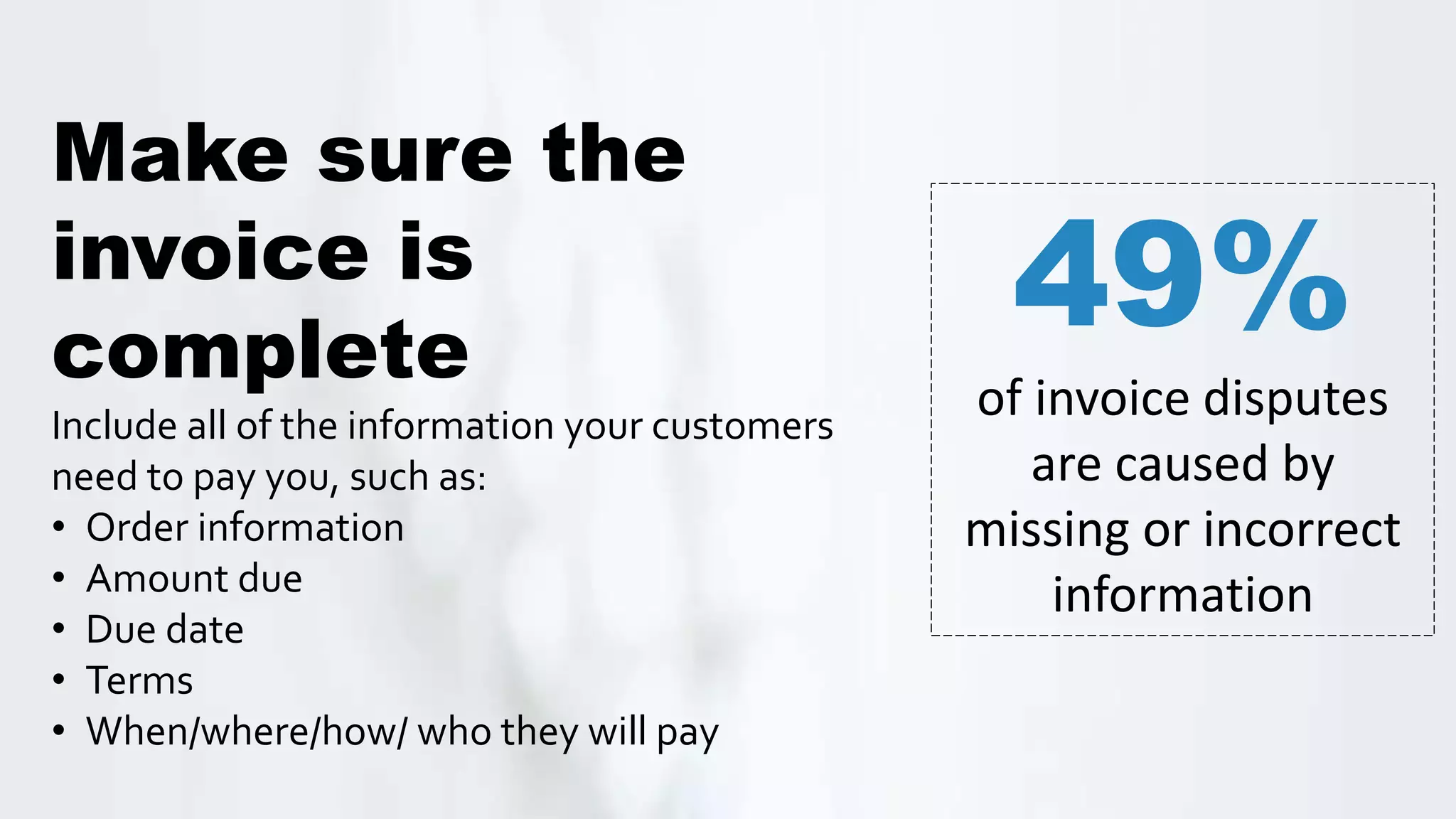

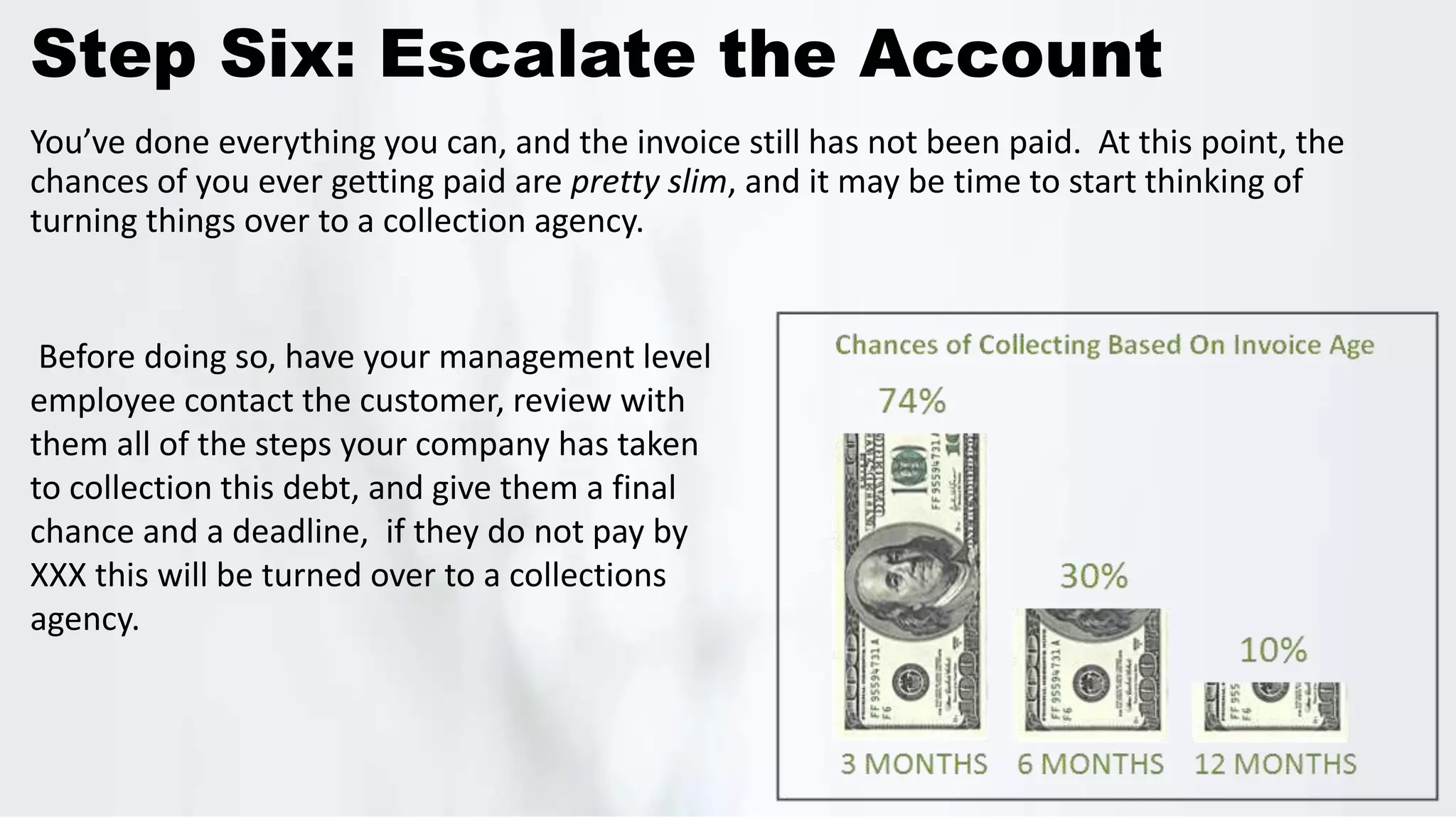

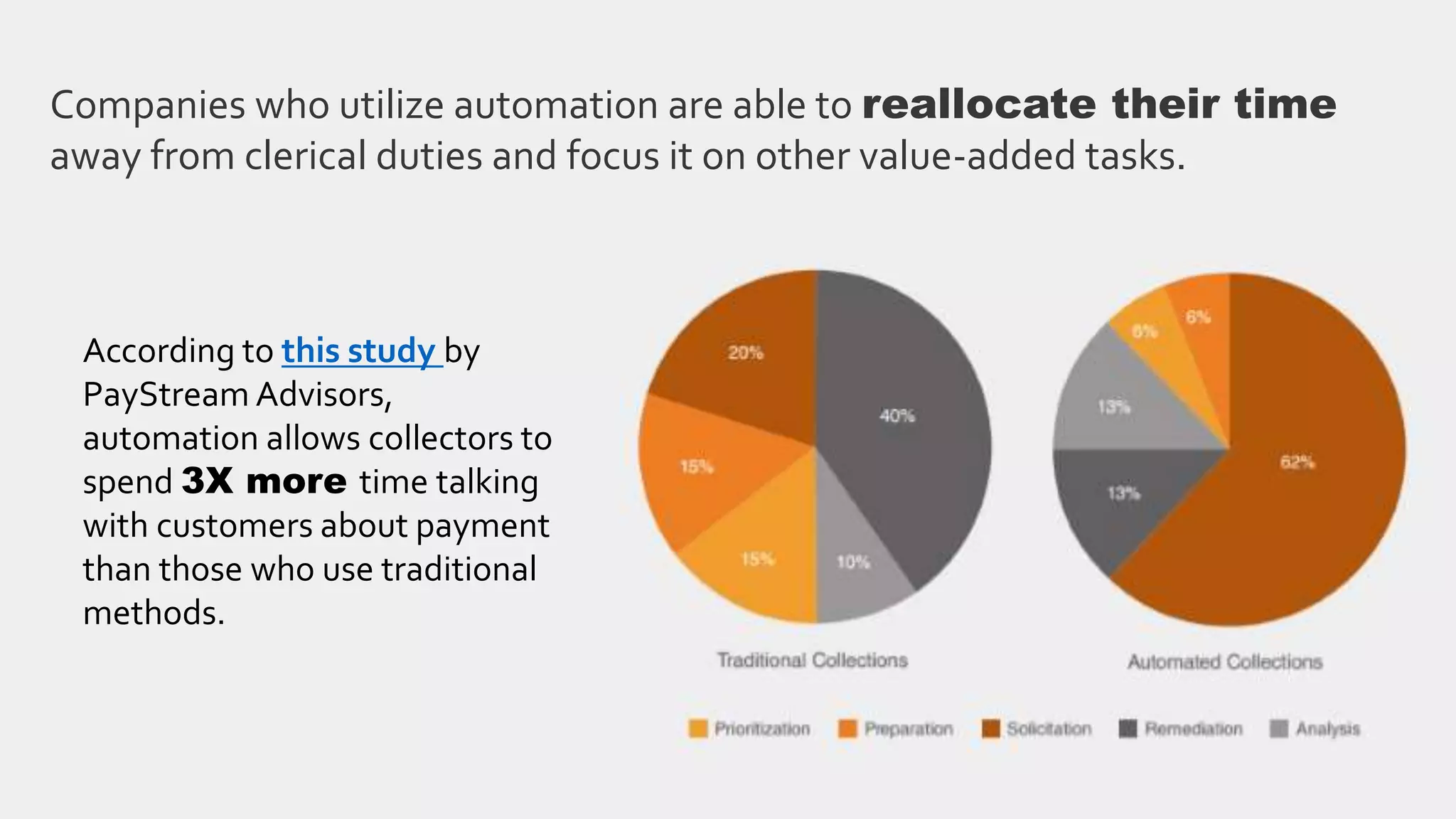

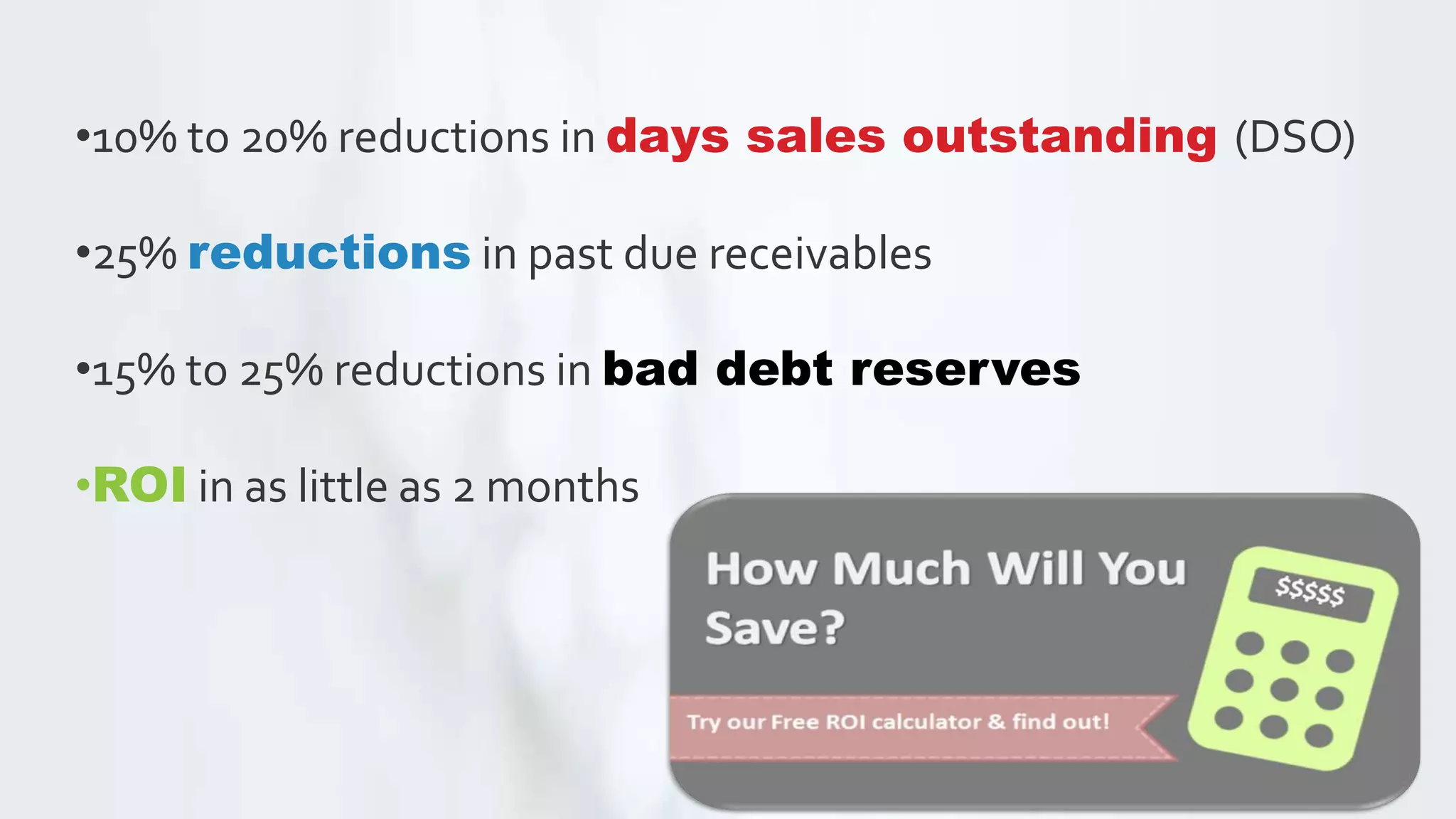

The document outlines six essential steps for effective B2B invoice collection to ensure timely payments: sending accurate invoices, confirming delivery, maintaining communication, addressing late payments, applying pressure when necessary, and escalating unresolved accounts. It emphasizes the importance of automation in streamlining these processes, enhancing the efficiency of collections, and reducing the proportion of overdue receivables. Automation allows businesses to focus on customer relationships and value-added activities, leading to significant reductions in days sales outstanding and bad debt reserves.