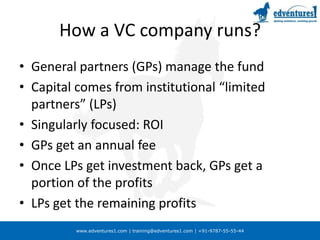

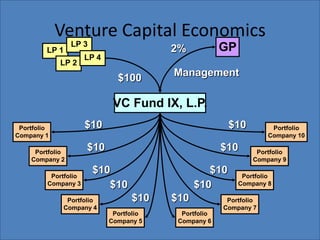

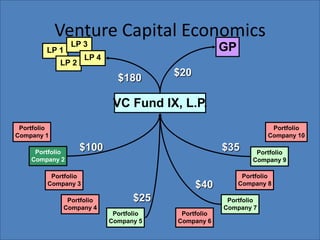

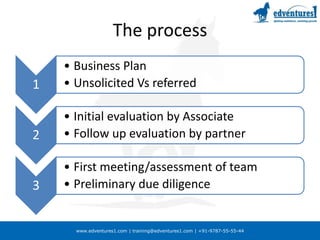

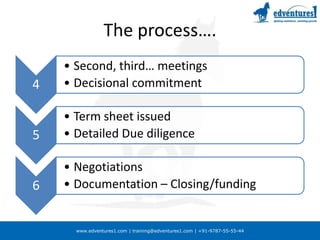

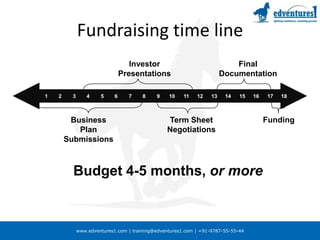

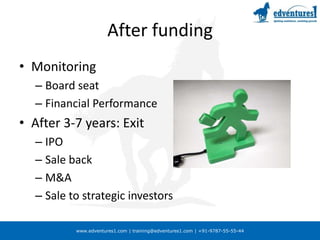

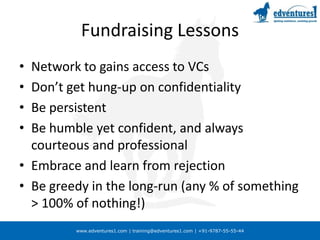

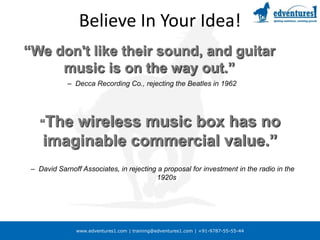

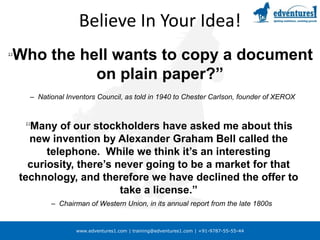

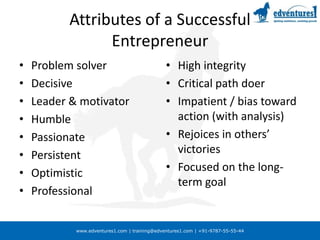

The document provides an overview of venture capital, covering its definition, types of funding, and what venture capitalists look for in investments, as well as the process of funding and exit strategies. It highlights the importance of risk-taking in venture capital and the role of general partners and limited partners in managing funds. Additionally, it emphasizes the qualities of successful entrepreneurs and offers advice on fundraising and learning from rejection.