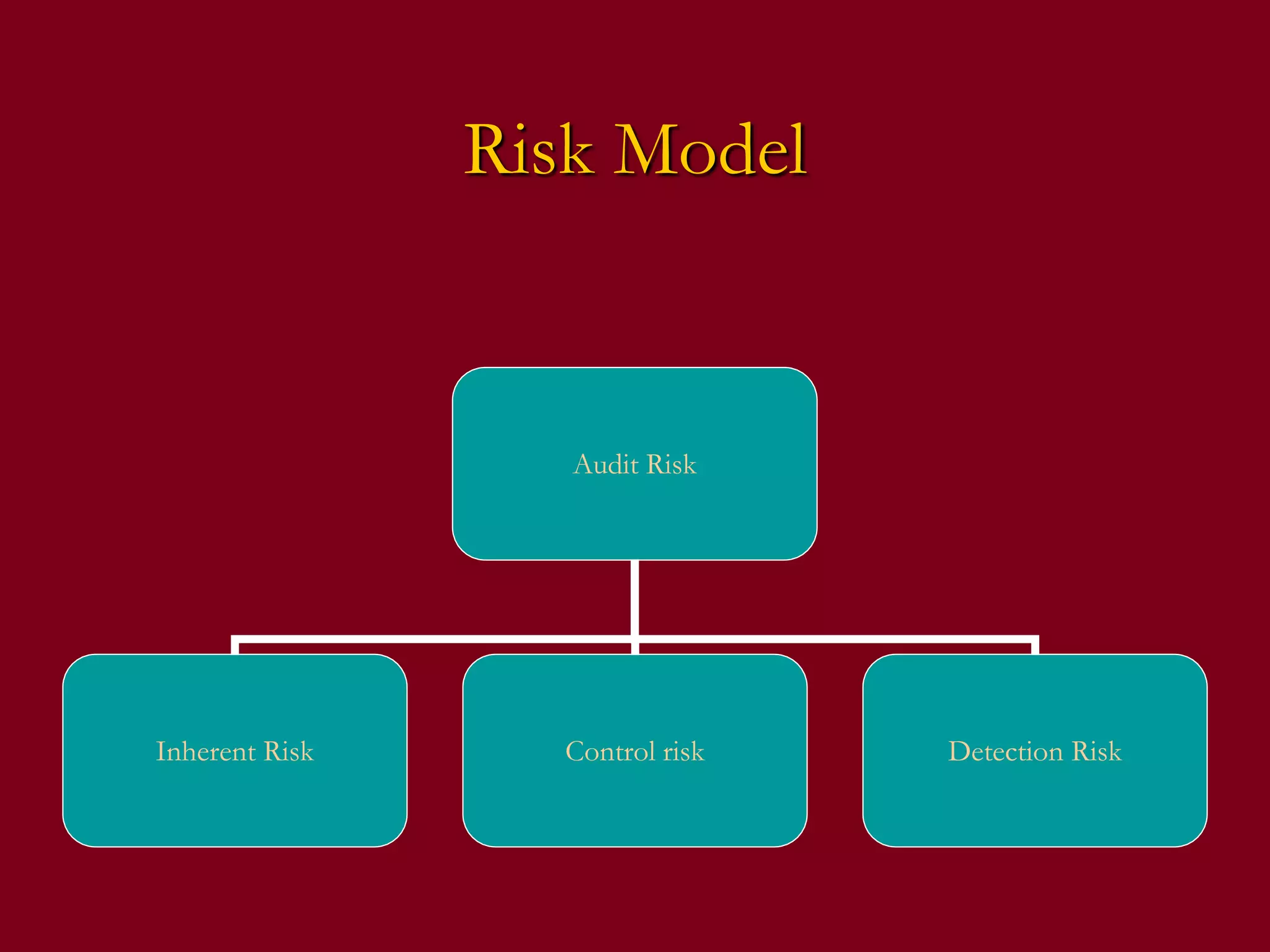

The document outlines the objectives of a risk-based audit approach, focusing on the relationship between audit risk and materiality, as well as the components of overall audit risk: inherent risk, control risk, and detection risk. It emphasizes the importance of appropriate planning and execution using a risk model to identify high-risk areas, ensuring sufficient assurance in audit procedures. Additionally, it discusses factors that influence inherent and control risks and the auditor's objectives in assessing these risks.