The document discusses various aspects of demand and recovery of tax under the GST regime in India, including:

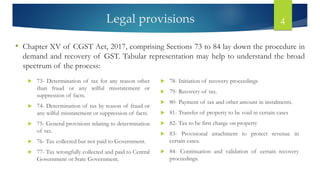

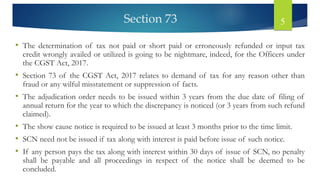

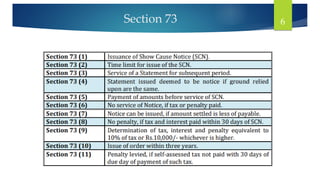

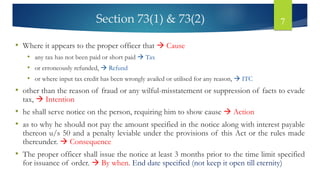

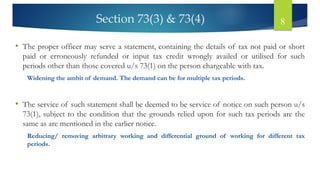

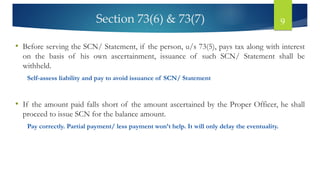

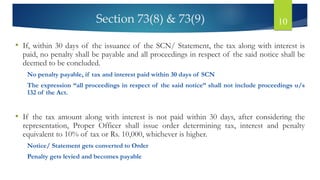

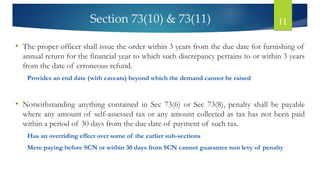

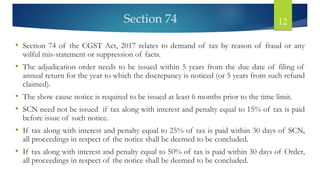

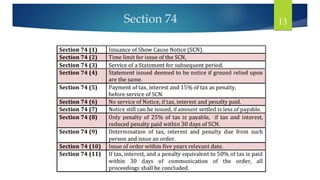

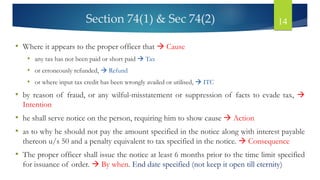

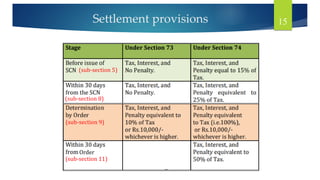

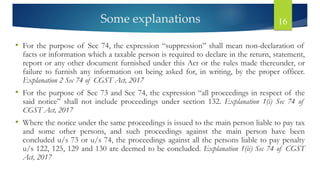

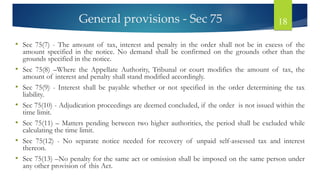

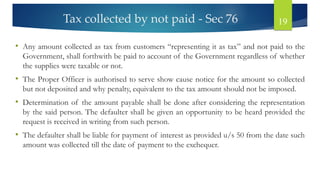

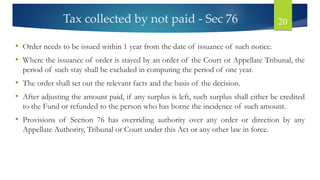

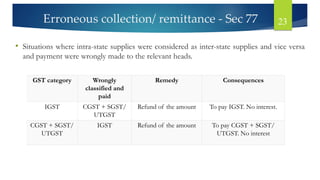

1) Key legal provisions around determination of tax, interest, and penalties in cases of non-payment, short payment, erroneous refunds or wrong availment of input tax credit.

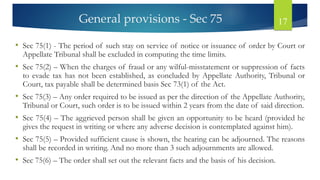

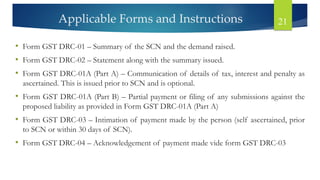

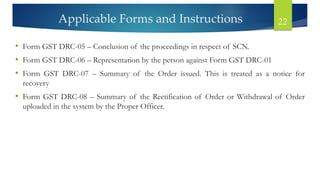

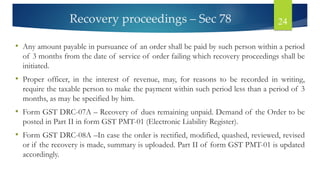

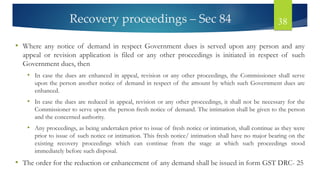

2) The procedures for issuing show cause notices, admitting representations, and ultimately passing an order determining tax liability.

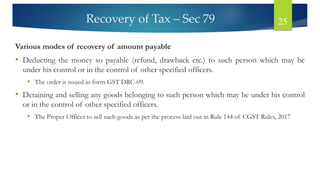

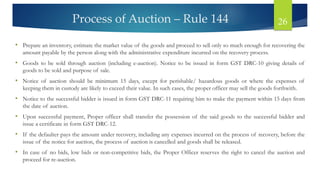

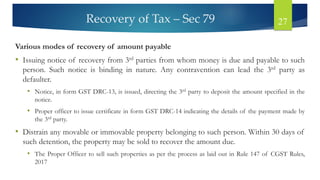

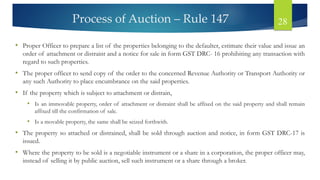

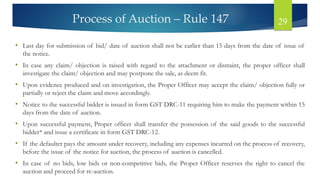

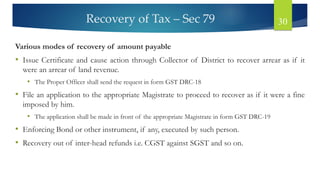

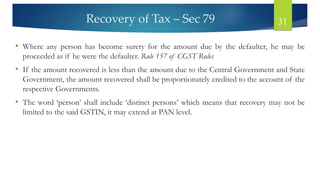

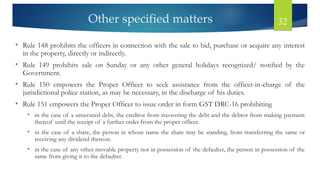

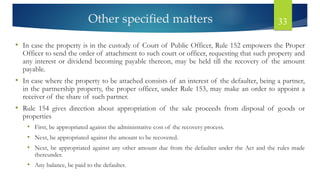

3) Modes of recovery of outstanding tax dues like deducting from refunds/drawbacks, detention and sale of goods, and recovery as arrears of land revenue.

4) Timelines and forms prescribed for different steps in the demand and recovery process.