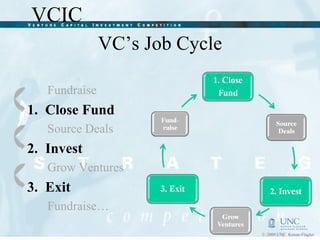

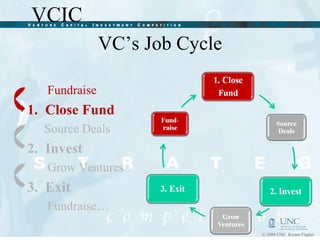

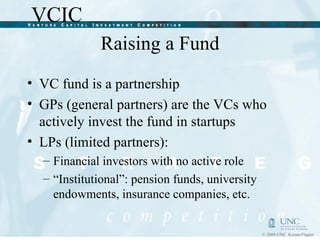

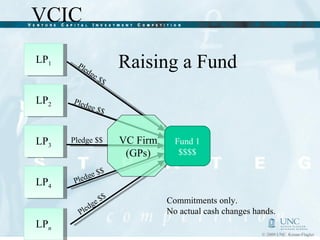

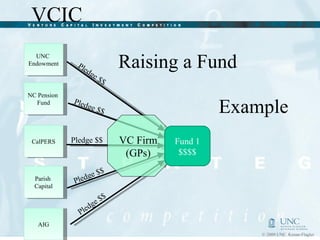

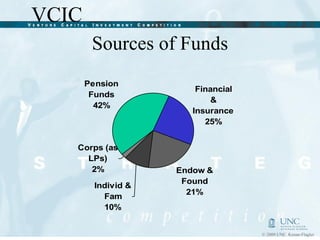

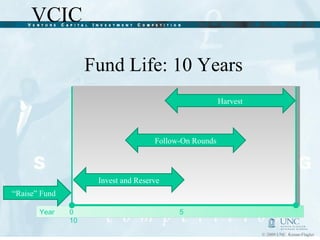

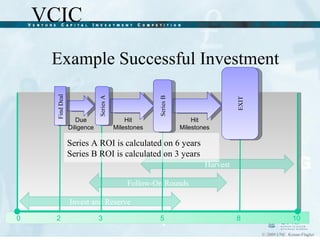

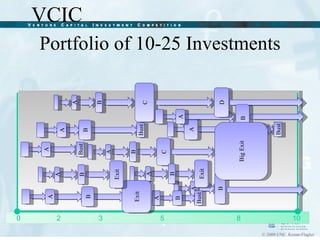

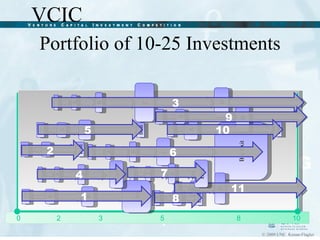

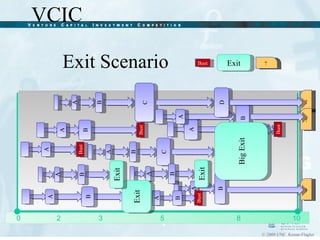

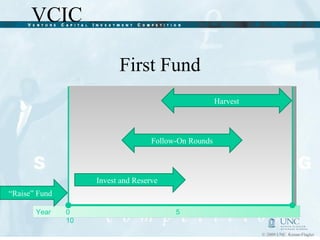

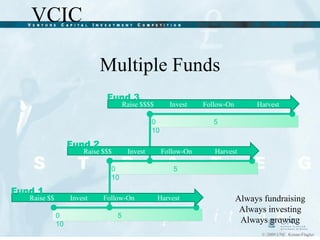

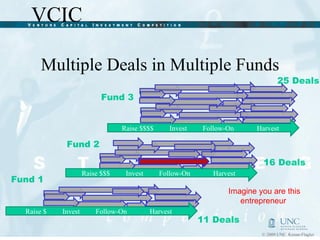

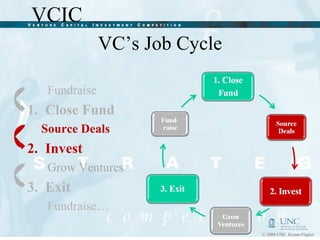

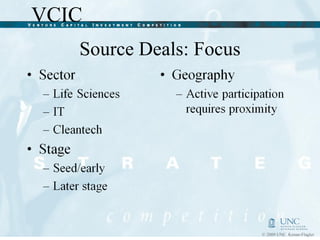

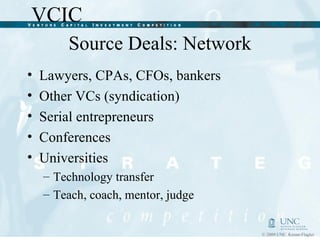

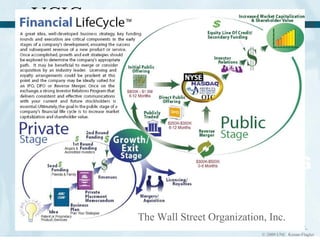

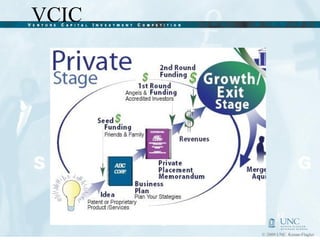

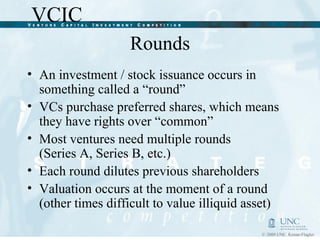

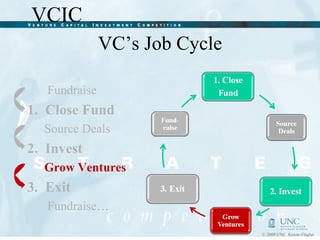

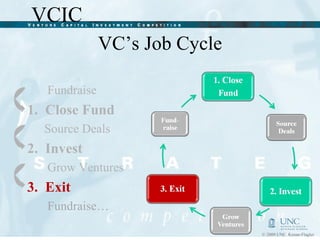

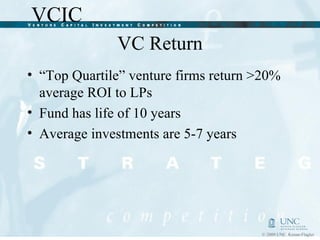

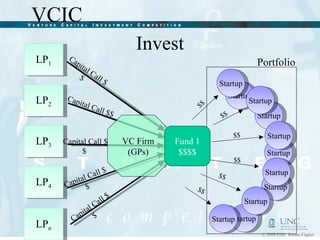

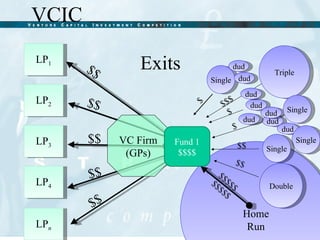

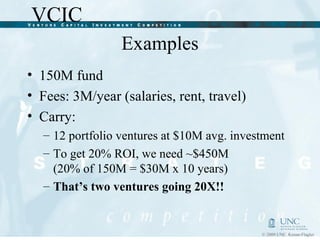

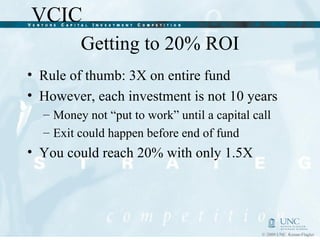

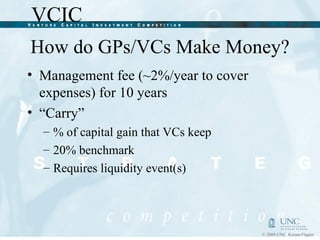

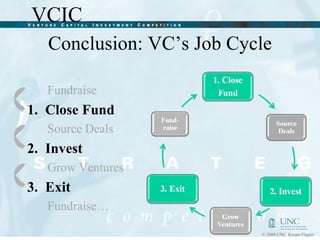

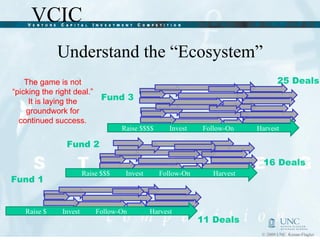

The document summarizes the key aspects of a venture capitalist's job cycle. It involves fundraising by securing commitments from limited partners for an investment fund. Then sourcing deals, investing in startups, helping them grow through follow-on rounds of funding, and ultimately exiting via IPO or acquisition to realize returns for investors. This cycle of fundraising, investing, growing and exiting portfolio companies repeats across multiple funds to generate the targeted 20% annualized returns.