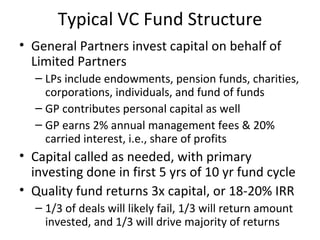

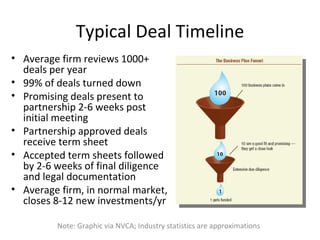

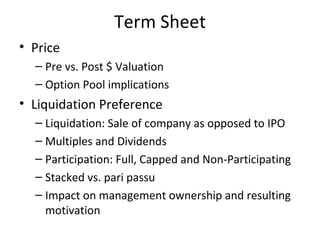

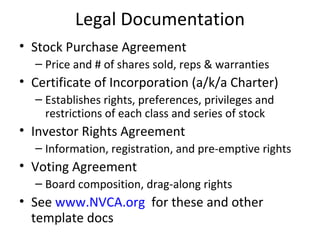

Venture capital involves private equity funding for early stage, high-growth companies. Venture capital funds are typically structured as limited partnerships that invest capital on behalf of endowments, pension funds, and other institutional investors. The fundraising process for companies involves setting a valuation and terms with a venture capital firm over several weeks. If approved, the company works with legal teams to finalize stock purchase agreements and investor rights documentation.