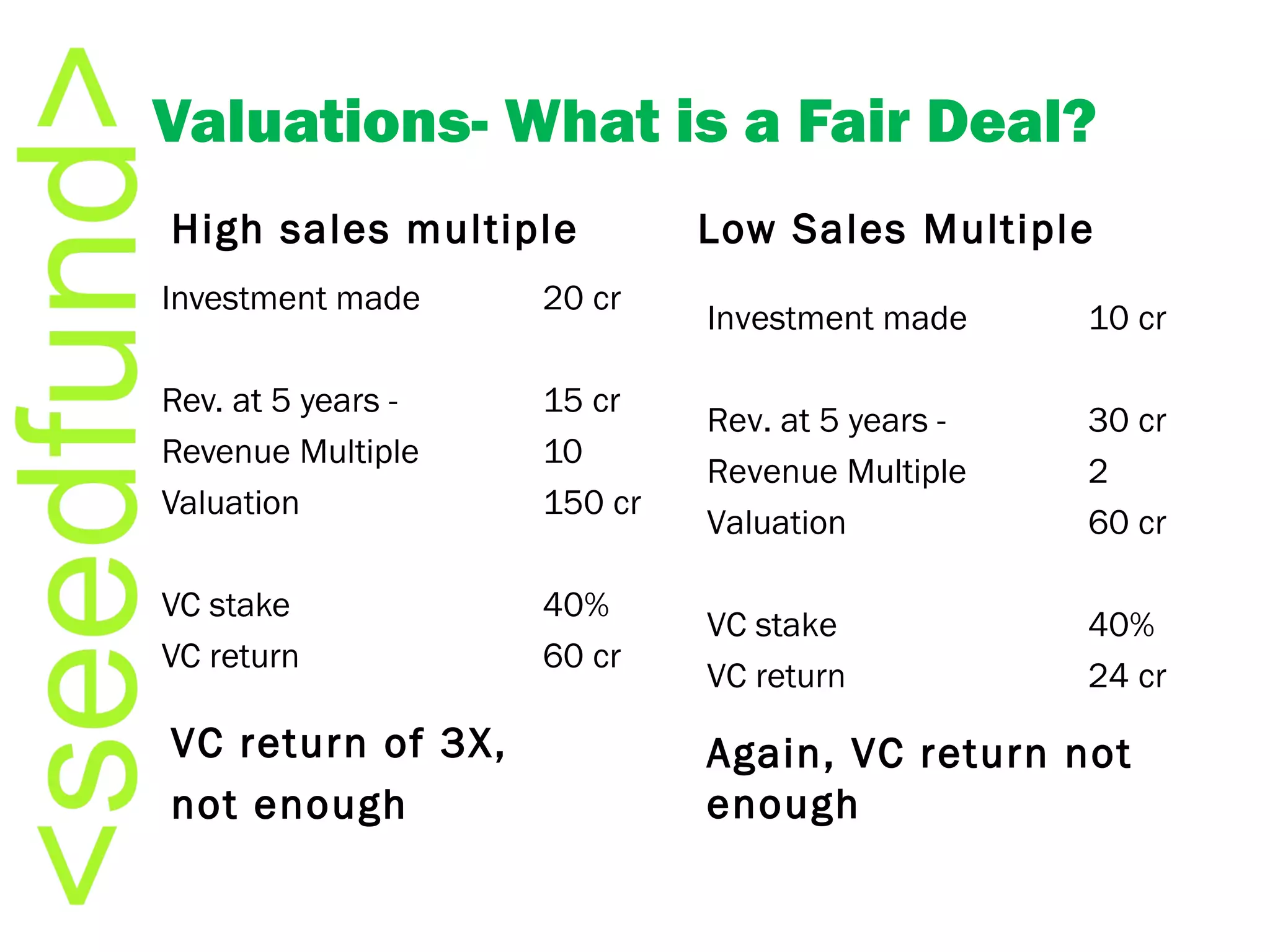

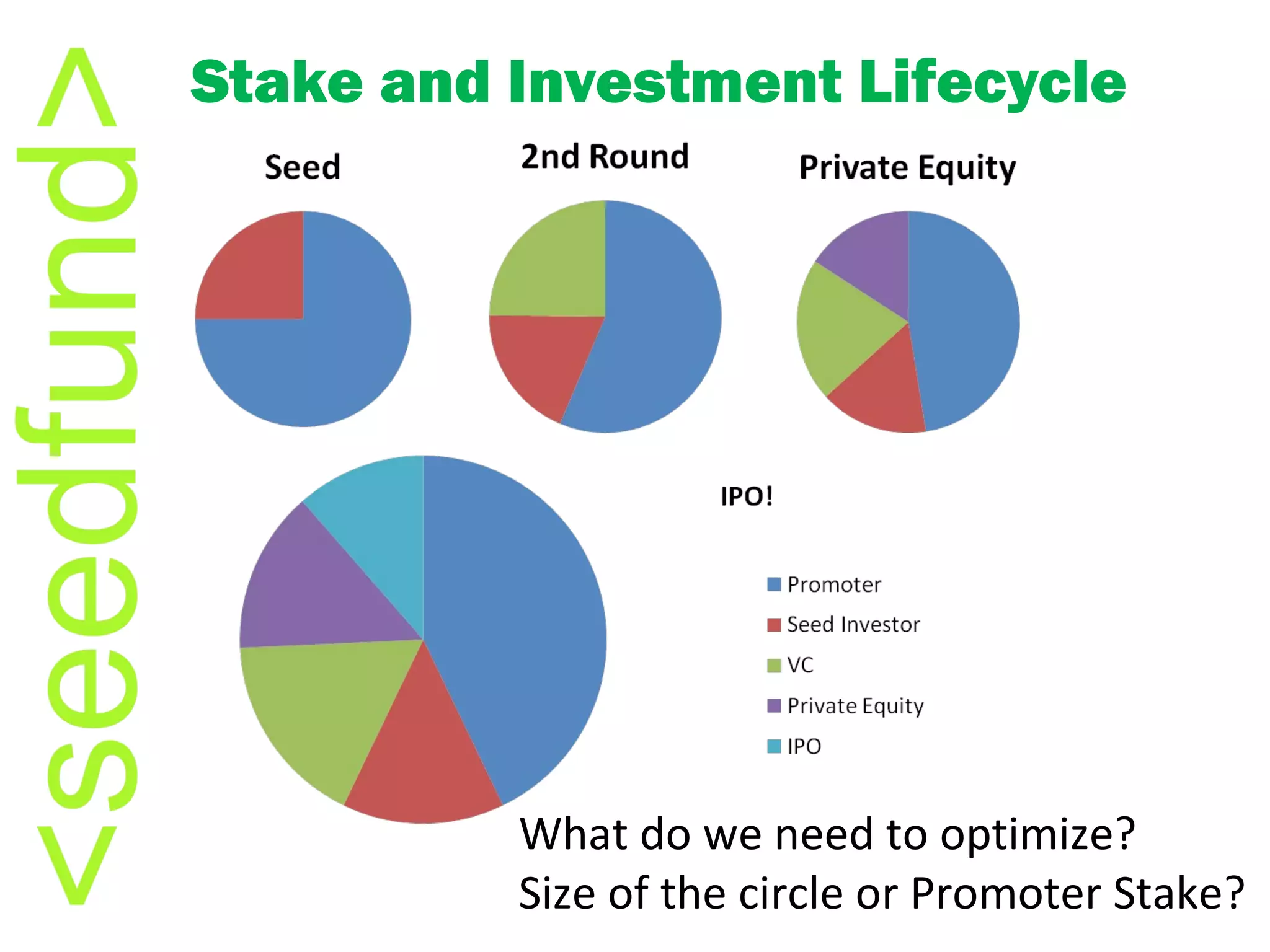

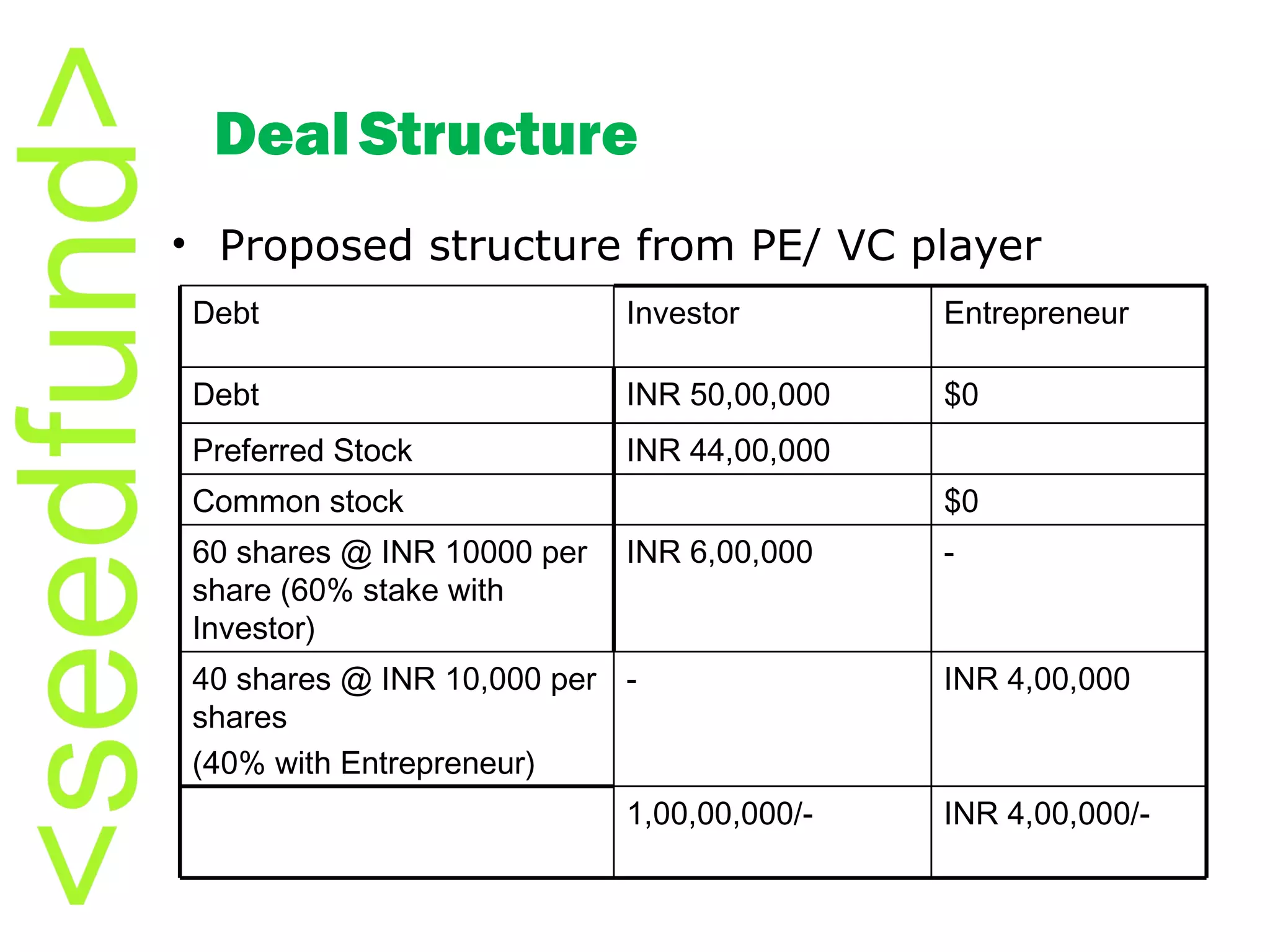

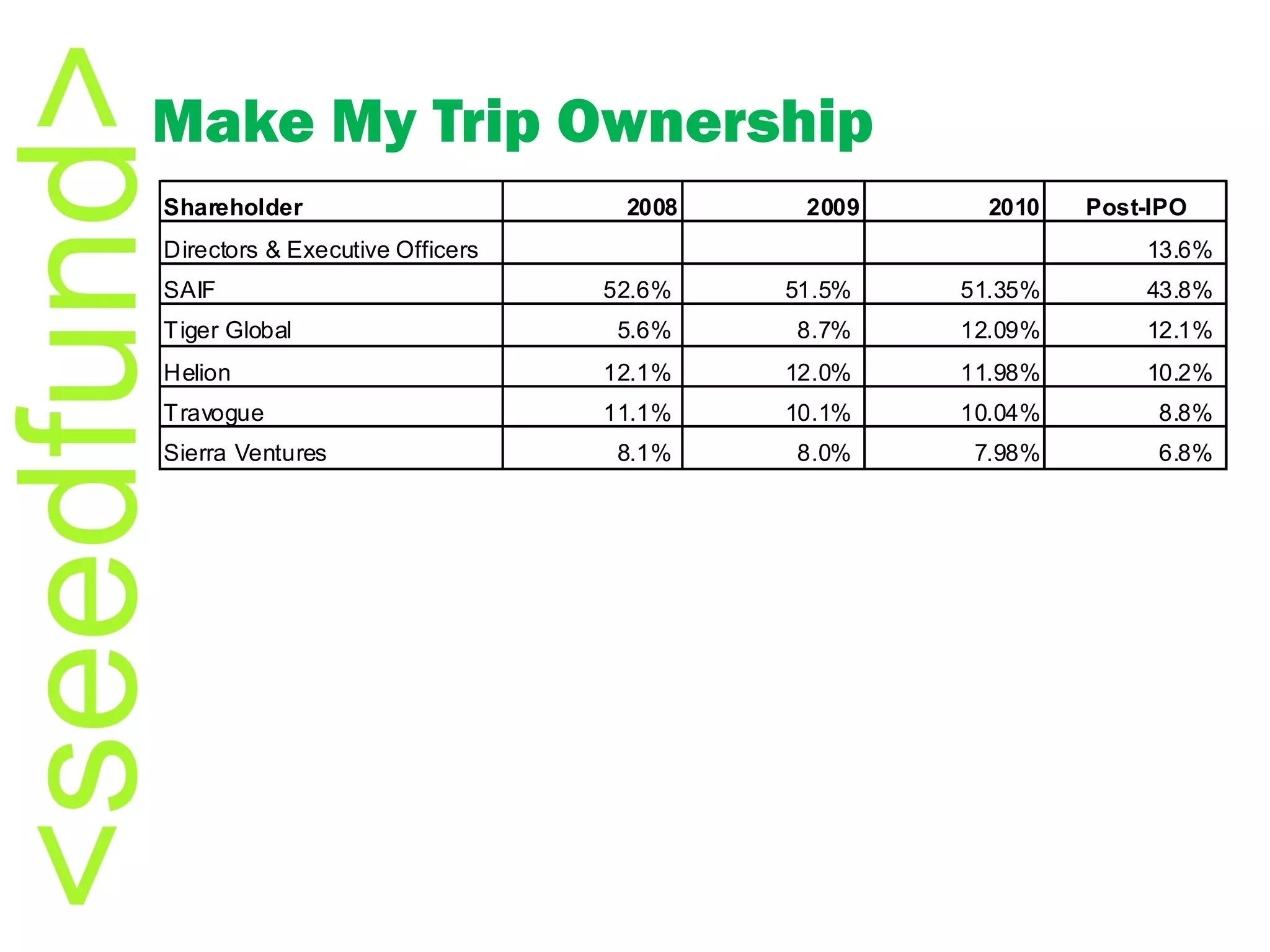

The document discusses venture capital and provides examples of companies that have reached valuations of over $1 billion (the "Billion Dollar Club"). It then covers topics such as the structure of venture capital funds, common valuation methodologies used in venture capital like discounted cash flow analysis and multiples, how deals are structured between investors and entrepreneurs, and provides a case study of the venture capital funding rounds for Make My Trip.

![An Introduction To Venture Capital Anand [email_address] Shailesh [email_address]](https://image.slidesharecdn.com/valuationanandluniashaileshvsingh-23jul2011v2-110725041700-phpapp01/75/Valuation-Workshop-by-Anand-Lunia-and-Shailesh-V-Singh-23-Jul-2011-v2-1-2048.jpg)