Embed presentation

Download as ODP, PPTX

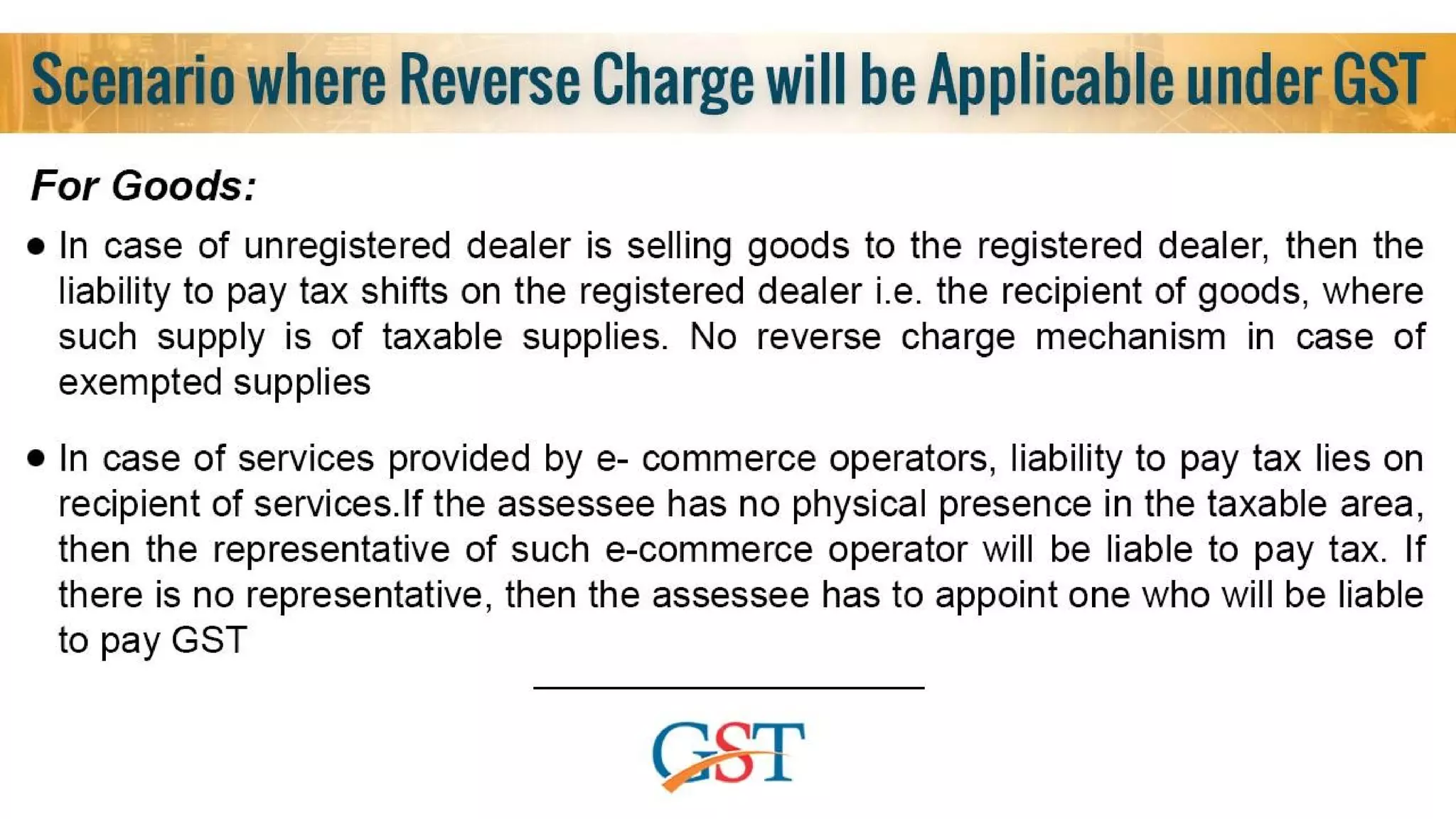

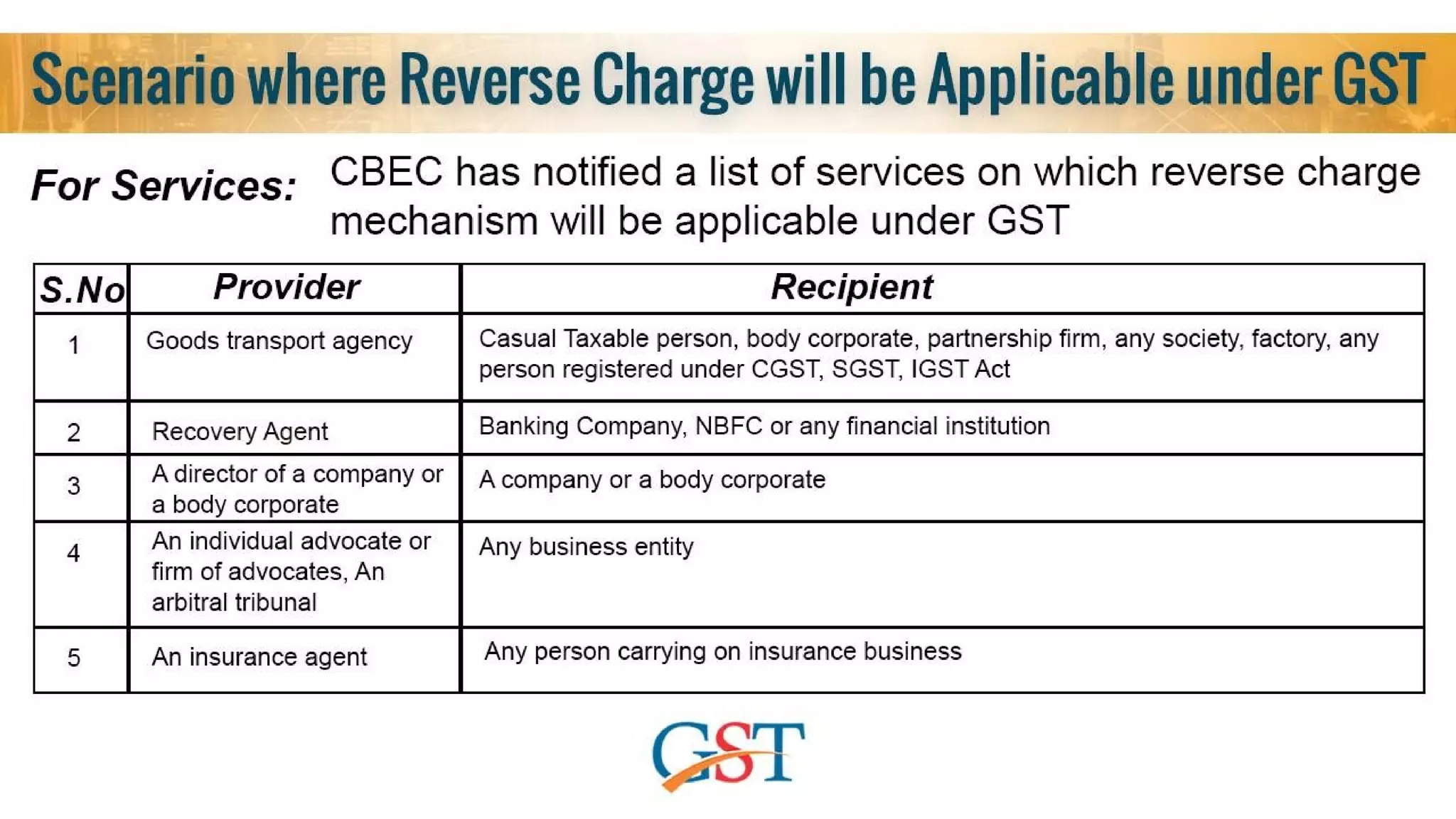

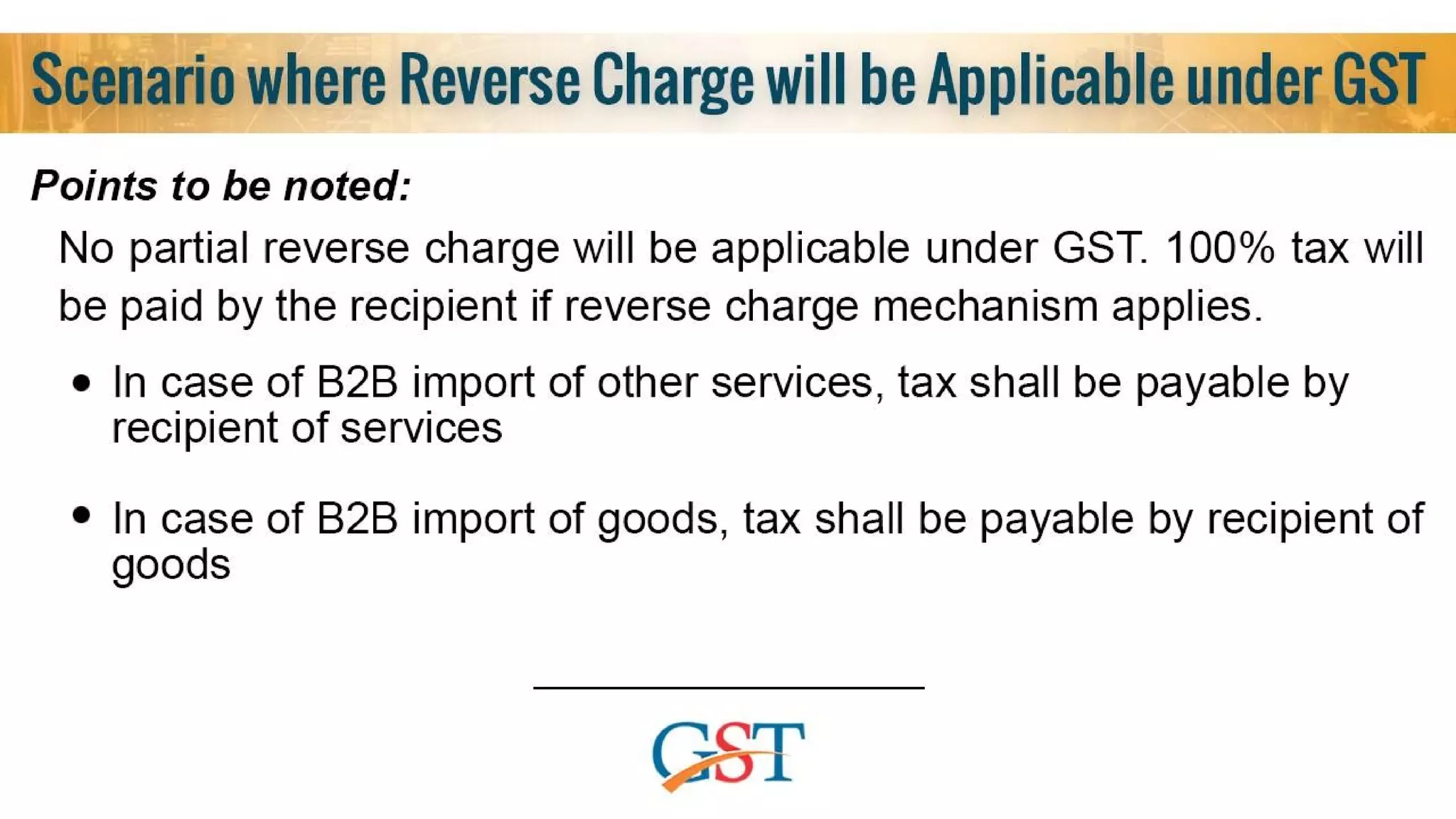

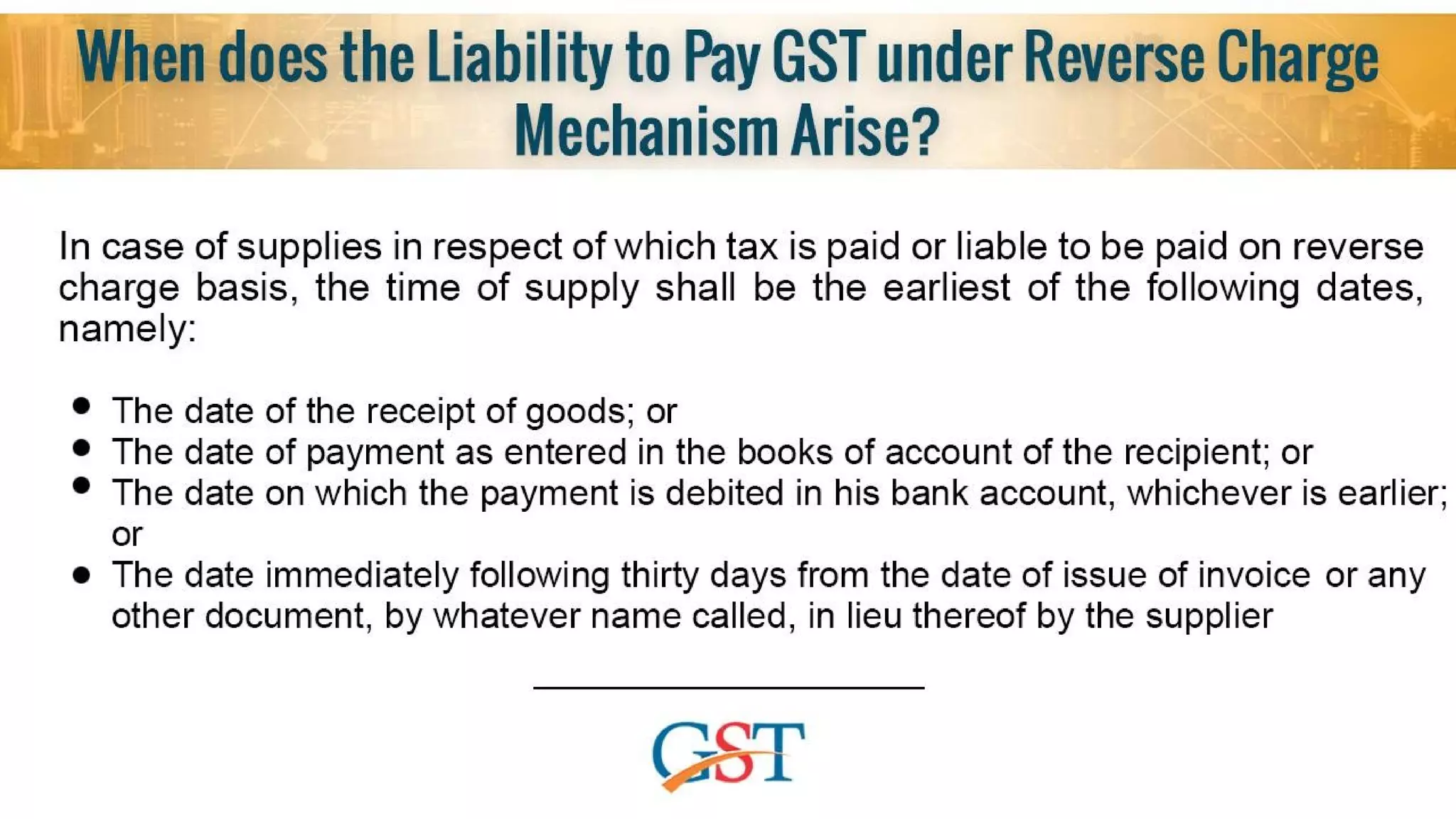

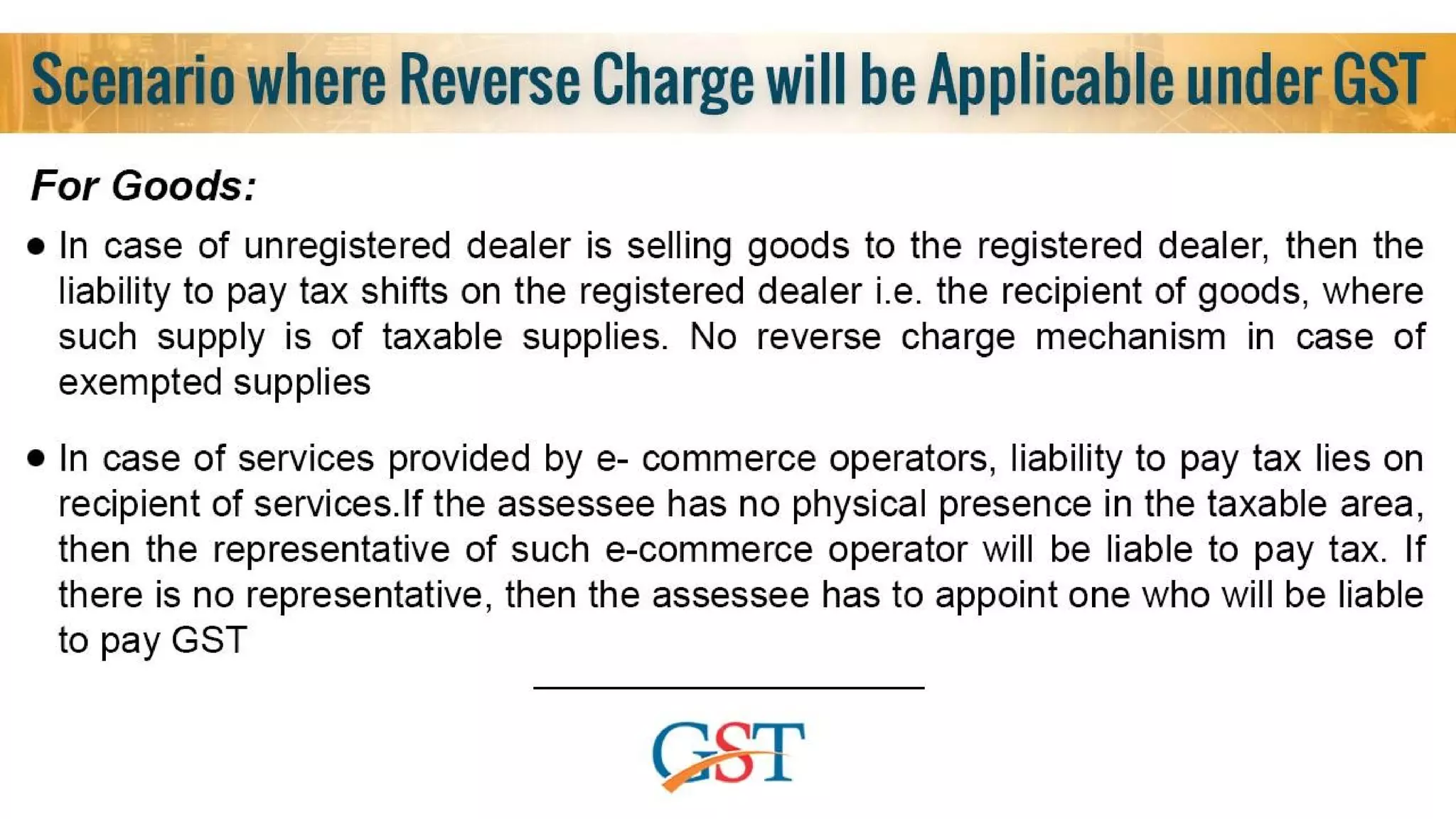

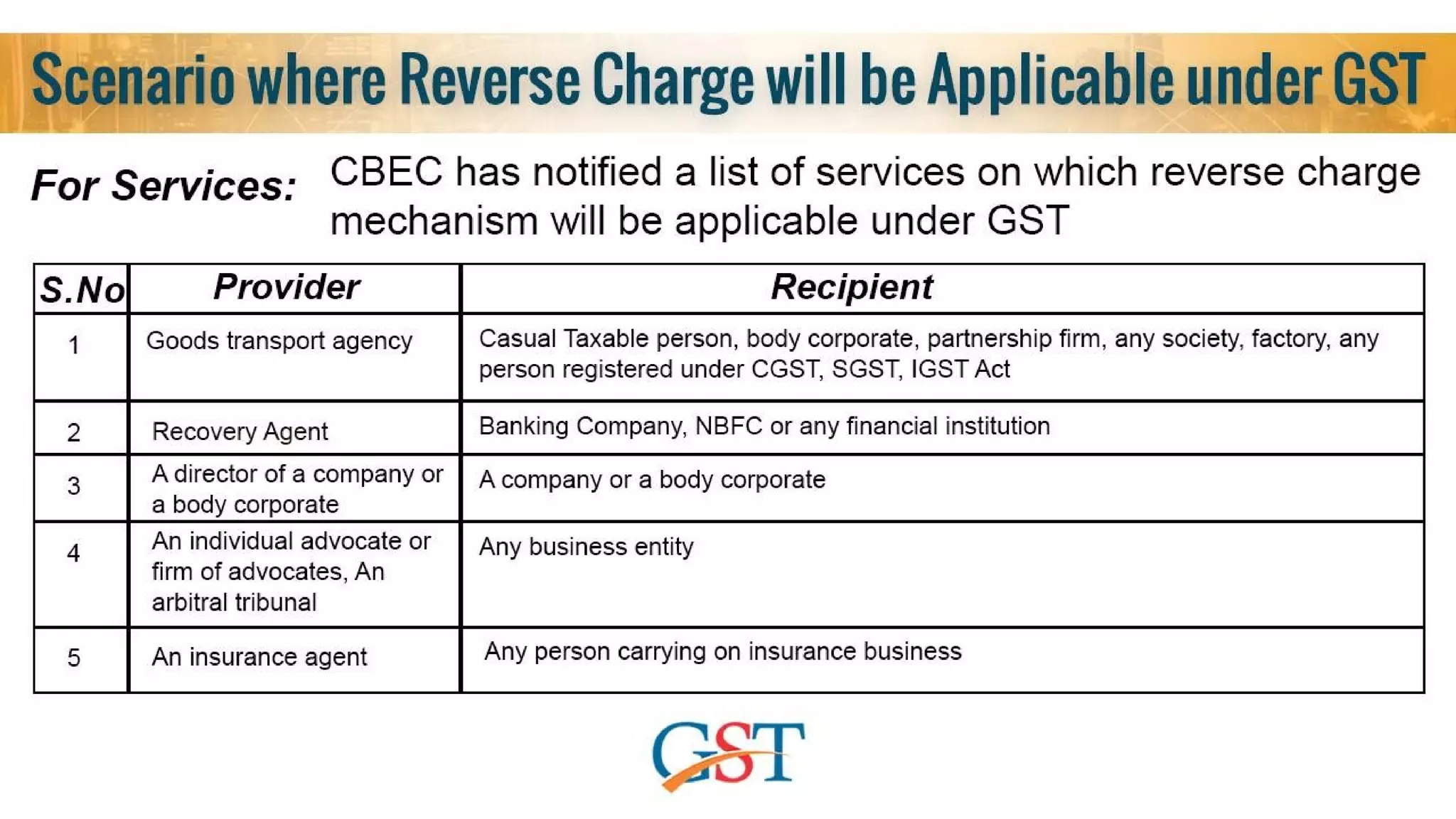

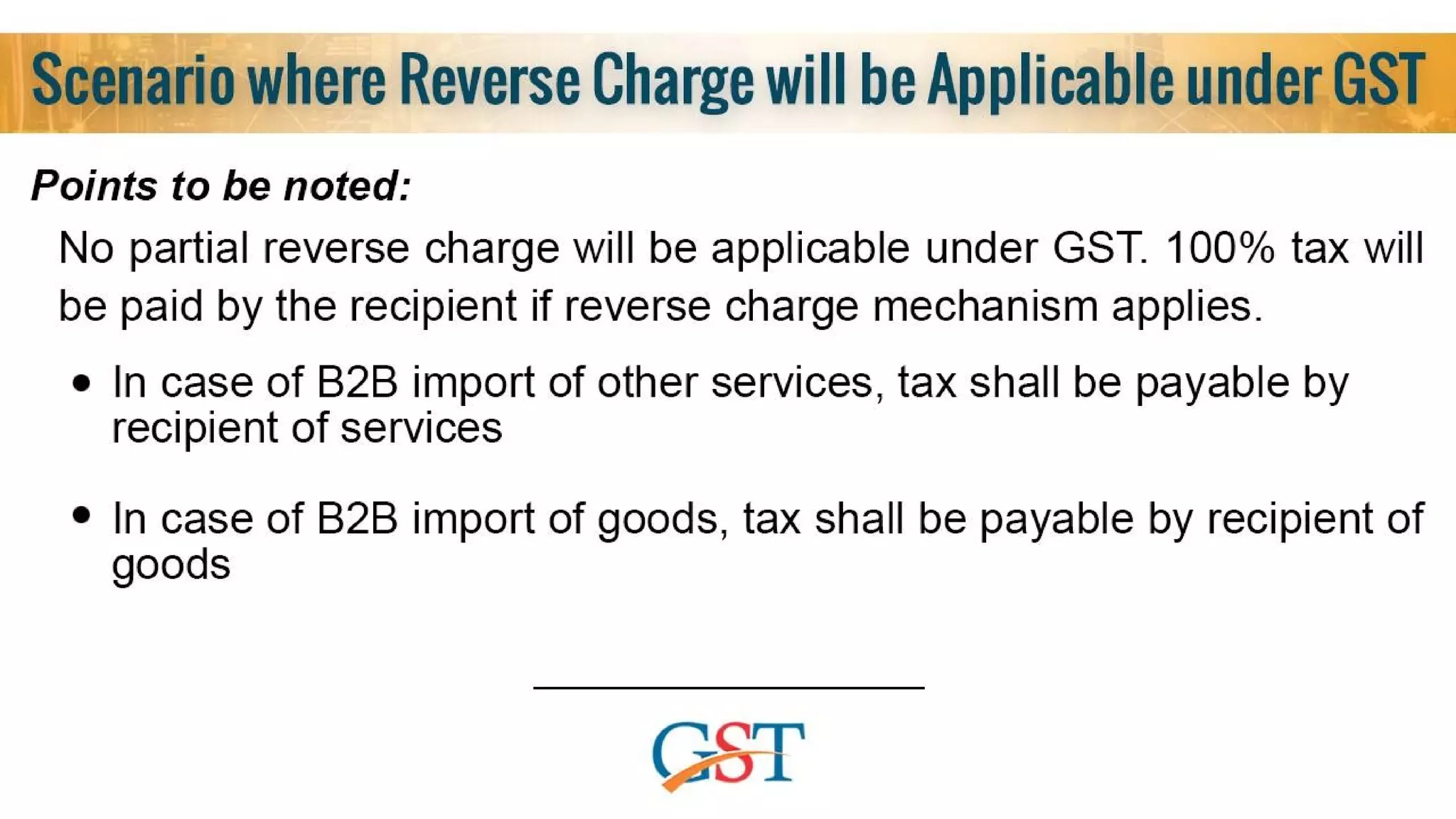

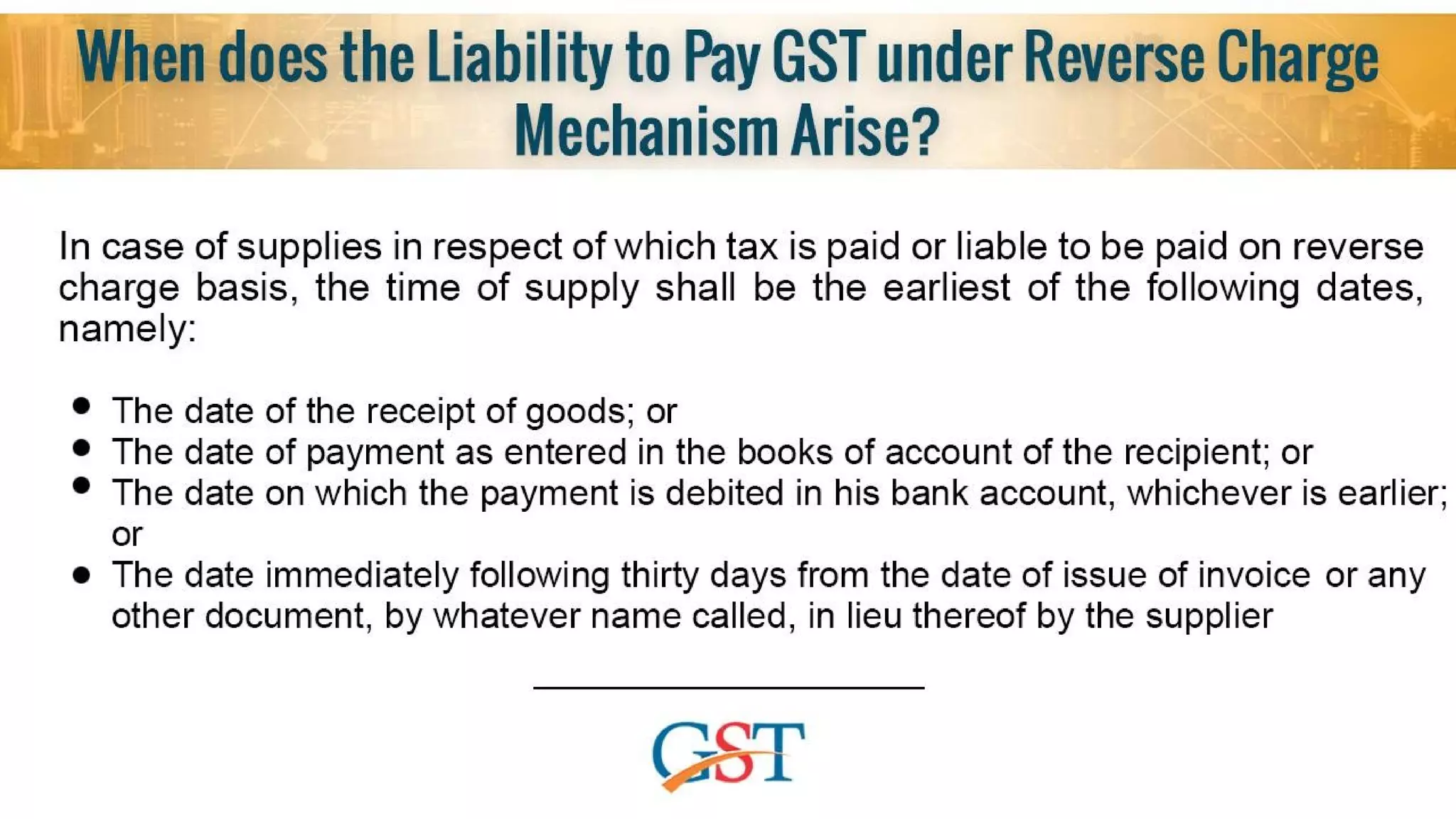

The document discusses various aspects of the Goods and Services Tax (GST) in India, including the disadvantages of dealing with unregistered dealers and the impact of GST on the e-commerce sector. It also covers the time of supply for goods and services, as well as a guide on calculating input tax credit with examples. Additionally, it explores the concepts of mixed and composite supplies under GST.