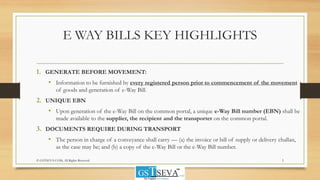

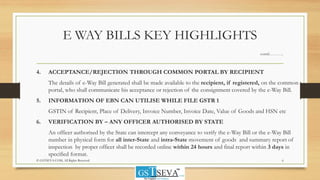

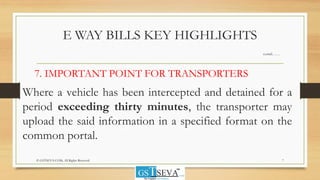

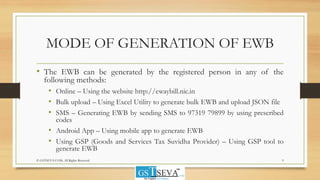

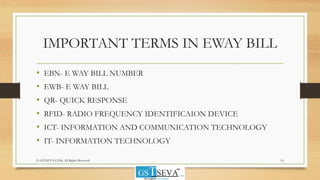

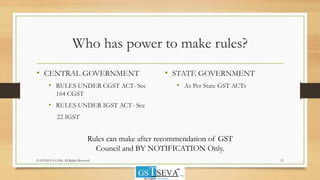

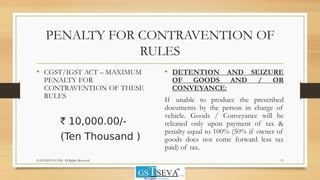

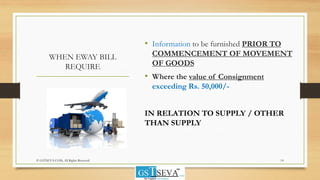

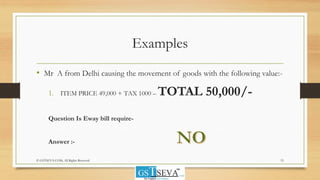

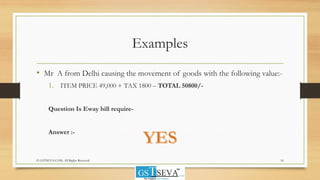

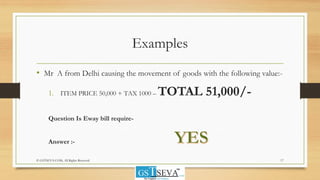

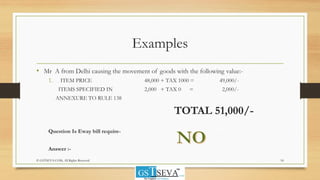

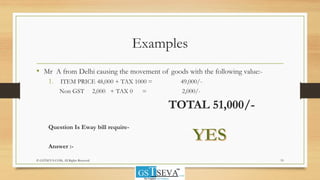

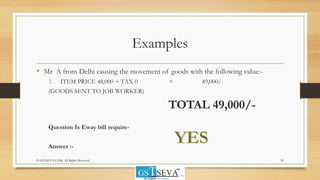

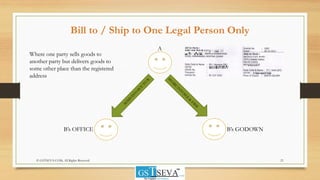

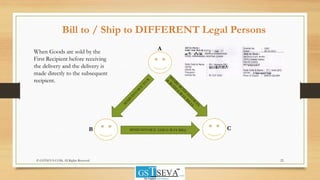

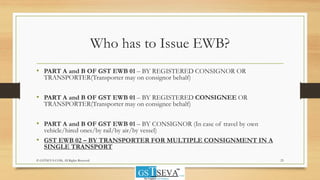

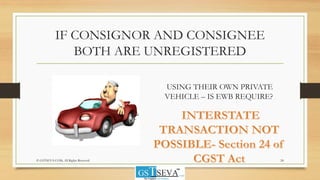

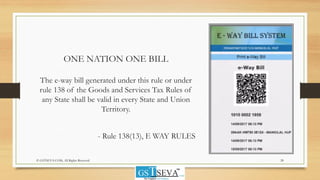

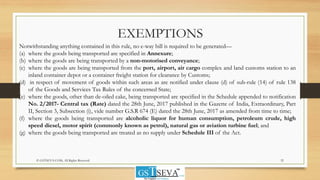

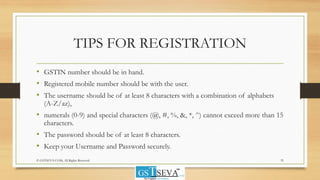

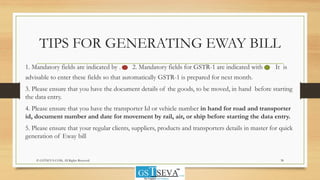

The document discusses the rules and procedures for generating e-way bills in India under the Goods and Services Tax (GST) system. It provides background on the introduction of e-way bills with the implementation of GST on July 1, 2017. It explains that e-way bills are electronic documents that must accompany the transportation of goods valued over Rs. 50,000 and are generated through the GST common portal. It also outlines the key parties involved in the e-way bill system including suppliers, recipients, and transporters.