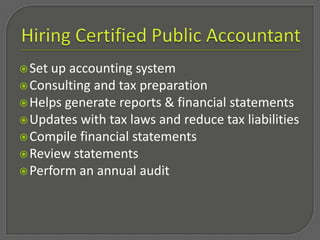

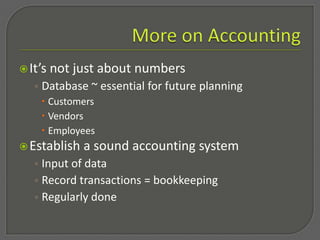

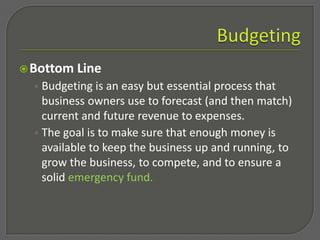

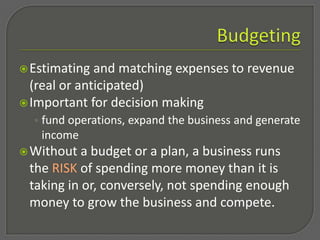

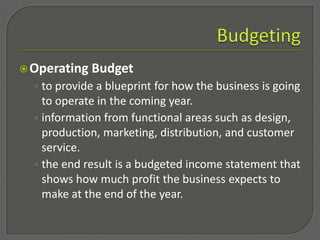

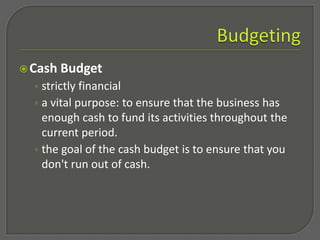

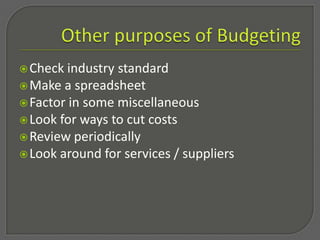

This document provides an overview of key aspects of financial management for entrepreneurs, including accounting and financial reporting, budgeting, collecting accounts receivable, and risk management. It discusses the importance of accounting systems and bookkeeping for tracking finances, as well as outsourcing to CPAs. Budgeting is described as essential for matching expenses to revenue and ensuring cash flow. Collecting accounts receivable involves following terms and aging receivables to focus collection efforts. Risk management involves identifying, measuring, and prioritizing risks to minimize their impact on the business.