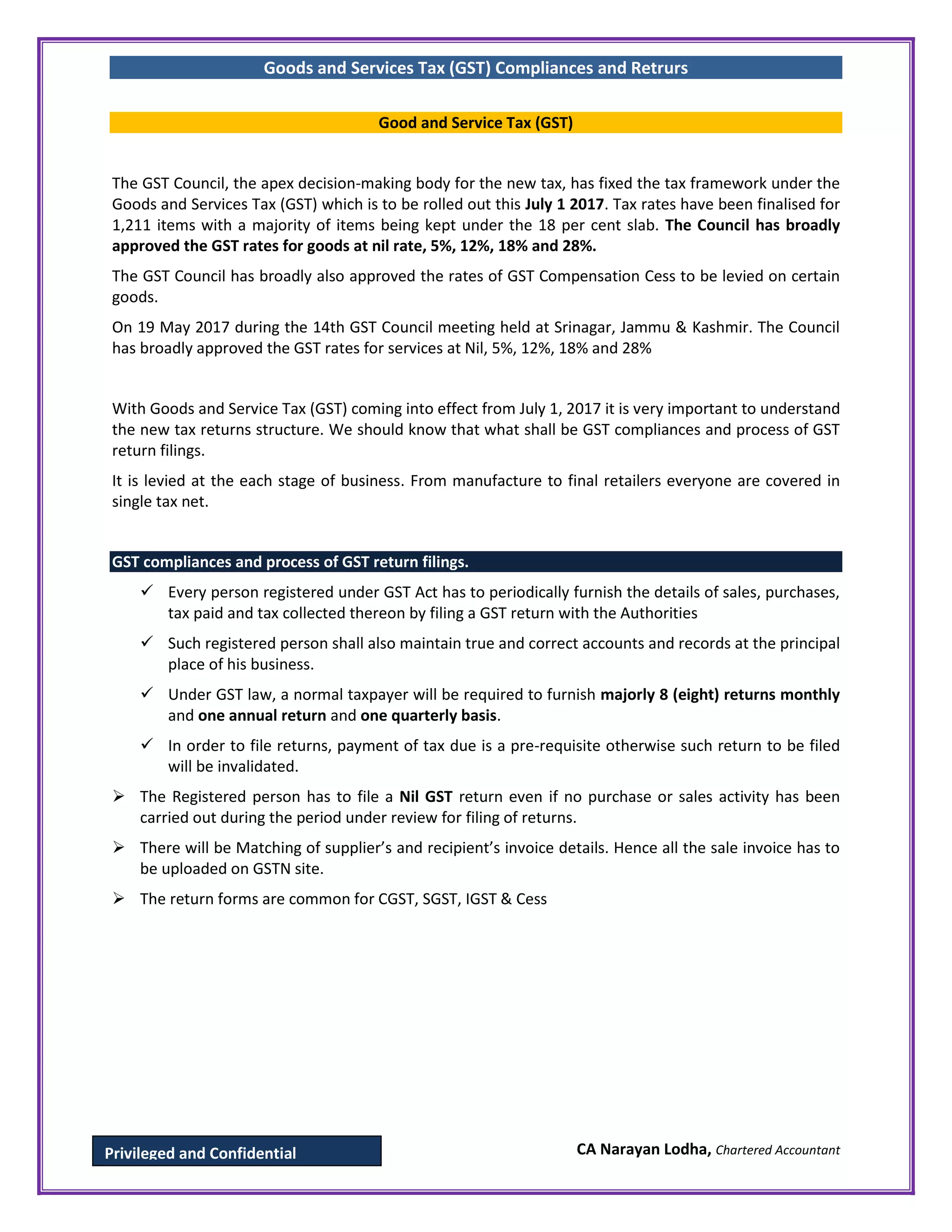

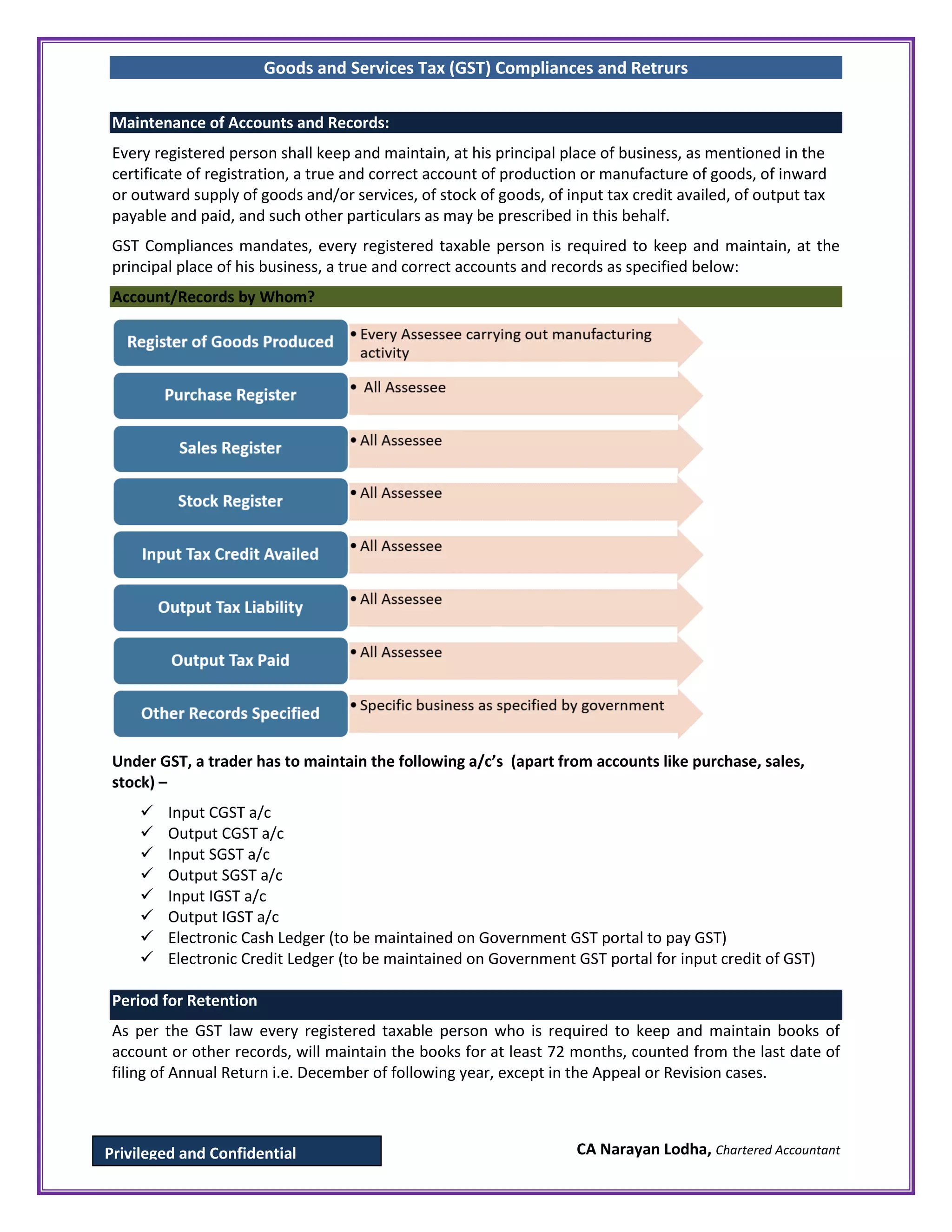

The document outlines the Goods and Services Tax (GST) framework set to be implemented in India from July 1, 2017, detailing the approved tax rates for goods and services. It emphasizes the compliance requirements for registered taxpayers, including the necessity to file multiple returns (monthly and annually) and maintain accurate records at their business location. The document also provides specific timelines and requirements for filing different GST return forms, highlighting the importance of adhering to these regulations for tax compliance.