This document provides information about input tax credit under GST including definitions, eligibility conditions, and procedures. It discusses what constitutes input, input services, capital goods, and the electronic credit ledger. It outlines the primary conditions for claiming ITC including the invoice, payment, and filing of returns. Special scenarios where ITC can be claimed are described. The document also discusses blocked credits, apportionment of credit, and the process for determining and reversing ITC.

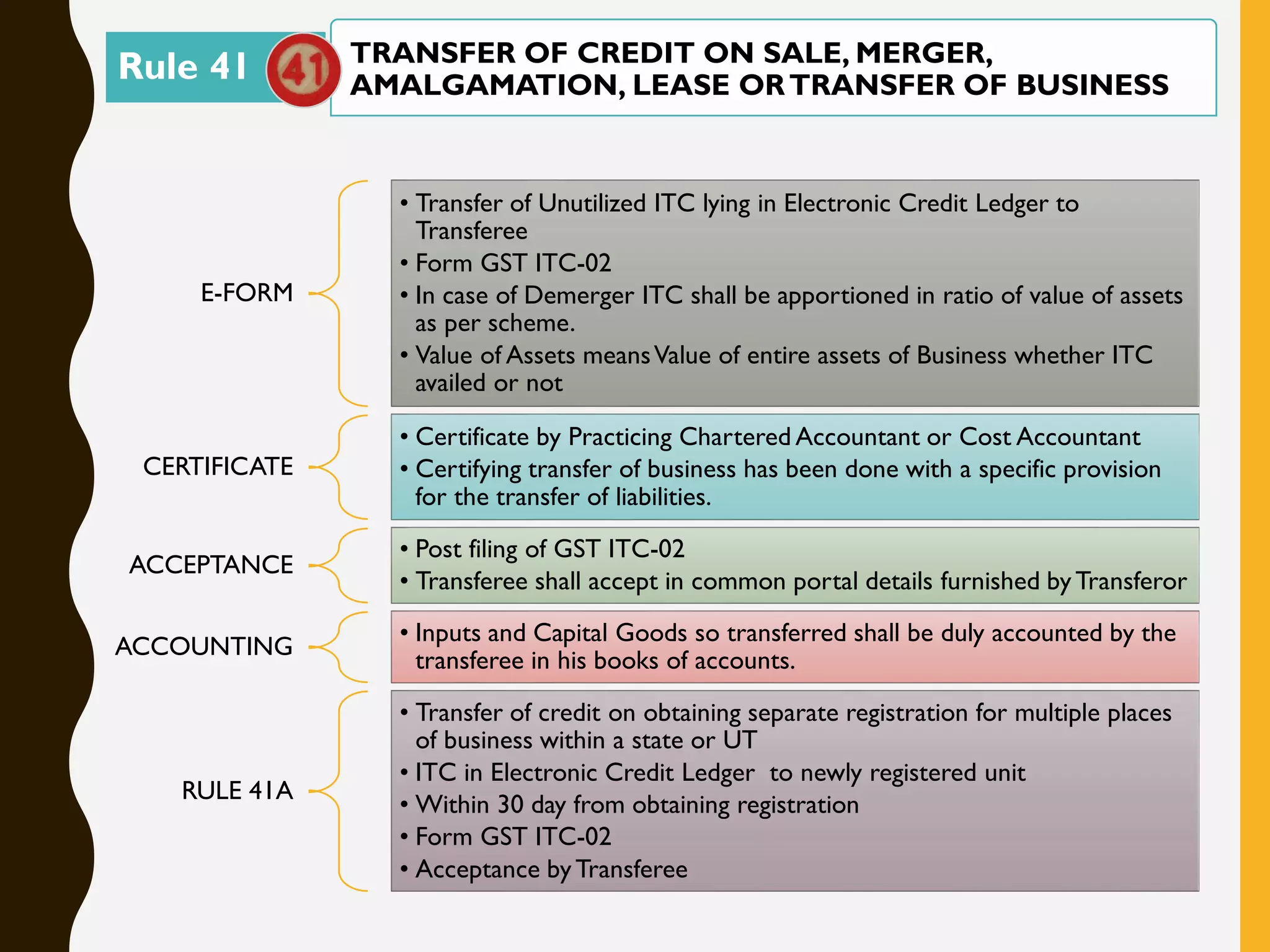

![Rule 36 (1)

Invoice Issued by

Supplier

In accordance

with Sec 31

Invoice by Supplier

in accordance with

Sec.31(3)(f)

[Sec9(3)/9(4)]

Subject to payment

of tax

Bill of Entry or

Similar Document

Customs Act

IGST on Imports

ISD Invoice / ISD

Credit Note / Any

Other Document

issued by ISD

Rule 36 (2)

ITC Shall be availed

only if all particulars

contained in said

documents and

relevant information

furnished in GSTR 2

Mandatory Content

of ITC Document

Amount ofTax

Charged, Description

of Goods / services

total value of supply,

GSTN of Supplier &

Recipient & Place of

Supply in case of Inter

State Supply

Rule 36 (3)

NO ITC shall be

availed in respect

of any tax that

has been paid

against any order

where demand

confirmed on

account of fraud,

willful

misstatement or

suppression of

facts

DOCUMENTARY REQUIREMENTS AND CONDITIONS

FOR CLAIMING INPUT TAX CREDITRule 36](https://image.slidesharecdn.com/20190505gstitcicaicertificatecourse-190506130251/75/GST-Input-Tax-Credit-7-2048.jpg)

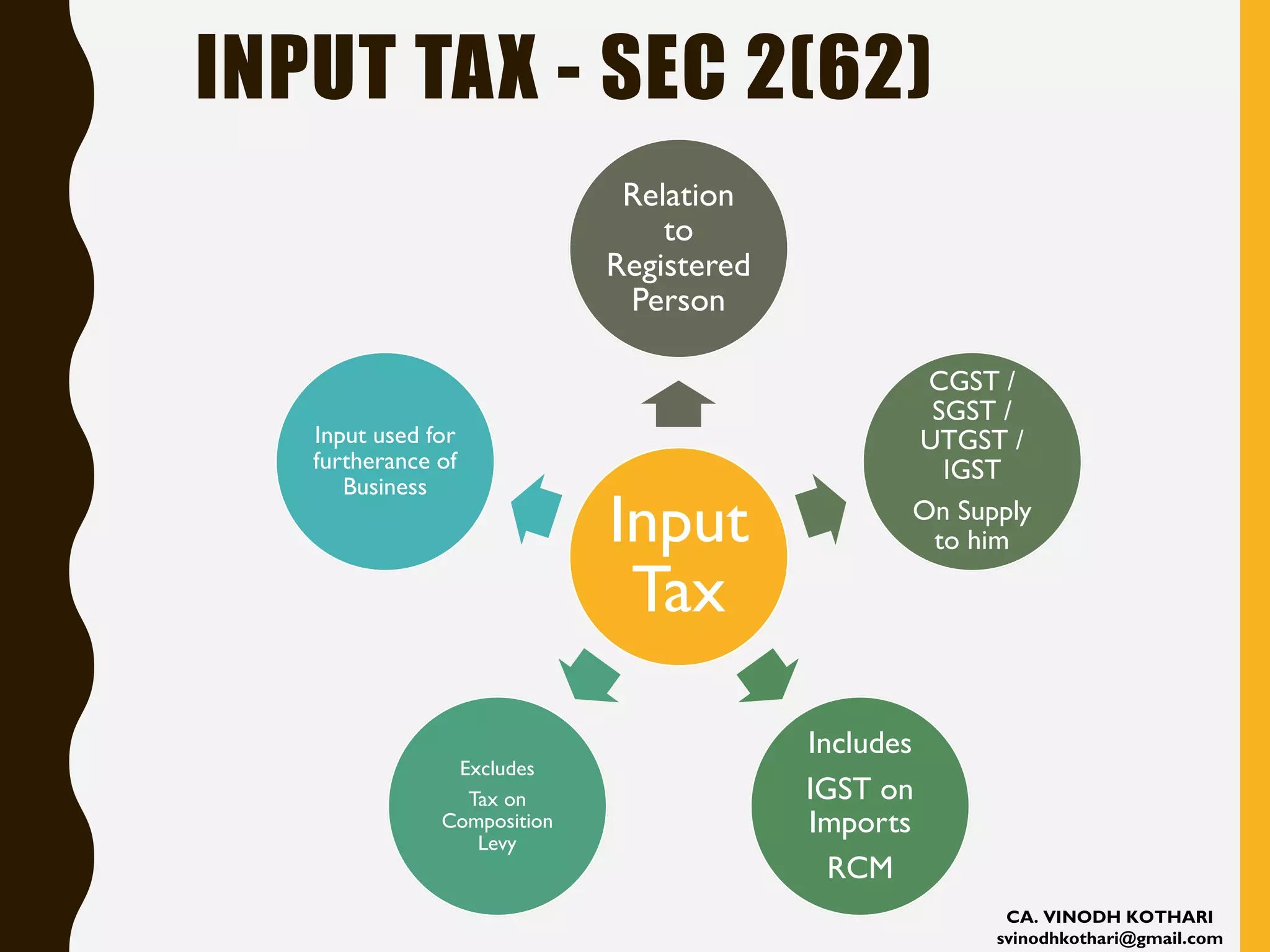

![ITC availed on any Inward Supply but fail to pay supplier

with 180 Days [Sec 16(2)]

Amount of Value not paid ITC Credit Availed proportionate

to such amount to be added to Output Tax Liability.

In the month following the period of 180 Days from

date of Issue of Invoice

This provision not applicable for Sch I Supplies made without

consideration. Deemed to have been paid.

Pay Interest @ Notified U/s. 50(1) from period starting from date of

availing credit till amount added to OutputTax Liability.

Time limit U/s16(4) shall not apply to claim for re-availing any

credit which is reversed earlier under this provision.

REVERSAL OF INPUTTAX CREDIT IN CASE OF

NON PAYMENT OF CONSIDERATION

Rule 37](https://image.slidesharecdn.com/20190505gstitcicaicertificatecourse-190506130251/75/GST-Input-Tax-Credit-8-2048.jpg)