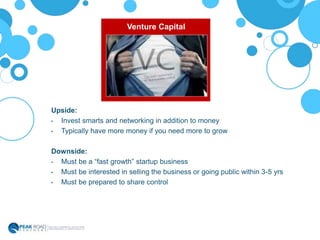

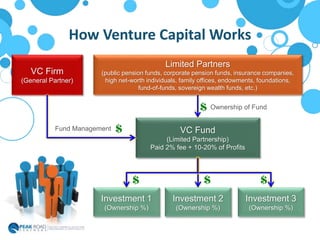

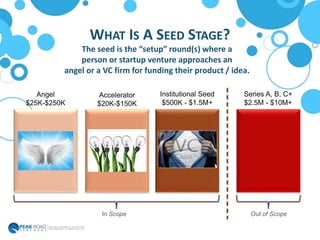

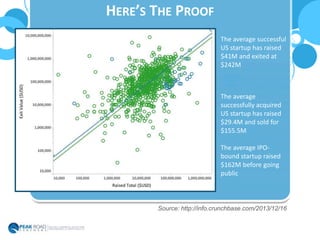

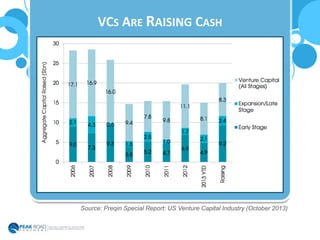

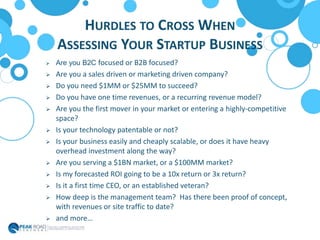

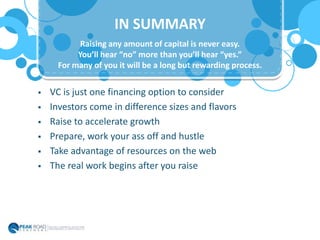

The document discusses various funding options for startups, including debt, equity, crowdfunding, angel investors, and venture capital, highlighting their advantages and disadvantages. It emphasizes the importance of having a solid business plan to attract investors and the need for preparation and hustle to secure funding. Ultimately, it reiterates that raising capital is merely a means to an end, with the focus on building a viable product and business.