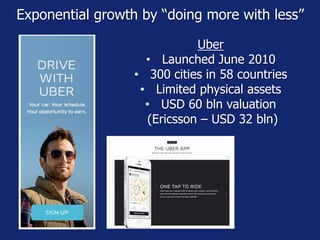

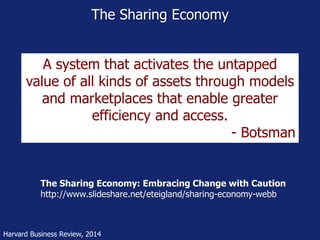

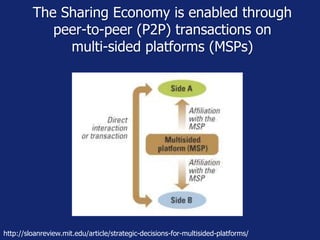

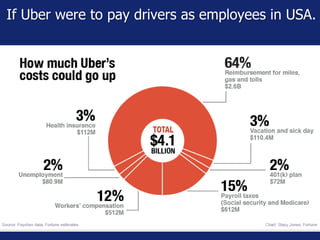

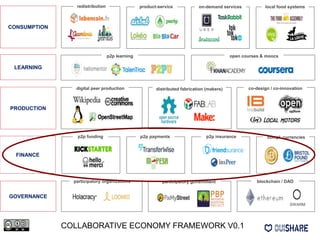

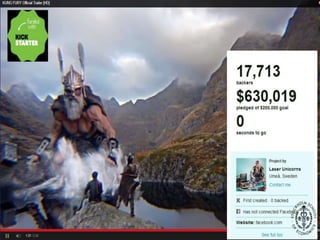

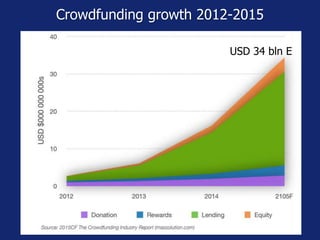

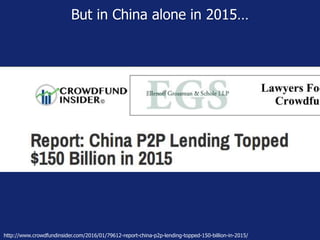

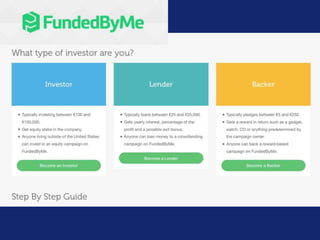

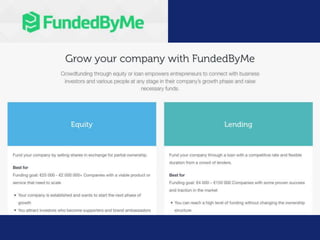

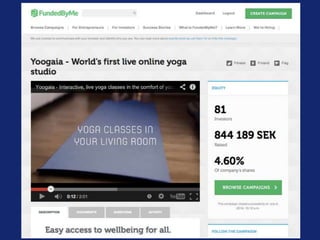

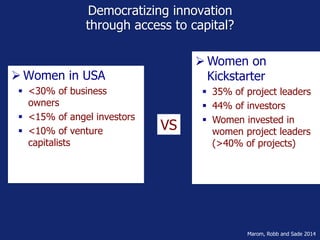

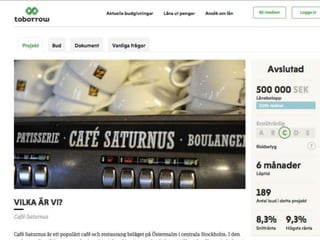

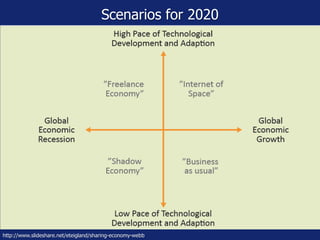

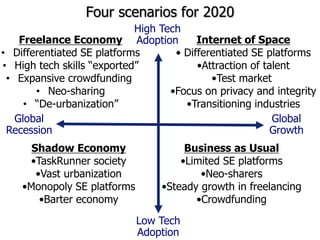

The document discusses the sharing economy, highlighting its exponential growth and the implications of peer-to-peer transactions on multi-sided platforms. It addresses the challenges of trust, regulation, and economic impacts associated with this emerging model. Additionally, it outlines the participation of women in entrepreneurial roles and the potential for democratizing innovation through accessible capital in different regions.