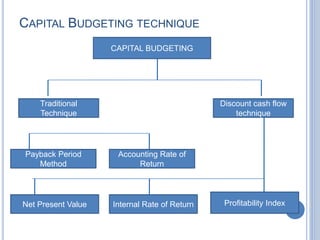

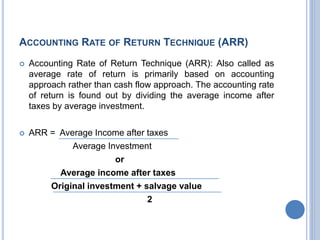

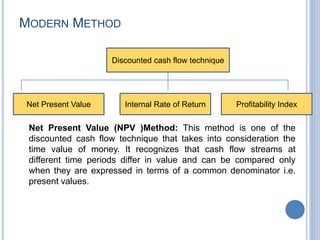

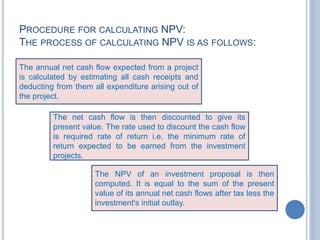

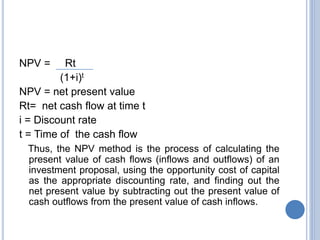

Capital budgeting is a critical financial planning process that involves allocating funds to investment projects aimed at long-term profitability and growth. It encompasses the evaluation of future benefits and costs, and is characterized by high risks and irreversible decisions, impacting a company's competitive strength and cost structure. Key objectives include controlling capital expenditure, selecting profitable projects, and identifying the right sources of funds while employing various techniques such as payback period and net present value for project assessment.