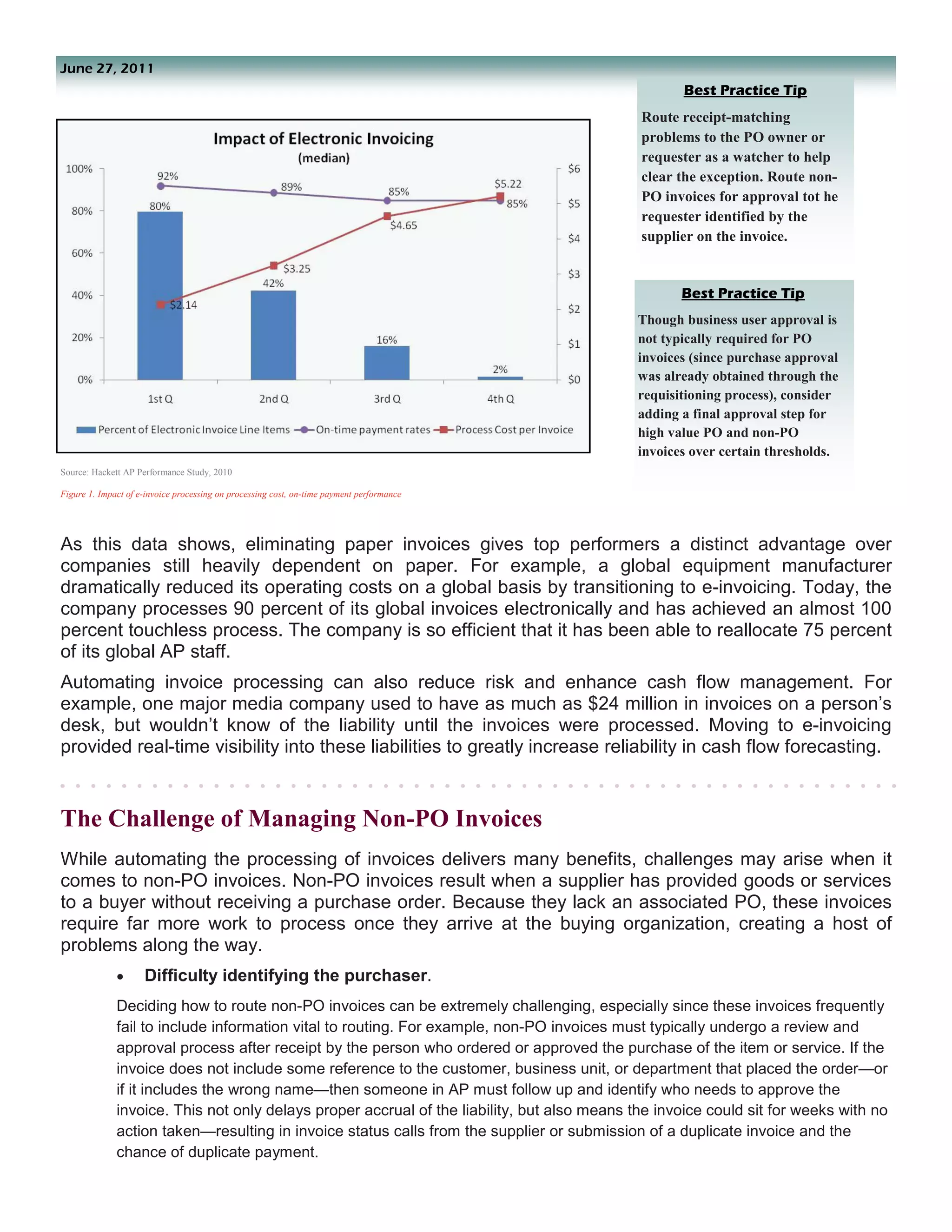

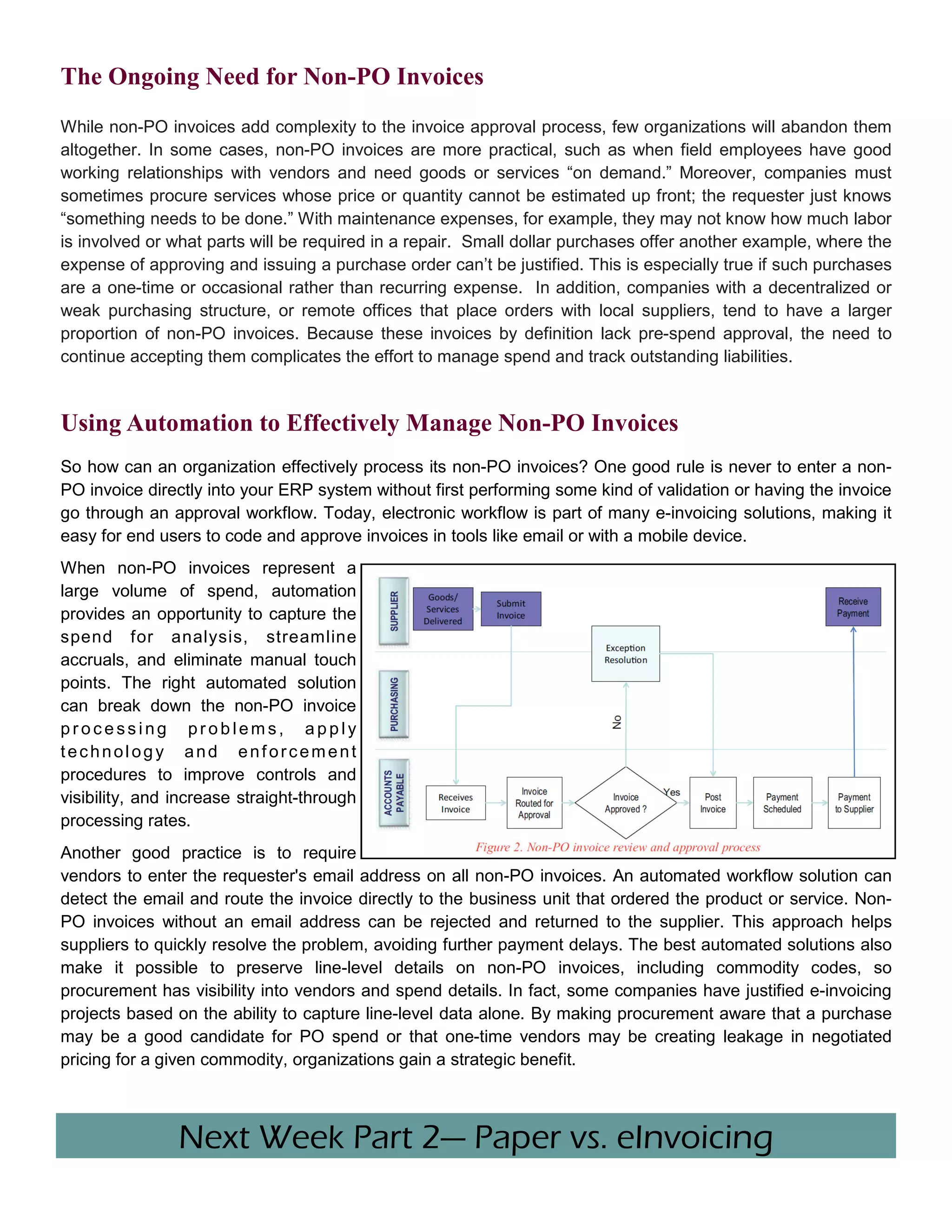

The document discusses the challenges of processing paper invoices versus electronic invoices. It notes that most organizations still receive the majority of their invoices via paper, which is costly and inefficient to process. Automating invoice processing and moving to electronic invoicing allows organizations to more effectively match invoices to purchase orders, improve visibility of spending, reduce errors, and lower costs. While non-purchase order invoices are still sometimes necessary, they are more difficult to process efficiently. The document recommends using invoice automation and electronic workflows to help route non-purchase order invoices for approval and capture spending details to improve controls and visibility over this type of spending.