This document discusses different types of corporate financing - preference capital, equity capital, debentures, and bonds.

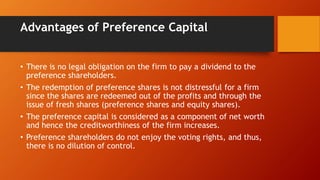

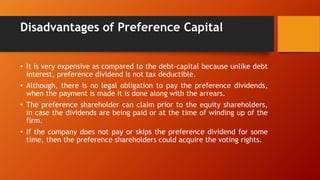

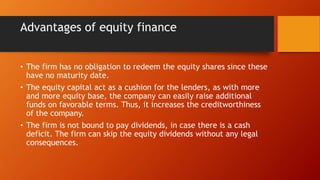

Preference capital is a hybrid form that has characteristics of both equity and debt. It increases a firm's creditworthiness but is more expensive than debt. Equity capital refers to ownership shares in a company. It provides no guaranteed returns and dilutes ownership but does not require repayment.

Debentures are debt instruments issued by companies as evidence of loans to the public. They have a fixed interest rate and are paid back before equity holders in liquidation. Debentures can be secured against assets or unsecured. They may also be redeemable or irredeemable.