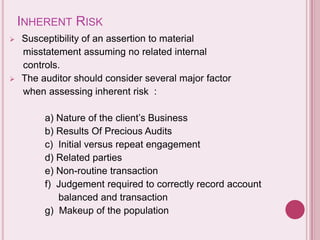

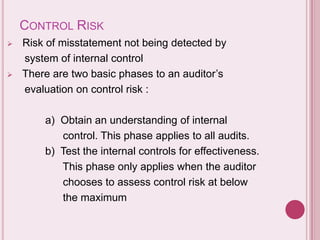

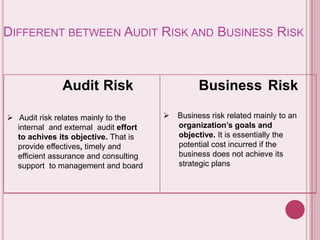

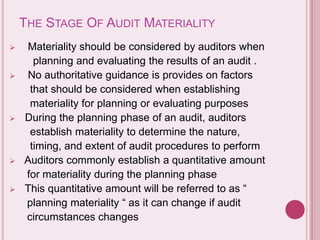

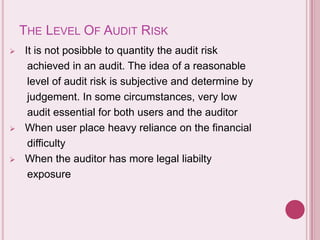

This document discusses materiality, audit risk, and their relationship. It defines materiality as a misstatement that could affect a user's decision. Audit risk is the risk of an inappropriate audit opinion. There are three types of audit risk: inherent risk, control risk, and detection risk. Materiality is considered at the planning and evaluation stages of the audit. The level of audit risk depends on factors like user reliance and legal liability exposure. Higher materiality and audit risk require more audit work.