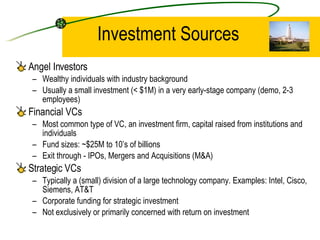

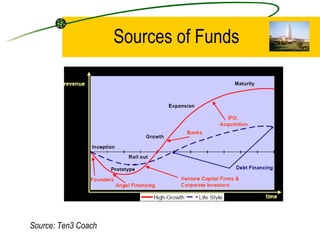

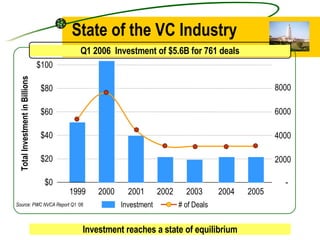

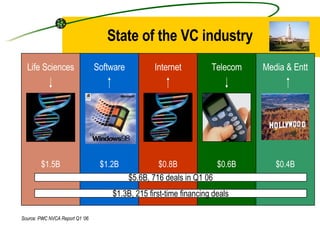

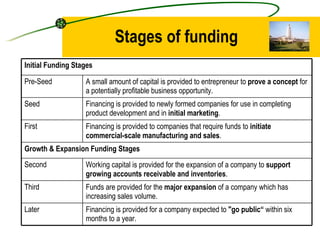

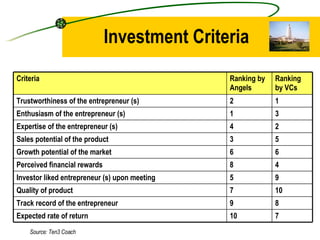

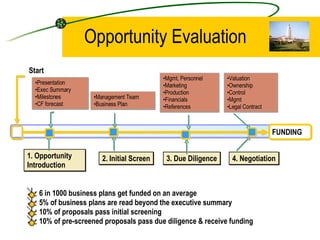

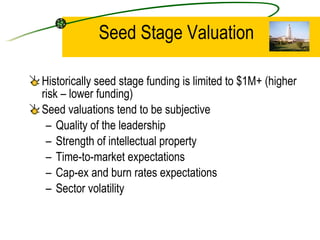

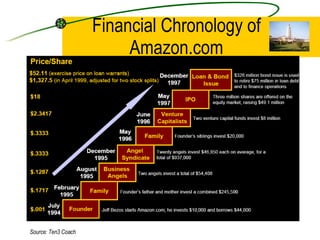

The document outlines the process of funding a start-up, highlighting various investment sources such as angel investors, financial VCs, and strategic VCs, along with the current state of the VC industry. It details the stages of funding, from seed stage to major expansions, and emphasizes the criteria that investors consider when evaluating business plans. Additionally, it provides a checklist for entrepreneurs to prepare for securing financing, focusing on both short-term and long-term financial needs.