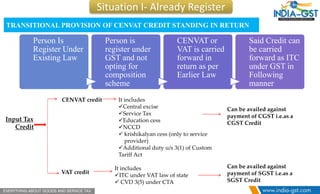

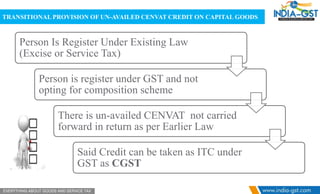

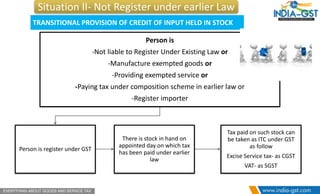

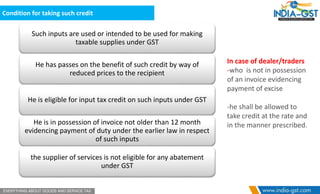

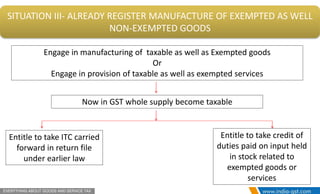

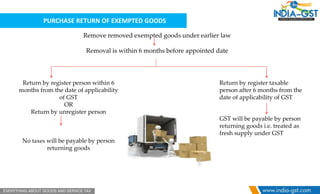

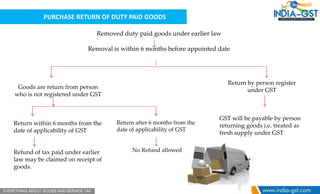

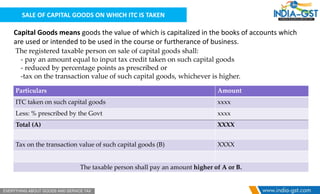

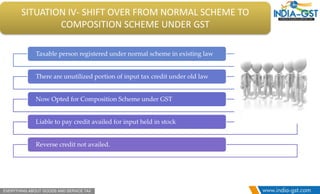

The document outlines the transitional provisions under GST for cenvat and input tax credit, detailing scenarios for registered individuals transitioning from the previous tax framework to GST. It covers eligibility criteria for taking credit on unavailed cenvat, input held in stock, and conditions for manufacturers of exempted and non-exempted goods. Additionally, it discusses regulations for capital goods and implications of switching from a normal scheme to a composition scheme under GST.