This document provides an overview of venture capital, including:

- The key difference between startups and SMEs, and between private equity and venture capital

- What venture capital is and examples of major investments like Accel Partners in Facebook

- The premise of venture capital being high risk but also high reward

- A brief history of venture capital and its growth in Australia

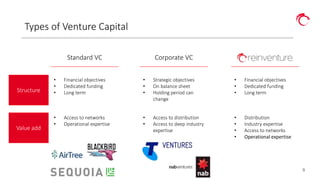

- How venture capital funds are typically structured and the types of venture capital

- Current areas of interest for venture capital like fintech, AI, and blockchain

- The key decision criteria venture capitalists examine like metrics, business dynamics, deal terms, and team