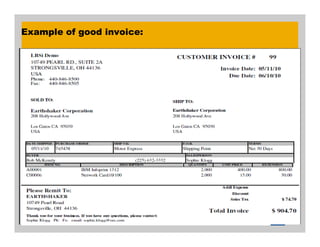

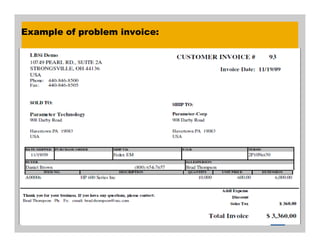

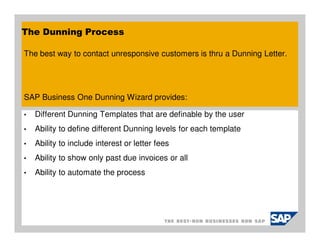

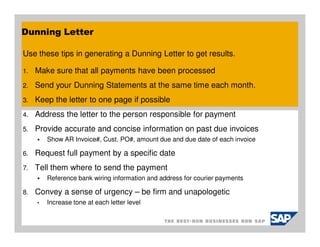

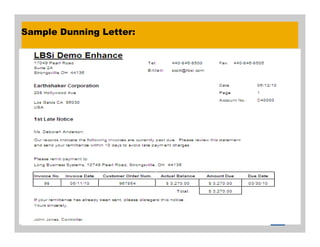

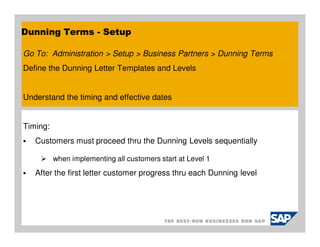

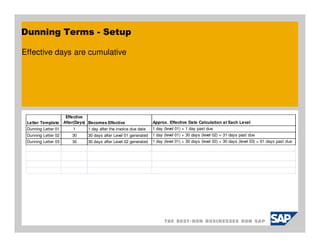

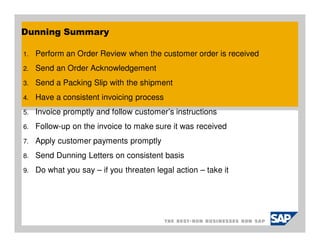

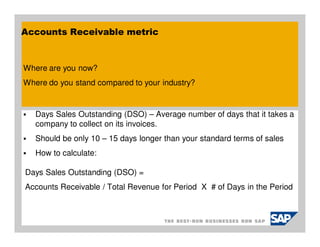

Long Business Systems, Inc. (LBSI) is a technology services firm focused on improving profitability and customer service through effective payment processes. The document outlines the dunning process, emphasizing the importance of timely customer interactions and the establishment of a consistent invoicing procedure to minimize accounts receivable days and enhance cash flow. It provides practical steps for order review, billing, and dunning letter generation to ensure effective communication with customers regarding overdue payments.