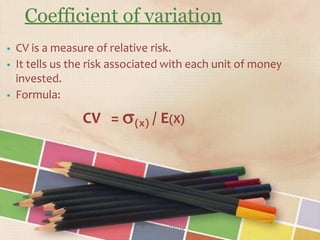

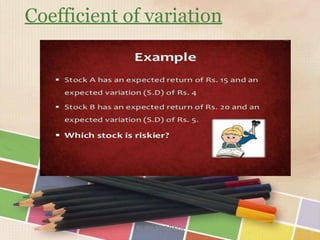

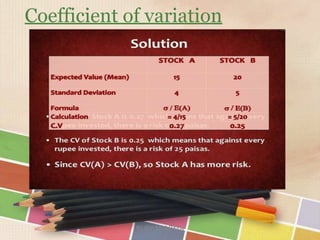

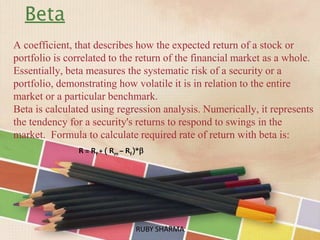

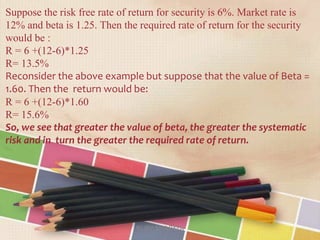

Risk is defined as the possibility that actual returns on an investment will differ from the expected returns. It includes the chance of losing some or all of the original investment. Standard deviation and beta are common metrics used to measure investment risk. Standard deviation provides a statistical measure of how much an investment's returns vary from its average returns over time. Beta measures the volatility of a security compared to the overall market. It represents the tendency of an investment's returns to respond to swings in the broader market. The coefficient of variation is used to assess risk per unit of return, allowing investors to compare investments and choose those with the lowest risk relative to their expected returns.