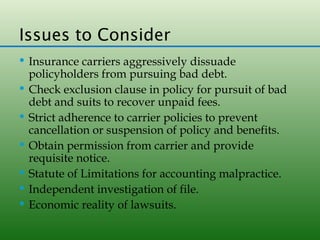

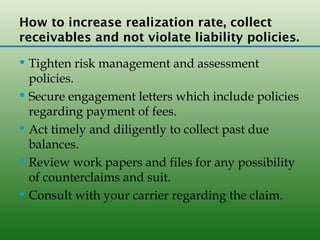

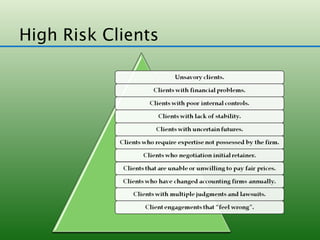

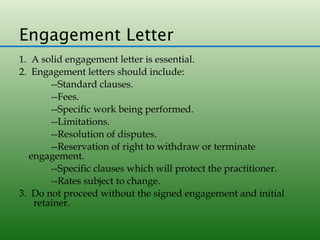

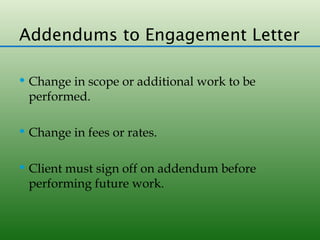

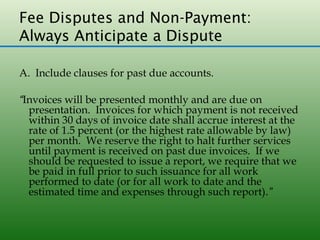

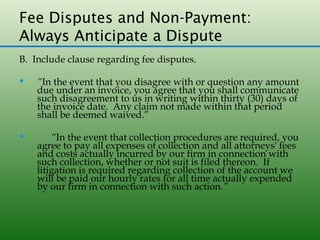

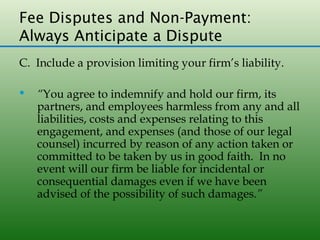

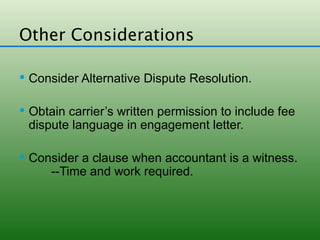

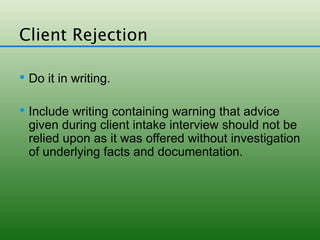

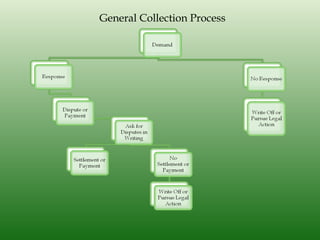

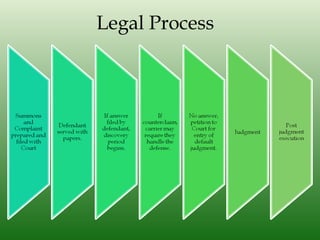

This document discusses strategies for improving realization rates for accounting firms. It suggests that realization rates should be around 90-95% and provides tips for tightening risk management policies, using solid engagement letters that specify payment terms, and acting promptly to collect past due balances. The document also addresses issues like insurance carrier policies, statute of limitations, and evaluating potential counterclaims before pursuing collection. It provides sample engagement letter clauses and discusses alternative dispute resolution and legal collection processes.