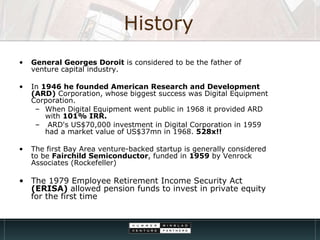

1. Venture capital firms raise funds to invest in new and growing companies, taking equity stakes and board positions in exchange for funding and guidance.

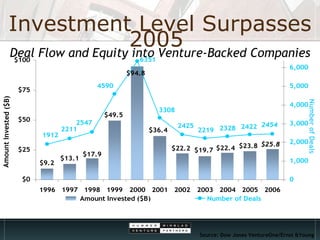

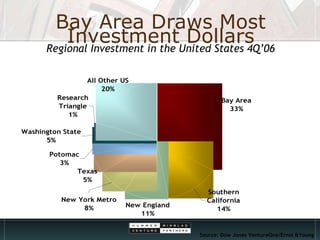

2. Venture capital has historically funded many influential companies and plays an important role in the economy. In 2006, over $25 billion was invested in the US through over 2,400 deals.

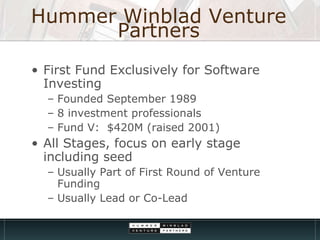

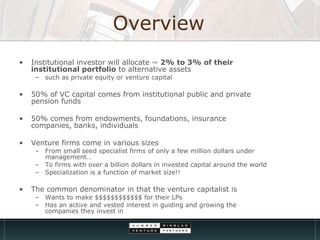

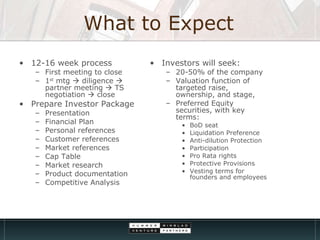

3. The presentation provided an overview of the venture capital industry and process, including typical firm structures, investment criteria, deal terms, and advice for entrepreneurs seeking funding.

![Introduction Will Price, Principal Harvard College, AB Northwestern University, MBA Investment banking, product mgt, start-up CEO [email_address] http://willprice.blogspot.com Hummer Winblad Venture Partners $1bn AUM early-stage software firm](https://image.slidesharecdn.com/introduction-to-venture-capital-9229-101014062442-phpapp02/85/Introduction-to-venture-capital-9229-2-320.jpg)

![Approaching VC’s Investing is a people business, and getting a meeting is all about “who you know” Best way to approach a VC is some form of introduction If you don’t know a VC, find someone who knows you who does and get them to introduce you Entrepreneur, professor, attorney… Sending a plan to [email_address] is a waste of time](https://image.slidesharecdn.com/introduction-to-venture-capital-9229-101014062442-phpapp02/85/Introduction-to-venture-capital-9229-18-320.jpg)